Invest in Italy Announces Partnership With ForeverGood Hotels

Invest in Italy’s partnership with FHG offers La Dolce Visa investors exclusive access to the hospitality brand’s real estate fund.

Investors can qualify for the Portuguese Golden Visa by investing at least EUR 500,000 in one of the investment funds listed in the table below.

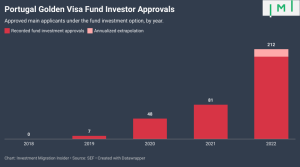

Since 2018, interest in this Golden Visa qualifying investment class has risen sharply and will increase further following the 2023 rules change.

Sort and filter the chart to find suitable investment funds. All are certified by CMVM, the Portuguese Securities Market Commission (similar to the SEC in the United States). If you find an error in our data, please do not hesitate to reach out to us directly: alexandra@imidaily.com

| Fund Name | Mgmt. Fee (% p.a.) | Fund Close | Lifecycle (years) | Minimum Investment | Target p.a IRR (%) | Fund Auditor | Subscription Fee | Fund Manager | Fund Advisor | Asset classes |

|---|---|---|---|---|---|---|---|---|---|---|

| Self-Storage I | 1.00% | 2023-3 | 7 | €150,000 | 7% | BDO | 1.0% | Insula Capital | Colares Capital | Other: Self-Storage |

| Pela Terra | 0.95% | 2025-9 | 7 | €100,000 | 10% | Deloitte | 1.0% | STAG | Impacto Pela Terra | Agricultural |

| Saratoga POR 1 | 0.55% | Continuous | Open-ended | €250,000 | 6% | FinTax | 0.0% | AIFCAP | Saratoga Capital | Mixed, ESG |

| Iberis Bluetech | 0.50% | 2023-1 | 8 | €257,500 | 15% | Ernst & Young | 3.0% | Iberis Capital | Technology | |

| BlueCrow Growth | 1.00% | 2023-1 | 7 | €52,500 | 6% | 5.0% | Bluecrow | Mixed | ||

| MedCapital | 2.00% | 2025-1 | 10 | €150,000 | 20% | Ernst & Young | 1.0% | C2 Capital | Healthcare, Commercial RE | |

| Portugal Gateway | 2.00% | 2022-9 | 10 | €100,000 | 12% | BDO | 0.0% | Portugal Ventures | Kigeni | Technology |

| ActiveCap Opportunities | 2.00% | 2024-1 | 10 | €250,000 | 13% | ORA | 2.0% | ActiveCap CP | ActiveCap CP | Mixed |

| impACT NOW | 2023-7 | 10 | €100,000 | Heed Capital | Impact Now | ESG, Startups | ||||

| Indico Blue | 2023-9 | 10 | €250,000 | Indico CP | ESG, Startups | |||||

| Planeur | 2023-1 | 10 | €350,000 | Mixed | ||||||

| Sustainable Innovation | 2022-8 | 6 | €250,000 | KPMG | Grosvenor | Healthcare, ESG, Startups | ||||

| Gaia | 2023-9 | 8 | €150,000 | BDO | Insula Capital | Agricultural | ||||

| Aretha Portugal Vision | 0.67% | 2024-5 | 10 | €50,000 | 10% | KPMG | 0.0% | Cedrus Capital | Aretha Capital | Mixed |

| TerraNova | 1.50% | 2024-7 | 8 | €100,000 | 8% | Deloitte | 1.5% | Quadrantis | Terra Verde | Agricultural |

| Growth Iberia | 2.00% | 2024-1 | 10 | €250,000 | 20% | Deloitte | 2.0% | Growth Partners | Mixed | |

| Port. Golden Opportunities | 1.8% | Continuous | Open-ended | €1,000 | Mazars | 1.0% | Optimize | Equities, Bonds | ||

| Marcha VC Fund | 3.0% | 2036-1 | 14 | €250,000 | 10% | Mc Godinho | 0.0% | INQBT | INQBT | Mixed |

| Container Fund | 2.0% | 2033-1 | 10 | €50,000 | 15% | BDO | 2.0% | Celtis Venture | Celtis Venture | Technology |

| InDexed Fund FCR | 2.0% | 2033-1 | 10 | €50,000 | 7% | BDO | 2.0% | Celtis Venture | Celtis Venture | Equities, Bonds |

| Mercurio Fund | 2.0% | 2025-1 | 7 | €100,000 | 15% | Ernst & Young | 0.0% | Oxy Capital | Mixed | |

| Prosper Harbor | 2.0% | 2025-1 | 5 | €100,000 | 5% | Ernst & Young | 3.0% | Oxy Capital | Mixed | |

| Portugal Liquid Opportunities | 1.2% | Continuous | Open-ended | €100,000 | 10% | Ernst & Young | 2.0% | Oxy Capital | Equities, Bonds | |

| VIDA Fund | 2.0% | 2025-1 | 7 | €200,000 | 10% | Deloitte | €3,500 | STAG | VIDA advisors | Hospitality |

| Tejo Solar Future | 2.0% | 2025-1 | 8 | €250,000 | 8% | BDO | 1.5% | Green One Capital | TEJO Ventures | Mixed, ESG |

| Iberian Net Zero | 1.6% | 2026-02 | 8 | €150,000 | 8% | Baker Tilly | 1.0% | STAG Fund Management | Renewable Energy | |

| Fund Name | Mgmt. Fee (% p.a.) | Lifecycle (years) | Minimum Investment | Target p.a IRR (%) | Subscription Fee |

Invest in Italy’s partnership with FHG offers La Dolce Visa investors exclusive access to the hospitality brand’s real estate fund.

Tejo Ventures: The Golden Visa’s prioritization of sustainable investments and fast-tracking citizenship heralds a brighter future for all.

Optylon Krea details the bright future of the Portuguese Golden Visa and advises investors on how to navigate the changes to the program.

“The investment fund category was gaining steam long before the government decided to abolish real estate investments,” explains Pedro Lino.

Get Golden Visa’s new report, “Get A Look Ahead: 2024,” provides insights into what awaits the Portuguese Golden Visa in 2024.

Fund investment will be the primary qualification route for the golden visa going forward. Here are four crucial elements to keep in mind.

Golden Visa funds must now limit their real estate exposure. Bluecrow details the most attractive sectors for fund investments going forward.

Meanwhile, the number of golden visas issued to American applicants has tripled in the same period. That is unlikely to be a coincidence.

Following the success of its residential real estate funds, Optylon Krea is making a big bet on the booming high-street retail market.

An interview with Safak Nervo, Optylon Krea’s CCO, on the company’s beginnings, rapid growth, and plans for the future.

PROGRAM SELECTION TOOLS

IMI Program Pages

Program Comparison and Filter Chart

Pre-Filtered Program Selections

Portugal Golden Visa Funds Comparison and Filter

EU Citizenship by Descent Policies

DATA & STATISTICS

IMI Data Center

IM Firms’ Global Office Distribution

CBI Banned Nationalities

REAL ESTATE

IMI Real Estate

CBI Real Estate Watch

Approved CBI Real Estate Developments

DIRECTORIES & LISTS

The RCBI Company Directory

Approved CBI Agents Lists

Blacklisted CBI Agents

Investment Migration Jobs

Investment Migration Events

RANKINGS & INDICES

The IMI CBI Transparency Index

The Passport Index-Index

Investment Migration Market Eligibility Index

LEARNING TOOLS

History of Citizenship by Investment

Books on Investment Migration

Caribbean CBI Documentary Series