The Relative IM Market Share of Residence, Citizenship, and Entrepreneur Programs

In the past, we’ve explored in detail the respective popularity, profitability, growth rates, and market sizes of the three sub-categories of investment migration (IM); residence by investment programs (RIPs), citizenship by investment programs (CIPs), and entrepreneur/startup visas (SUVs).

Some examples of our past global, IM category-specific analysis:

- 57,000+ Chinese Spent More Than US$44 Billion on Golden Visas in Last Decade

- With More Than 100,000 Participants, Malaysia’s M2H Is The World’s Biggest Golden Visa

- Golden Visas: A Mechanism For Moving People From Unfree Countries to Free Ones, Analysis Shows

- The 10 Most Lucrative Golden Visas Last Year, According to the Statistics

- The 10 Most Popular Golden Visas in The World Last Year, According to Statistics

- Investment Migration Market Would Reach US$100bn in Revenue by 2025 if 23% CAGR Trend Persists

- What Difference Does a Citizenship Program Make? Comparison of CIPs’ Contribution to GDP and Govt. Revenue

Some will object to our including entrepreneur visas under the IM umbrella because, in many cases, it requires hands-on involvement in the management of a business and/or physical presence requirements, thereby landing such programs outside the realm of mere investment, which is generally considered a passive engagement.

Nonetheless, we choose to count SUVs as part of the IM market because, while they often require personal involvement and presence, the basis on which such programs rest are investment and migration. They are just as much investment migration programs as RIPs and CIPs, just with more conditions attached.

Scroll through our Intel & Data category, or visit the IMI Data Center, to see the world’s largest single statistical compendium on the investment migration market. Regular readers of IMI know that data-driven analysis of the industry is what we do the most of, and what we do better than anyone else on the internet.

What we’ve rarely ventured to analyze, however, is the positions of the three sub-categories in relation to each other. Our hesitance to grapple with inter-category comparison and for favoring intra-category dissection of statistics is that the different structures, pricing, and requirements of RIPs, CIPs, and SUVs make apples-to-apples juxtaposition a thorny endeavor.

Statistical reporting standards, for instance, are not uniform (in general, RIPs do a much better job of this than programs in the other two categories, but with notable exceptions).

Moreover, while revenue figures are easy to calculate for some programs (either because exact figures are reported or because fairly accurate sums can be derived from official approval statistics), they are hard to pin down for others (certain CIPs, notably in the Caribbean and Pacific, are reticent about their data, either by design or by negligence). For others yet, revenue would be impossible to track because investment amounts are not fixed (the US E-2 program is an example).

For RIPs, we have rich, longitudinal data, in some cases dating back to the 1980s, but we can say the same for only a minority of CIPs and SUVs.

But there is one metric on which – thanks to data recently made available – we have fairly accurate numbers for the last year on all three subcategories; main applicant approval figures.

For the last full year of records (i.e., either the last four quarters, the last two halves, or the last full fiscal year), we have been able to obtain reliable figures on the number of approved main applicants for all but two programs; The Saint Kitts & Nevis CIP and the Vanuatu Citizenship Program (itself composed of two programs, the VDSP and the VCP).

For these two programs, however, which, after all, make up only a small share of the total IM market worldwide, we have arrived at estimates based on their CIP-related revenue figures (which, thankfully, are available to the public).

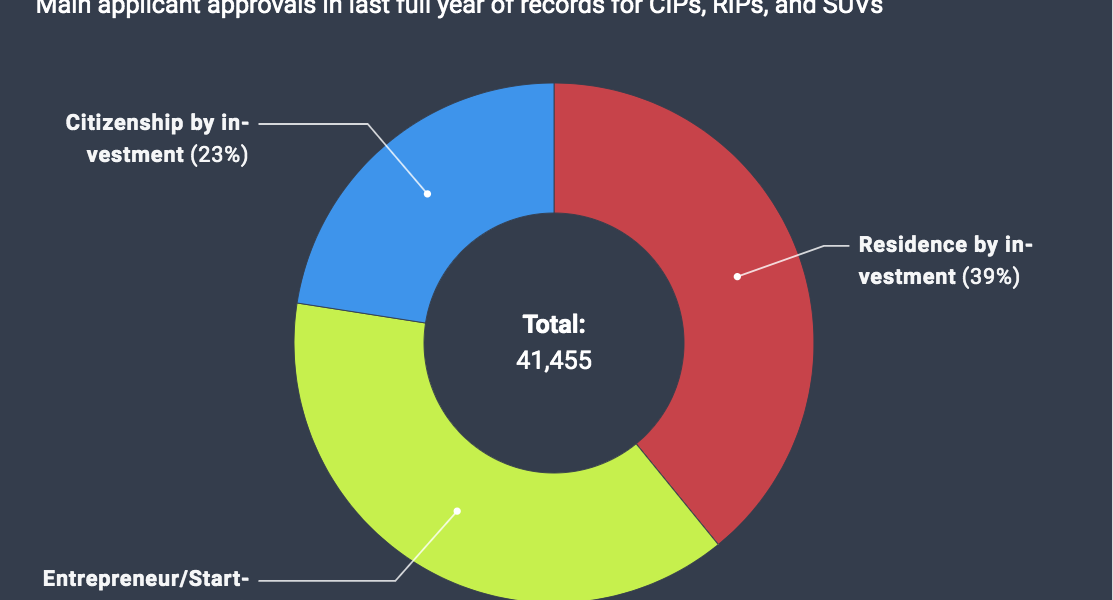

Over the last full year for which we have data:

- CIPs approved 9,344 main applicants

- RIPs approved 16,216 main applicants

- Entrepreneur/Startup visas approved 15,895 main applicants

Overall, then, in the period, 41,455 main applicants gained approval under some form of investment migration program. Accounting for some very minor programs for which we no data is available (Botswana’s golden visa and San Marino’s startup program, for example), the total number may slightly exceed 42,000.

The total number of individuals who have participated in these programs over the last year will be – based on average family sizes for the different programs – between 2.5 and 3.5 times greater than the number of main applicants. In other words, if you triple the number of main applicants (126,000 people), you won’t be far off.

Two big takeaways from this analysis:

- Citizenship by investment has grown to become a much larger component of the overall market than it was just a few years ago. Exclude, for a moment, SUVs, which we’ve only recently begun to measure, and you’ll find that of the RIP/CIP market, CIPs now account for some 37% of the overall. CIPs used to be a niche, but those days are over. One driver of this trend over the last year is the surprisingly strong performance of the Turkish CIP.

- The second lesson here is that in terms of the number of applicants – but not in terms of dollars – the Entrepreneur category is enormous.

Keep in mind that, were we to measure relative market share in terms of investment raised – which we can only do for RIPs and CIPs, and not SUVs, as we did here – the relative size of each slice of the pie would change drastically.

Should you wish to learn more about the statistics for any particular program, we encourage you to visit its program page, which you can find in the dropdown menu at the top of this website under “programs”.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.