From

IMI Research Unit

The Tax-Efficient Way to

Renounce US Citizenship

The authoritative guide on how you or your client can successfully expatriate from the United States.

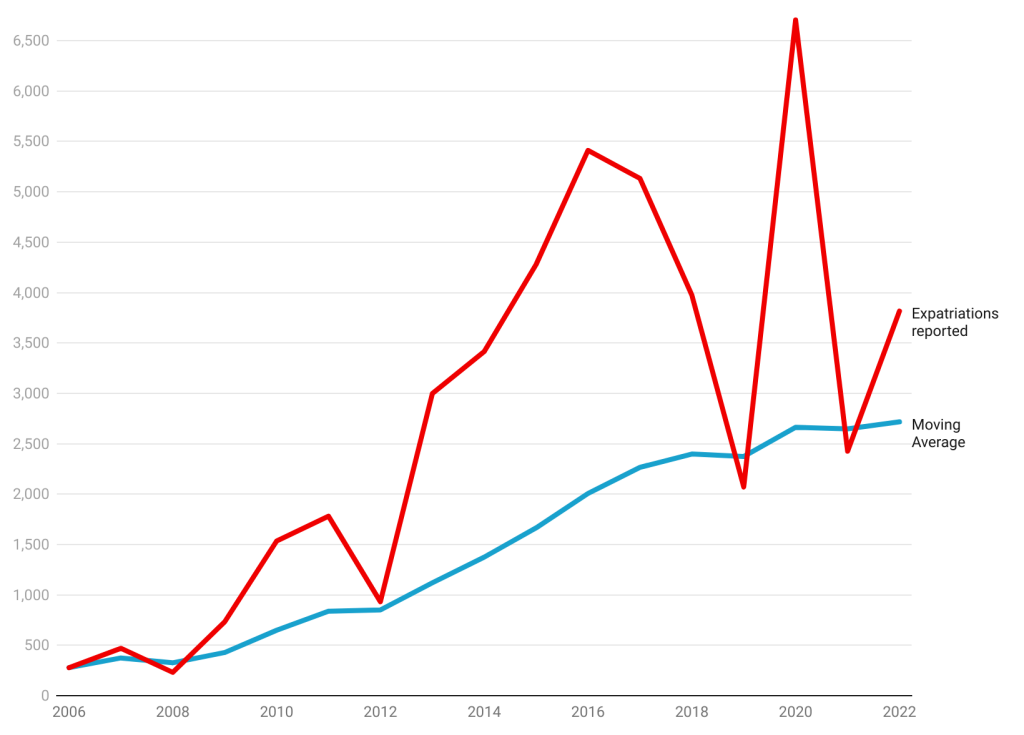

The Lesperance US Expatriation (LUSE) Index©

ABOUT THE REPORT

This guide is for HNWIs who wish to give up their American citizenships (or their advisors) while ensuring they do not run afoul of the law or become subject to unnecessarily burdensome tax liabilities.

The guide explains, in detail, the individual steps those wishing to expatriate must take, and the precise order in which they should take them.

The report answers questions and covers topics like:

– Why are Americans giving up their citizenships in increasing numbers?

– Which tax regimes apply to expatriates?

– How does the exit-tax work, and how may it be reduced or avoided altogether?

– Who should worry about the expat tax regimes?

– What are the legal and tax implications of expatriation for green card holders and US citizens?

– Which actions trigger the expatriation tax regime?

– Who are “covered expatriates”?

– The 3 Covered Expatriate Tests

– How Covered Expatriates are taxed

– What paperwork is involved in the expatriation tax regime?

– How to use pre-expatriation trusts

– The 5 steps to formally renouncing citizenship

– How to relinquish Green Card status

– How to file taxes after expatriating

– How expatriation affects future travel to the US

– and countless other questions and topics

REPORT AUTHORS

The report is authored by two of the world’s foremost experts on US expatriation and tax planning, Melvin A. Warshaw and David Lesperance, who between them have more than 70 years of experience in helping hundreds of clients expatriate from the United States.

Mel has more than 40 years of experience as a US estate planning and tax lawyer.

He represents both US and non-US high net worth individuals, families, and companies on a wide range of personal and business tax matters, especially in connection with cross-border income and estate tax planning and compliance in the US.

Mel is an ACTEC Fellow, a member of the International Academy of Estate and Trust Law, a STEP member and a member of the editorial board of Trusts & Estates magazine.

Before undertaking his current solo practice, Mel was a private client partner in the Boston office of McDermott, Will & Emery, and also worked as a senior wealth advisor at JP Morgan Private Bank, and he began his legal career in the General Counsel’s office of the IRS National Office in Washington, DC. He holds an L.L.M. (Tax) from Georgetown University.

David is one of the world’s leading advisors on international tax and immigration, an area in which he has worked for more than 30 years. Over the years, he has helped hundreds of Americans successfully expatriate.

A published author in the field, David’s personal interest in these areas grew from his experience working as a Canadian immigration and customs officer while studying law. Since being called to the bar in Ontario in 1990, he has established his expertise with major law firms, his own law firm and as a private consultant.

Routinely cited in the world’s most respected publications, David has successfully advised hundreds of high and ultra high net worth individuals and their families, many of whom continue to seek his counsel today.

David is supported by a team of professionals, some of whom have worked with him since the early 1990s.

50 pages

July, 2023

This report is FREE for IMI Pro members.

Not an IMI Pro member?

IMI Club members-only benefits:

- ✓ Unlimited articles

- ✓ Full access to the IMI Data Center

- ✓ Full access to our databases

- ✓ Full access to partner reports

- ✓ Preferential access to IMI Research Unit reports

- ✓ Free access to the Market Eligibility Index

- ✓ Listing of your profile as an IMI Expert

- ✓ Exclusive interviews

- ✓ Read IMI on the iPhone and Android apps

- ✓ Free access to our resume bank

“Thanks to IMI Club, I am never that one guy in the meeting that hasn’t heard about the latest RCBI program price cut or rule change. Getting those regular alerts is simply necessary for me to stay on top of this rapidly-changing market.”

Eric G. Major

CEO, Latitude Residency & Citizenship

PROGRAM SELECTION TOOLS

IMI Program Pages

Program Comparison and Filter Chart

Pre-Filtered Program Selections

Portugal Golden Visa Funds Comparison and Filter

EU Citizenship by Descent Policies

DATA & STATISTICS

IMI Data Center

IM Firms’ Global Office Distribution

CBI Banned Nationalities

REAL ESTATE

IMI Real Estate

CBI Real Estate Watch

Approved CBI Real Estate Developments

DIRECTORIES & LISTS

The RCBI Company Directory

Approved CBI Agents Lists

Blacklisted CBI Agents

Investment Migration Jobs

Investment Migration Events

RANKINGS & INDICES

The IMI CBI Transparency Index

The Passport Index-Index

Investment Migration Market Eligibility Index

LEARNING TOOLS

History of Citizenship by Investment

Books on Investment Migration

Caribbean CBI Documentary Series