RCBI-Industry Year-in-Review: Investment Migration’s Big Stories in 2018

In lieu of a newsletter summing up the past week in investment migration, this week we’re reviewing 2018 as a whole.

Record Growth, Changing Chinese Preferences, Increased Media Attention: Investment Migration in 2018

On the whole, 2018 was the investment migration industry’s best year on record in several respects; never have so many individuals invested so much in so many residence and citizenship by investment (RCBI) schemes. An ever swelling number of programs – with price points running the gamut from $30,000 to £2 million – are bringing the market into the arena of the mass affluent.

Investing in a residence permit or a passport is quickly becoming ordinary and unremarkable, a matter that’s attracted the attention of a long list of small economies now realizing the untapped economic potential available to them through the opening of an investment migration program, but also that of the industry’s skeptics.

China as catalyst

China remains – by a wide margin – the largest source market for investment migration; globally, over the last 12 months, roughly half of the more than 54,000 individuals who participated in a residence or citizenship by investment program were Chinese nationals.

Conservatively estimated, the RCBI-industry raised in excess of US$14 billion in FDI, around US$8 billion of which came from China.

While the market as a whole has seen across-the-board growth in excess of 20% compared to last year, some programs have enjoyed more of those gains than others; Portugal, for many years the undisputed leader of European golden visa programs, has seen its application volumes plateau thanks to a drop in interest from Chinese applicants who increasingly prefer Greece, Malta, and Ireland.

There are nine million bicycles in Athens

The big winner in 2018 has been the Greek Golden Visa program; With 3,404 main applicants and 5,495 dependents obtaining residence permits already by September this year, its 2018 application numbers are on track to more than double its 2017 record. Before the year is over, Greece’s Golden Visa program will officially become the world’s most popular residence by investment program, surpassing even the US EB-5 scheme.

A handful of factors have catapulted Greece to pole position:

It offers residence permits for far less than its main European competitor, Portugal, and its real estate prices are also historically low; while Portugal’s housing price index is 30% above its last peak in 2008, that of Greece is 40% below. This explains much of Greece’s rising star among Chinese applicants, who have gone from constituting a quarter of all applicants in the program in 2017 to more than half today. If there’s one asset class with which Chinese investors are familiar and comfortable betting on, it’s real estate.

Moreover, Greece, unlike traditional Chinese favorites like the US EB-5 and Quebec IIP, does not impose any per-country quotas, which means there are no multi-year waiting lists for applicants from China.

The Chinese government’s increasingly close relationship with Greece – investment in key infrastructure (belt and road), the promotion of tourism to the country, and so on – further eases the path for prospective Chinese residents.

Investor-naturalization and its discontents

The market has grown on the supply-side as well; three new citizenship by investment programs – Montenegro, Moldova, and Jordan – opened this year. While in 2010 there were only two formal CIPs – Saint Kitts & Nevis and Dominica – there are now 12; five in the Caribbean, four in Europe, one in the Pacific, and two in the Middle East.

The growing popularity of investment migration – both among investors and countries seeking non-tax revenue – has not gone unnoticed among opponents, chiefly from left-leaning politicians and press. The industry is now routinely a topic of media attention, nearly always of the unfavorable kind, and invariably mischaracterized.

Industry professionals will have their work cut out for them in correcting a flawed and unfairly negative perception among the lay public.

The most popular stories in 2018 by category

Reports and Analysis

- 33 Countries That Could Open a Citizenship by Investment Program

- The Truth About Bulgarian Citizenship by Investment – An Expert Panel Comments

- Yes, Portugal Golden Visa DOES Lead to Citizenship, First Cases Confirm

- The 13 Most Popular Golden Visas in the World, According to the Data

- Europe’s Golden Visa Boom: From 3 to 23 Programs in 10 Years

- 1 in 5 RCBI-Firms Say Dominica Will be Best-Selling Program This Year – 2018 Investment Migration Executive Survey

- Greece to Dethrone EB-5 as World’s Biggest Golden Visa by Year-End

Statistics and Data

- Close to 40,000 People Have Invested in a Passport, Analysis Reveals

- 3 Countries Make up 84% of Europe’s €5bn-a-Year Golden Visa Market

- Processing Time for EB-5 Regional Center Applications Now 27 Months, All-Time High

- Half of Spanish Golden Visas Issued in Catalonia, 2 of 3 Investors Are Chinese or Russian

- Portugal, Spain, Greece: A Statistical Comparison of Golden Visa Rivals

- Malta Rejects 1 in 4 Applications for Citizenship by Investment

Policy updates

- Price of Turkey’s Citizenship by Investment Program Cut to $250,000

- Antigua Extends $100k Limited Time Offer, University Option Commissions on Sliding Scale

- Big Changes Coming to Québec Investor Program – Min. Investment Now C$ 1.2M, Net Asset Requirement Raised

- UAE Announces 10-year Visas to Investors, 100% Foreign Ownership, Visa-Free Travel to Canada

- Portugal’s Golden Visa Introduces €350,000 Capital Transfer Option

- Overview of the Restricted Nationalities Lists of Citizenship by Investment Programs

New programs

- Montenegro to Open Citizenship Program by Oct 1st – Min. Investment Starts at €250,000

- Moldova CIP Officially Opens for Applications During 12th H&P GRCC

- Jordan’s New CIP Gets 52 Applications in First Month Despite Hefty Price Tag and Dubious Benefit

- Three Routes to Italian Residence by Investment – An Overview, by Daniele Dapporto

Opinion pieces

- Burke Files: OECD-Countries Themselves are the Main Beneficiaries of RCBI-Programs

- Mahmoudi: Why Portugal, Objectively Speaking, Has the Best Golden Visa in the World

- Henderson: RCBI-Advisors Lose Clients By Not Really Listening to Them

- Yngson: As CBI-Competition Toughens, Digital Economy Offers Edge for

Caribbean - The RCBI-Industry’s Greatest Threat is of Our Own Making and We Can Stop it Ourselves

- Bayat: CIPs’ Blanket Bans on Iranians are Draconian and Bad for Business

Tajick : 50+ Misleading, False and Biased Statements Found in EU Report on RCBI- Green: Without CIP-Unity, Caribbean Economies Will Not Survive

- Volek: The Investment Migration Industry Enters its Most Exciting Period

- Chetcuti: 5 Common Reasons for Rejection of Maltese Citizenship Applications

People on the move

- Major’s League: Former H&P Execs Team Up to Launch Investment Migration Firm

- Juerg Steffen Takes Helm as CEO of Henley & Partners Amid Slew of Top-Flight Appointments

- Thomas Anthony New CEO of Grenada CIU

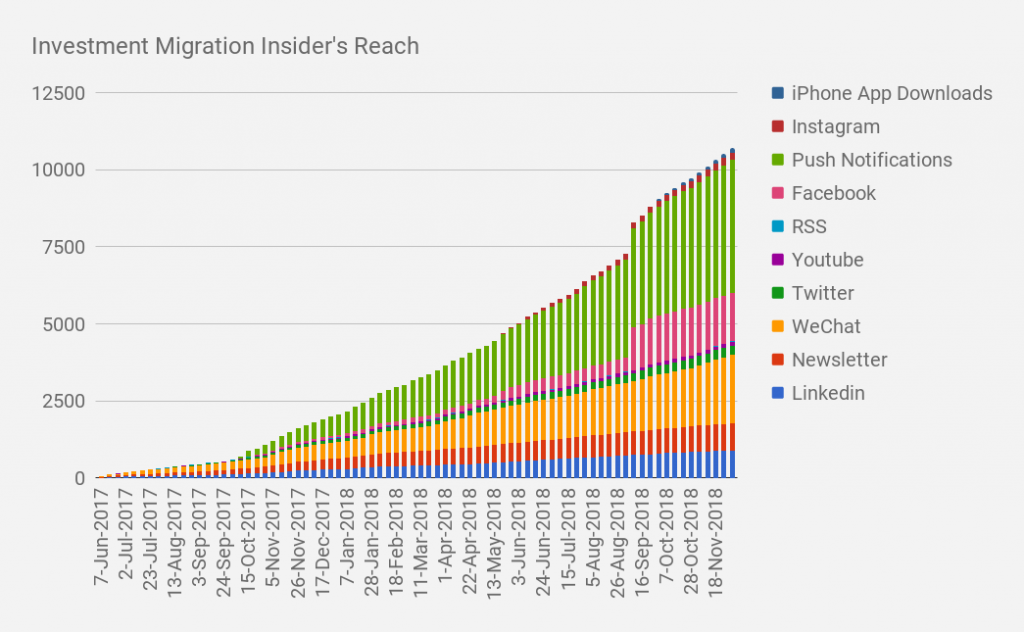

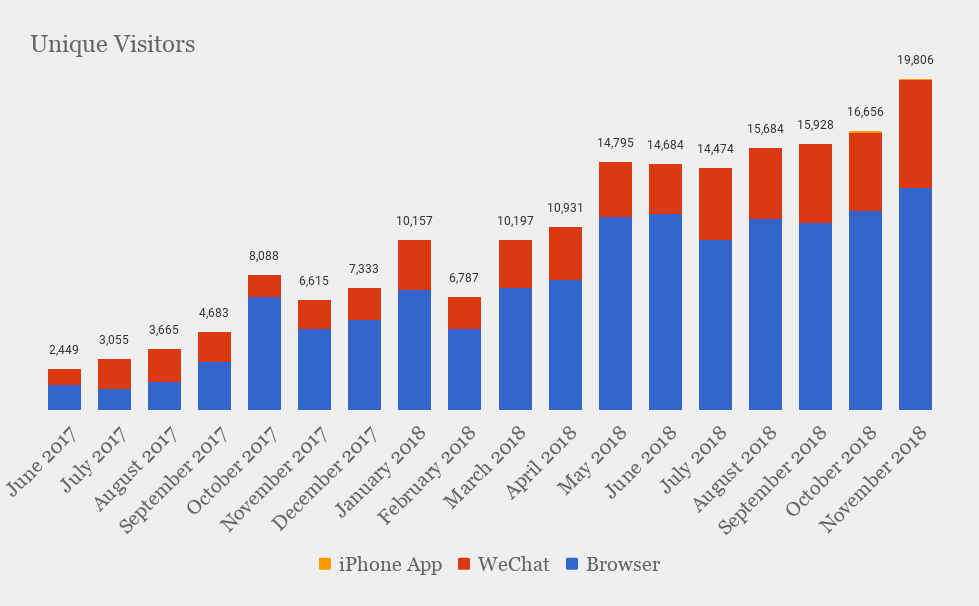

IMI’s readership tripled in 2018

New features and projects we introduced in 2018

- At the beginning of the year, we began gathering data from many of the industry’s leading firms, the results of which we later published in the Investment Migration Leaders Survey 2018. The data gathered proved gave unique insights regarding the direction the top executives believe the industry is moving, what the most popular programs were, and which source markets they are growing the most. In 2019, we will conduct another Leaders Survey, this time with greater sample size and with new questions.

- In March and April, and again in October, Investment Migration Insider took a variety of speaking engagements and moderated an array of panels during investment migration conferences from Malta to Hong Kong to Ho Chi Minh City. We also interviewed a robot in Dubai.

- In September, we published the IMI iPhone app, which has become very popular among our regular readers. The app allows for a far more smooth mobile experience than what was possible on mobile browsers.

- In May, we released the Caribbean Citizenship by Investment documentary series. Just on YouTube, more than 100,000 have seen the series so far. We’d like to extend a special thank you to the sponsors who made the series possible: Range Developments, Bayat Legal, and The Hideaway Grenada.

- In November, we launched the RCBI Company Directory, a free, public database listing some 250 companies in the investment migration industry. The database makes it possible for service providers to easily find partners with whom to work based on geographic location, program offering, number of employees, and so on. In 2019, we plan to expand the directory by also including CBI-developers, local law firms, as well as our database of Chinese immigration firms.

- In October, we introduced the IMI Data Center, a section of the website dedicated to publishing the most recent data and estimates on the world’s RCBI-programs. In 2019, we will expand this section to include statistical pages for individual countries, as well as more global data.

What to expect from IMI in 2019

- More speaking engagements

- New features on the website

- A re-launch of the CBI-Real Estate Watch section

- An expansion of the RCBI-directory to include Chinese immigration firms, local law firms, and CBI-real estate developers

- Possible extension of the documentary series

- Website redesign

- A few large-scale projects about which we cannot at the moment divulge any information.

What would you like to see more of on IMI in 2019? Leave a comment on LinkedIn or Facebook, or email the editor on cn@imidaily.com

Merry Christmas and a happy new year.

Christian Henrik Nesheim

Editor

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.