First Data Batch in 3 Years Reveals Antigua & Barbuda CIP Now Caribbean’s Least Popular Program

For more than three consecutive years, the Antigua & Barbuda CIU has withheld from the public statistics on its citizenship by investment program, despite its legal obligation under the Citizenship by Investment Act to publish reports on the program every six months. Yesterday, however, the CIU finally published data on the program, releasing reports for no fewer than five half-year periods at once, perhaps prompted by its declining performance in IMI’s Citizenship by Investment Transparency Index

The figures reveal that, by the end of last year, the Antigua & Barbuda CIP had received a total of 3,779 applications from main applicants (approval figures are not published) since opening in 2014. These applications have resulted in the issuance of citizenship to altogether 7,205 individuals.

2018 remains the program's high-water mark, a year during which the CIU received 678 applications and raised some US$64 million in National Development Fund (NDF) contributions (amounts invested through other program categories are not published).

The numbers also indicate that - following the meteoric rise in demand for Grenada citizenship and a less-pronounced but also remarkable increase in Saint Lucia application volume over the last two years - Antigua & Barbuda is now the least popular of the five Caribbean CIPs. While neither Saint Kitts & Nevis nor Dominica has been forthcoming about releasing regular data, we know - thanks to third-party revelations and ad-hoc government reports - that their application volume is in the thousands.

The second half of 2018, in particular, stands out for having logged 400 applications in a single six-month period. Since then, application volume has remained stable, ranging between 182 and 275 each half year.

On the whole, the NDF contribution has been the program's decidedly most popular qualifying option, accounting for 76% of the all-time total. The distribution of investors' preference in qualifying option, however, has varied considerably throughout the years: Between 2014 and 2018, about one-third of applicants chose to qualify by investing in real estate. Since then, however, property investment has accounted for only 6% of applications.

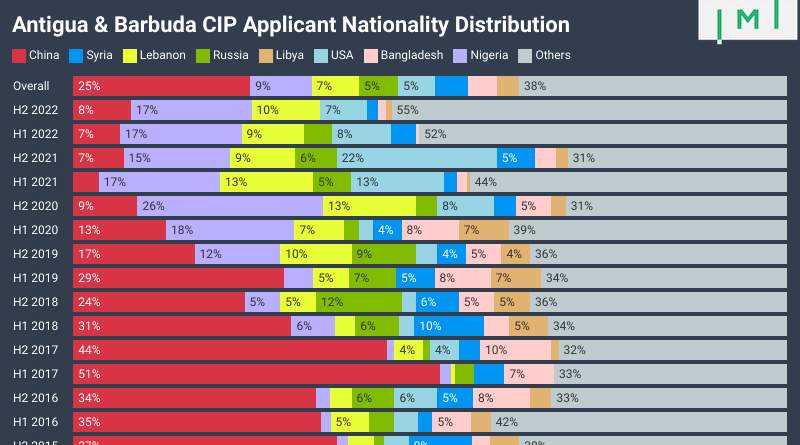

A similar pattern has played out in the nationality distribution of applicants: In the first four years of the program, 40% of applicants were Chinese. In the last five years, however, Chinese nationals have accounted for only 15% of applications. Nigerians, in particular, have demonstrated growing appetites for Antiguan citizenship: Since H1 2020, they have been the program's single-biggest applicant nationality.

Since the second half of 2016 (data on NDF contributions prior to this period are missing), Antigua & Barbuda's CIP has raised an average of just shy of US$42 million a year, with contributions peaking in 2018 at US$64 million.

While precise figures on the amounts invested in real estate, businesses, and the University of West Indies contribution option, the government - in its annual Budget Speeches - has revealed the direct revenues it received from the program in the form of passport stamp, agent license, application processing, and due diligence fees. Since 2015, these have amounted to EC$735.3 million (US$272 million).

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.

IMI Pros who can help with Antigua & Barbuda Citizenship

| . | - | Name | Location | Expertise | IM Programs | Service language(s) | Get Started |

|---|---|---|---|---|---|---|---|

|

|

Adriano Vieira | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa, Chile Independent Means Visas, Chile Investor Visa | English, Spanish, French, Portuguese | https://www.imidaily.com/adriano-vieira/#ask||Ask this IMI Pro a question |

|

Alexander Osetinskiy | 🇪🇸 Valencia, Spain | Residence and Citizenship by Investment, International Tax and Wealth Planning | UAE Golden Visa Spain Non-Lucrative Visa Spain Golden Visa Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa Turkey CIP | English, Russian | https://www.imidaily.com/alexander-osetinskiy/#ask||Ask this IMI Pro a question | |

|

|

Anastasia Barna | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Hungary Active Investor Visa Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Russian | https://www.imidaily.com/anastasia-barna/#ask||Ask this IMI Pro a question |

|

André Gonçalves | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Vanuatu DSP/REO/VCP | English, Portuguese | https://www.imidaily.com/andre-goncalves/#ask||Ask this IMI Pro a question | |

|

Antoine Saliba-Haig | 🇲🇹 Malta | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Latvia Investor Visa Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Maltese, Italian | https://www.imidaily.com/antoine-saliba-haig/#ask||Ask this IMI Pro a question | |

|

|

Aran Hawker | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Turkey CIP | English, Turkish | https://www.imidaily.com/aran-hawker/#ask||Ask this IMI Pro a question |

|

|

Ariane Real | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa Chile Independent Means Visas, Chile Investor Visa | English, Spanish, Portuguese | https://www.imidaily.com/ariane-real/#ask||Ask this IMI Pro a question |

|

Asif Ali | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Portugal Golden Visa Turkey CIP Vanuatu DSP/REO/VCP | English, Punjabi | https://www.imidaily.com/asif-ali/#ask||Ask this IMI Pro a question | |

|

Bastien Trelcat | 🇹🇭 Bangkok, Thailand | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Chile Independent Means Visas Chile Investor Visa Cyprus Golden Visa Dominica CIP France Talent Passport Business Investor France Talent Passport – Startup and Business France Talent Passport Startup and Business Creation France Citizenship by Descent France Financially Independent Person Greece Golden Visa Grenada CIP Italy Citizenship by Descent Italy Elective Residency Visa Italy Investor Visa Irish Citizenship by Descent Lithuania Citizenship by Descent Malta Permanent Residence Program Mauritius Permanent Residency Program Mauritius Active Investor Visas Mauritius Retirement Visa Monaco Carte de Séjour Namibia Investor Residency New Zealand Investor Visa Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista/Pensionado Visa Philippines Retirement Visa SRRV Philippines Special Investor Residence Permit Portugal Golden Visa Portugal D7 Visa Quebec Entrepreneurs for French speakers Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass Slovakia Citizenship by Descent South Africa Financial Independent Permit Spain Golden Visa Taiwan Golden Visa Thailand Elite Residence Program Thailand Long-Term Residency Thailand Retirement Visa Thailand Permanent Residency Thailand Citizenship | English, French, Chinese, Thai | https://www.imidaily.com/bastien-trelcat/#ask||Ask this IMI Pro a question | |

|

Calvin Mazlumyan | 🇺🇸 Los Angeles, US | Residence and Citizenship by Investment, International Real Estate | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Chile Independent Means Visas Chile Investor Visa Cyprus Golden Visa Dominica CIP France Talent Passport Business Investor France Talent Passport – Startup and Business France Talent Passport Startup and Business Creation France Citizenship by Descent Greece Golden Visa Grenada CIP Italy Citizenship by Descent Italy Elective Residency Visa Italy Investor Visa Irish Citizenship by Descent Lithuania Citizenship by Descent Malta Permanent Residence Program Mauritius Permanent Residency Program Mauritius Active Investor Visas Mauritius Retirement Visa Monaco Carte de Séjour Namibia Investor Residency New Zealand Investor Visa Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista/Pensionado Visa Philippines Retirement Visa SRRV Philippines Special Investor Residence Permit Portugal Golden Visa Portugal D7 Visa Quebec Entrepreneurs for French speakers Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass Slovakia Citizenship by Descent Spain Golden Visa Taiwan Golden Visa Thailand Elite Residence Program Thailand Long-Term Residency Thailand Retirement Visa Thailand Permanent Residency Thailand Citizenship | English, French, Spanish, Turkish | https://www.imidaily.com/calvin-mazlumyan/#ask||Ask this IMI Pro a question | |

|

Ceri Pratley | 🇹🇭 Bangkok, Thailand | Residence and Citizenship by Investment, International Tax and Wealth Planning | UAE Golden Visa Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Spain Golden Visa Spain Non-Lucrative Visa UK Innovator Founder Visa Grenada CIP Guernsey Investor & Entrepreneur Residency Greece Golden Visa Greece FIP Visa Italy Investor Visa Saint Kitts & Nevis CIP Cayman Islands Investor Visa Saint Lucia CIP Malta Permanent Residence Program Mauritius Permanent Residency Program Mauritius Active Investor Visas Mauritius Retirement Visa Netherlands Investor Visa Portugal Golden Visa Portugal HQA Visa Portugal D7 Visa Singapore Entrepass United States E2 Visa | Englis, Spanish, Afrikaans, Chinese, Arabic | https://www.imidaily.com/ceri-pratley/#ask||Ask this IMI Pro a question | |

|

Charles Savva | 🇨🇾 Nicosia, Cyprus | Residence and Citizenship by Investment, International Tax and Wealth Planning | Cyprus Golden Visa Greece Golden Visa Malta Permanent Residence Program Malta MEIN Portugal Golden Visa | English, Greek | https://www.imidaily.com/charles-savva/#ask||Ask this IMI Pro a question | |

|

Chloe Chen | 🇲🇹 Malta | Residence and Citizenship by Investment | Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Policy Portugal Golden Visa Turkey CIP | English, Chinese | https://www.imidaily.com/chloe-chen/#ask||Ask this IMI Pro a question | |

|

|

Christopher Lennon | 🇨🇦 Vancouver, Canada | Residence and Citizenship by Investment | Canada Startup Visa France Talent Passport Business Investor Portugal HQA Visa | English | https://www.imidaily.com/chris-lennon/#ask||Ask this IMI Pro a question |

|

|

Christina Georgaki | 🇬🇷 Thessaloniki, Greece | Residence and Citizenship by Investment | Greece Golden Visa; Greece FIP | English, Greek | https://www.imidaily.com/christina-georgaki/#ask||Ask this IMI Pro a question |

|

Colin Bishop | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Dominica CIP Grenada CIP Saint Kitts & Nevis CIP | English | https://www.imidaily.com/colin-bishop/#ask||Ask this IMI Pro a question | |

|

Crystal Xie | 🇲🇹 Malta | Residence and Citizenship by Investment | Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Policy Portugal Golden Visa Turkey CIP | English, Chinese | https://www.imidaily.com/crystal-xie/#ask||Ask this IMI Pro a question | |

|

Csaba Magyar | 🇭🇺 Budapest, Hungary | Residence and Citizenship by Investment, International Tax and Wealth Planning | Hungary Active Investor Visa | English, Hungarian, German | https://www.imidaily.com/csaba-magyar/#ask||Ask this IMI Pro a question | |

|

David Lawrence Lincoln | 🇵🇾 Asunción, Paraguay | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Argentina Rentista and Pensionado Residency Brazil Investor Visa (VIPER) Dominica CIP Grenada CIP Greece FIP Visa Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Latvia Investor Visa Malta Permanent Residence Program Malta MEIN Mexico Legal Residency Visa Portugal D7 Visa Portugal HQA Visa Portugal Golden Visa Paraguay Independent Means Visa Paraguay Investor Permanent Residency Program (SUACE) Turkey CIP Nicaragua Canada SUV | English, Portuguese | https://www.imidaily.com/david-lawrence-lincoln/#ask||Ask this IMI Pro a question | |

|

David Lesperance | 🇵🇱 Gdynia, Poland | Citizenship by Descent, Residence and Citizenship by Investment, US Expatriation, International Tax and Wealth Planning, Family Office Advisory | Antigua & Barbuda CIP, Dominica CIP, Grenada CIP, Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Bahamas Economic Permanent Residence Cayman Islands Investor Visa Cyprus Golden Visa Greece Golden Visa Latvia Investor Visa Malta Permanent Residence Program New Zealand Investor Visa Panama Qualified Investor Visa Portugal Golden Visa Spain Golden Visa Austria Independent Means Visa Gibraltar Category 2 HNWI Residence Greece FIP Visa Ireland Independent Means Italy Elective Residency Visa Jersey High Value Residency Portugal D7 Visa Canada Startup Visa Panama Business Investor Visa UK Innovator Founder Visa Hungary Citizenship by Descent Ireland Citizenship by Descent Italy Citizenship by Descent Latvia Citizenship by Descent Poland Citizenship by Descent Bermuda Economic Investment Certificate (EIC) Program | English | https://www.imidaily.com/david-lesperance/#ask||Ask this IMI Pro a question | |

|

Demetris Demetriades | 🇨🇾 Paphos, Cyprus | Residence and Citizenship by Investment | Cyprus Golden Visa Greece Golden Visa Greece FIP Visa | English, Greek | https://www.imidaily.com/demetris-demetriades/#ask||Ask this IMI Pro a question | |

|

Dwayne Chauhan | 🇮🇪 Dublin, Ireland | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Dominica CIP Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa Vanuatu DSP/REO/VCP | English | https://www.imidaily.com/dwayne-chauhan/#ask||Ask this IMI Pro a question | |

|

Ekaterina Mavrenkova | 🇨🇭 Zürich, Switzerland | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cayman Islands Investor Visa Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa United States EB-5 Thailand Elite Residence Program | English, Russian | https://www.imidaily.com/ekaterina-mavrenkova/#ask||Ask this IMI Pro a question | |

|

Elena Ruda | 🇦🇹 Vienna, Austria | Residence and Citizenship by Investment | Andorra Residence Without Lucrative Activity Antigua & Barbuda CIP Austria Independent Means Visa Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Italy Investor Visa Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP Hungary Active Investor Visa | English, Russian, German | https://www.imidaily.com/elena-ruda/#ask||Ask this IMI Pro a question | |

|

|

Eric G. Major | 🇬🇧 London, UK | Citizenship by Descent, Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Anguilla Permanent Residency Program Australia BIIP Investor Streams Cayman Islands Investor Visa Colombia Investor Visas M and R Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Germany Self-Employment Visa Guernsey Investor & Entrepreneur Residency United States EB-5 | English, French | https://www.imidaily.com/eric-g-major/#ask||Ask this IMI Pro a question |

|

Geoffrey DuBoulay | 🇱🇨 Saint Lucia | Residence and Citizenship by Investment | Saint Lucia CIP | English | https://www.imidaily.com/geoffrey-duboulay/#ask||Ask this IMI Pro a question | |

|

George Ganey | 🇺🇸 Washington DC, US | Residence and Citizenship by Investment | United States EB-5 United States E2 Visa | English, Spanish, Catalan | https://www.imidaily.com/george-ganey/#ask||Ask this IMI Pro a question | |

|

|

Gökçe Emer | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Spain Golden Visa Greece Golden Visa Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN New Zealand Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, Turkish | https://www.imidaily.com/gokce-emer/#ask||Ask this IMI Pro a question |

|

Güvenç Ketenci | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Antigua & Barbuda CIP, Dominica CIP, Grenada CIP, Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cyprus Golden Visa Greece Golden Visa Malta Permanent Residence Program Portugal Golden Visa UK Innovator Founder VisaUnited States EB-5 United States E2 UAE Golden Visa Austria Independent Means Visa Monaco Carte de Séjour Vanuatu DSP/REO/VCP | English, Turkish | https://www.imidaily.com/guvenc-ketenci/#ask||Ask this IMI Pro a question | |

|

|

Hakan Cortelek | 🇹🇷 Istanbul, Turkey | Citizenship by Descent, Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cayman Islands Investor Visa Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa United States EB-5 | English, Turkish | https://www.imidaily.com/hakan-cortelek/#ask||Ask this IMI Pro a question |

|

Hammad Farooqi | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP UK Innovator Founder Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Mauritius Permanent Residency Program Portugal D7 Visa Portugal Golden Visa Turkey CIP Vanuatu DSP/REO/VCP | English, Arabic, Chinese | https://www.imidaily.com/hammad-farooqi/#ask||Ask this IMI Pro a question | |

|

|

Hannah Ma | 🇸🇬 Singapore | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Malaysia M2H Visa Malta MEIN Policy Malta Permanent Residence Program Portugal D7 Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass South Korea Investor Visa Spain Golden Visa Spain Non-Lucrative Visa Thailand Elite Residence Program Turkey CIP UAE Golden Visa UK Startup/Innovator Visa United States E2 Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Chinese | https://www.imidaily.com/hannah-ma/||Ask this IMI Pro a question |

|

Hany Mostafa Moawad | 🇪🇬 Cairo, Egypt | Residence and Citizenship by Investment, International Real Estate | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Egypt CIP Egypt Residence by Investment Program Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa Vanuatu DSP/REO/VCP | English, Arabic | https://www.imidaily.com/hany-mostafa-moawad/#ask||Ask this IMI Pro a question | |

|

Huma Baig | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP UK Innovator Founder Visa Grenada CIP Greece FIP Visa Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Mauritius Active Investor Visas Mauritius Permanent Residency Program Mauritius Retirement Visa Portugal D7 Visa Portugal Golden Visa Turkey CIP Uruguay Independent Means Visa Uruguay Investor Visa Vanuatu DSP/REO/VCP | English, Hindi, Punjabi | https://www.imidaily.com/huma-baig#ask||Ask this IMI Pro a question | |

|

|

Imad Elbitar | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Andorra Residence Without Lucrative Activity Antigua & Barbuda CIP Austria Independent Means Visa Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Italy Investor Visa Malta Permanent Residence Program Nicaragua Investor PR Program Nicaragua Pensionado and Rentista Visas Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Paraguay Investor PR Program SUACE Paraguay Independent Means Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Uruguay Independent Means Visa Uruguay Investor Visa Vanuatu DSP/REO/VCP, Colombia Independent Means Visas | English, Arabic, German | https://www.imidaily.com/imad-elbitar/#ask||Ask this IMI Pro a Question |

|

James Hall | 🇸🇬 Singapore | Residence and Citizenship by Investment | Australia BIIP Investor Streams New Zealand Investor Visa | English | https://www.imidaily.com/james-hall/#ask||Ask this IMI Pro a question | |

|

|

Jasmin Lopez | 🇲🇽 Mexico City | Residence and Citizenship by Investment | Andorra Residence Without Lucrative Activity Antigua & Barbuda CIP Austria Independent Means Visa Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Italy Investor Visa Malta Permanent Residence Program Nicaragua Investor PR Program Nicaragua Pensionado and Rentista Visas Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Paraguay Investor PR Program SUACE Paraguay Independent Means Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Uruguay Independent Means Visa Uruguay Investor Visa Vanuatu DSP/REO/VCP, Colombia Independent Means Visas | English, Spanish | https://www.imidaily.com/jasmin-lopez/#ask||Ask this IMI Pro a question |

|

Jean-Philippe Chetcuti | 🇲🇹 Malta | Citizenship by Descent, Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Latvia Investor Visa Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Maltese | https://www.imidaily.com/jean-philippe-chetcuti/#ask||Ask this IMI Pro a question | |

|

Jerry Lewless | 🇺🇸 Orlando, US | Residence and Citizenship by Investment, International Real Estate | Bahamas Economic Permanent Residence | English | https://www.imidaily.com/jerry-lewless/#ask||Ask this IMI Pro a question | |

|

Joana Ferreira Reis | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa | English, Portuguese, Spanish | https://www.imidaily.com/joana-ferreira-reis/#ask||Ask this IMI Pro a question | |

|

Joseph Iskander | 🇪🇬 Cairo, Egypt | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Egypt CIP Egypt Residence by Investment Program Greece Golden Visa Grenada CIP Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa Vanuatu DSP/REO/VCP | English, Arabic | https://www.imidaily.com/joseph-iskander#ask/||Ask this IMI Pro a question | |

|

|

Kemal Nicholson | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa | English | https://www.imidaily.com/kemal-nicholson/#ask||Ask this IMI Pro a question |

|

Kenneth Camilleri | 🇲🇹 Malta | Residence and Citizenship by Investment, International Tax and Wealth Planning | Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Policy Portugal Golden Visa Turkey CIP | English, Maltese, Italian | https://www.imidaily.com/kenneth-camilleri/#ask||Ask this IMI Pro a question | |

|

Kevin Hosam | 🇦🇬 Antigua & Barbuda | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Anguilla Permanent Residency Program Australia BIIP Investor Streams Bahamas Economic Permanent Residence Bermuda Economic Investment Certificate (EIC) Program Cayman Islands Investor Visa Colombia Investor Visas M and R Greece Golden Visa Latvia Investor Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Barbados Welcome Stamp Paraguay Investor PR Program SUACE Paraguay Independent Means Visa Uruguay Independent Means Visa Uruguay Investor Visa Andorra Residence Without Lucrative Activity Cambodia My 2nd Home Canada Startup Visa Cyprus Golden Visa Malaysia M2H Visa Monaco Carte de Séjour Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Vanuatu DSP/REO/VCP | English | https://www.imidaily.com/kevin-hosam/#ask||Ask this IMI Pro a question | |

|

|

Kyle De Klerk | 🇲🇺 Port Louis, Mauritius | Residence and Citizenship by Investment, International Tax and Wealth Planning | UAE Golden Visa Antigua & Barbuda CIP Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Malta MEIN Portugal Golden Visa United States EB-5 Vanuatu DSP/REO/VCP Mauritius | English, Afrikaans | https://www.imidaily.com/kyle-de-klerk/#ask||Ask this IMI Pro a question |

|

Laszlo Kiss | 🇲🇹 Malta | Residence and Citizenship by Investment | Antigua & Barbuda CIP, Dominica CIP, Grenada CIP, Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cyprus Golden Visa Greece Golden Visa Malta Permanent Residence Program Portugal Golden Visa UK Innovator Founder Visa United States EB-5 United States E2 UAE Golden Visa Austria Independent Means Visa Monaco Carte de Séjour Vanuatu DSP/REO/VCP Hungary Active Investor Visa | English, Hungarian | https://www.imidaily.com/laszlo-kiss/#ask||Ask this IMI Pro a question | |

|

Mana Hosseini | 🇨🇦 Toronto, Canada | Residence and Citizenship by Investment | Canada Startup Visa | English, Spanish, Farsi, Armenian | https://www.imidaily.com/mana-hosseini/#ask||Ask this IMI Pro a question | |

|

Manpreet Kataria | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Malaysia M2H Visa Portugal Golden Visa Turkey CIP Vanuatu DSP/REO/VCP | English, Hindi, Punjabi | https://www.imidaily.com/manpreet-kataria/#ask||Ask this IMI Pro a question | |

|

|

Matías Apparcel | 🇨🇱 Santiago, Chile | Residence and Citizenship by Investment | Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa | English, French, Spanish, Portuguese | https://www.imidaily.com/matias-apparcel/#ask||Ask this IMI Pro a question |

|

Melvin Warshaw | 🇺🇸 Boston, US | Residence and Citizenship by Investment, International Tax and Wealth Planning, US Expatriation | United States EB-5 United States E2 | English | https://www.imidaily.com/melvin-warshaw/#ask||Ask this IMI Pro a question | |

|

Mikkel Thorup | 🇵🇦 Panama City, Panama | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Brazil Investor Visa (VIPER) Colombia Independent Means Visas Colombia Investor Visa Costa Rica Independent Means Visas Costa Rica Investor Visa Cyprus Golden Visa Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Malta MEIN Malta Permanent Residence Program Mexico Legal Residency Visa Nicaragua Pensionado and Rentista Visas Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Paraguay Independent Means Visa Paraguay Investor Permanent Residency Program (SUACE) Uruguay Independent Means Visa Uruguay Investor Visa Vanuatu DSP/REO/VCP | English | https://www.imidaily.com/mikkel-thorup/#ask||Ask this IMI Pro a question | |

|

Mixue Qin | 🇲🇹 Malta | Residence and Citizenship by Investment | Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Policy Portugal Golden Visa Turkey CIP | English, Maltese, Chinese | https://www.imidaily.com/mixue-qin/||Ask this IMI Pro a question | |

|

Mo Shaban | 🇭🇺 Budapest, Hungary | Residence and Citizenship by Investment | Hungary Active Investor Visa Hungary Citienship by Descent | English, Farsi | https://www.imidaily.com/mo-shaban/#ask||Ask this IMI Pro a question | |

|

Moataz Elzayat | 🇪🇬 Cairo, Egypt | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Latvia Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP Egypt | English, Arabic | https://www.imidaily.com/moataz-elzayat/#ask||Ask this IMI Pro a question | |

|

Mohamed Hassan | 🇪🇬 Cairo, Egypt | Residence and Citizenship by Investment | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Egypt CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Portugal Golden Visa | English, Arabic | https://www.imidaily.com/mohamed-hassan/#ask||Ask this IMI Pro a question | |

|

Mohamed Mousa | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Dominica CIP Spain Golden Visa Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa | English, Arabic | https://www.imidaily.com/mohamed-mousa/#ask||Ask this IMI Pro a question | |

|

Mona Shah | 🇺🇸 New York, US | Residence and Citizenship by Investment | Antigua & Barbuda CIP Grenada CIP Portugal Golden Visa Saint Kitts & Nevis CIP Turkey CIP UK Startup/Innovator Visa United States EB-5 | English | https://www.imidaily.com/mona-shah/#ask||Ask this IMI Pro a question | |

|

|

Murat Coskun | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Spain Golden Visa Greece Golden Visa Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN New Zealand Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, Turkish, French | https://www.imidaily.com/murat-coskun/#ask||Ask this IMI Pro a question |

|

Natalie Fridlender | 🇻🇳 Saigon (HCMC), Vietnam | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cayman Islands Investor Visa Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Russia Investor Visa | English, Russian | https://www.imidaily.com/natalie-fridlender/#ask||Ask this IMI Pro a question | |

|

Nerses Isajanyan | 🇦🇲 Yerevan, Armenia | Residence and Citizenship by Investment | English, Armenian | https://www.imidaily.com/nerses-isajanyan/#ask||Ask this IMI Pro a question | ||

|

Nicolas Salerno | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Monaco Carte de Séjour Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa United States EB-5 | English, French, Spanish | https://www.imidaily.com/nicolas-salerno/#ask||Ask this IMI Pro a question | |

|

Ömer Kahraman | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment, International Tax and Wealth Planning | Turkey CIP | English, Turkish | https://www.imidaily.com/omer-kahraman/#ask||Ask this IMI Pro a question | |

|

|

Pablo Ostrick | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment, International Tax and Wealth Planning | UAE Golden Visa Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Malta MEIN New Zealand Investor Visa Portugal Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, French | https://www.imidaily.com/pablo-ostrick/#ask||Ask this IMI Pro a question |

|

Patrick Peters | 🇨🇦 Montreal, Canada | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Saint Kitts & Nevis CIP United States EB-5 | English, French, Arabic, Chinese | https://www.imidaily.com/patrick-peters/#ask||Ask this IMI Pro a question | |

|

|

Paul Girodo | 🇨🇦 Vancouver, Canada | Residence and Citizenship by Investment | Canada Startup Visa France Talent Passport Business Investor Portugal HQA Visa | English, French | https://www.imidaily.com/paul-girodo/#ask||Ask this IMI Pro a question |

|

Paul Williams | 🇬🇧 London, UK | Residence and Citizenship by Investment, International Real Estate | Antigua & Barbuda CIP, Dominica CIP, Grenada CIP, Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Cyprus Golden Visa Greece Golden Visa Malta Permanent Residence Program Portugal Golden Visa UK Innovator Founder Visa United States EB-5 Spain Golden Visa Vanuatu DSP/REO/VCP Canada Startup Visa | English | https://www.imidaily.com/paul-williams/#ask||Ask this IMI Pro a question | |

|

Philippe May | 🇸🇬 Singapore | Citizenship by Descent, Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Anguilla Permanent Residency Program Australia BIIP Investor Streams Bahamas Economic Permanent Residence Bermuda Economic Investment Certificate (EIC) Program Cayman Islands Investor Visa Colombia Investor Visas M and R Greece Golden Visa Latvia Investor Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Barbados Welcome Stamp Paraguay Investor PR Program SUACE Paraguay Independent Means Visa Uruguay Independent Means Visa Uruguay Investor Visa Andorra Residence Without Lucrative Activity Cambodia My 2nd Home Canada Startup Visa Cyprus Golden Visa Malaysia M2H Visa Monaco Carte de Séjour Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Vanuatu DSP/REO/VCP | English, German, Chinese | https://www.imidaily.com/philippe-may/#ask||Ask this IMI Pro a question | |

|

Priscilla Mifsud Parker | 🇲🇹 Malta | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Latvia Investor Visa Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Maltese, Italian | https://www.imidaily.com/priscilla-mifsud-parker/#ask||Ask this IMI Pro a question | |

|

Reid Kirchenbauer | 🇹🇭 Bangkok, Thailand | Residence and Citizenship by Investment | Cambodia My 2nd Home Cambodia CIP | English, Khmer | https://www.imidaily.com/reid-kirchenbauer/#ask||Ask this IMI Pro a question | |

|

Roberts Valpiters | 🇱🇻 Riga, Latvia | Residence and Citizenship by Investment | Latvia Citizenship by Descent, Latvia Investor Visa | English, Russian, Hindi, Latvian | https://www.imidaily.com/roberts-valpiters/#ask||Ask this IMI Pro a question | |

|

Rogelio Caceres | 🇺🇸 Miami, US | Residence and Citizenship by Investment | Bahamas Economic PR Canada Startup Visa Cayman Islands Investor Visa Costa Rica Investor Visa Czechia Citizenship by Descent Hungary Citizenship by Descent Ireland Citizenship by Descent Italy Citizenship by Descent Latvia Citizenship by Descent Panama Qualified Investor Visa Poland Citizenship by Descent Portugal D7 Visa Singapore Entrepass Slovak Citizenship by Descent Spain Golden Visa Spain Non-Lucrative Visa UAE Golden Visa UAE Golden Visa United States E2 Visa United States EB-5 | English, Spanish | https://www.imidaily.com/rogelio-caceres/#ask||Ask this IMI Pro a question | |

|

Rosalind Cox | 🇻🇺 Port Vila, Vanuatu | Residence and Citizenship by Investment | Vanuatu DSP/REO/VCP | English | https://www.imidaily.com/rosalind-cox/#ask||Ask this IMI Pro a question | |

|

Saadiya Saadat | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Latvia Investor Visa Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Farsi, Urdu | https://www.imidaily.com/saadiya-saadat/#ask||Ask this IMI Pro a question | |

|

Sam Bayat | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cayman Islands Investor Visa Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Canada Startup Visa United States EB-5 | English, French, Farsi | https://www.imidaily.com/sam-bayat/#ask||Ask this IMI Pro a question | |

|

Sarrah Sammoon | 🇱🇰 Colombo, Sri Lanka | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Austria Independent Means Visa Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Jersey High Value Residency Latvia Investor Visa Malaysia M2H Visa Malta MEIN Policy Malta Permanent Residence Program Monaco Carte de Séjour New Zealand Investor Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass Sri Lanka Independent Means Visas Sri Lanka Investor Visas United States EB-5 | English, Sinhala | https://www.imidaily.com/sarrah-sammoon/#ask||Ask this IMI Pro a question | |

|

|

Siren Chen | 🇨🇳Shenzhen, China | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Malaysia M2H Visa Malta MEIN Policy Malta Permanent Residence Program Portugal D7 Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass South Korea Investor Visa Spain Golden Visa Spain Non-Lucrative Visa Thailand Elite Residence Program Turkey CIP UAE Golden Visa UK Startup/Innovator Visa United States E2 Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Chinese | https://www.imidaily.com/siren-chen#ask||Ask this IMI Pro a question |

|

Slava Apel | 🇨🇦 Toronto, Canada | Residence and Citizenship by Investment | Canada Startup Visa | English, Russian, Romanian | https://www.imidaily.com/slava-apel/#ask||Ask this IMI Pro a question | |

|

|

Taymour Polding | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Turkey CIP | English, Turkish | https://www.imidaily.com/taymour-polding/#ask||Ask this IMI Pro a question |

|

Till Neumann | 🇨🇭 Zürich, Switzerland | Residence and Citizenship by Investment | Antigua & Barbuda CIP Cyprus Golden Visa Germany Self-Employment Visa Spain Golden Visa Greece Golden Visa Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, German | https://www.imidaily.com/till-neumann/#ask||Ask this IMI Pro a question | |

|

Valentina Elsayed | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Latvia Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, Arabic, French | https://www.imidaily.com/valentina-elsayed/#ask||Ask this IMI Pro a question | |

|

Vito Magagnino | 🇨🇭 Zürich, Switzerland | Residence and Citizenship by Investment | Antigua & Barbuda CIP Austria Independent Means Visa Germany Self-Employment Visa Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP UAE Golden Visa UK Startup/Innovator Visa United States EB-5 Vanuatu DSP/REO/VCP | English, German, Italian | https://www.imidaily.com/vito-magagnino/#ask||Ask this IMI Pro a question | |

|

|

Werner Gruner | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Spain Golden Visa Greece Golden Visa Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN New Zealand Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, French | https://www.imidaily.com/werner-gruner/#ask||Ask this IMI Pro a question |

|

Zaid Al-Hindi | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Dominica CIP Egypt CIP Spain Golden Visa Grenada CIP Greece Golden Visa Jordan CIP Saint Kitts & Nevis CIP Saint Lucia CIP Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Turkey CIP Vanuatu DSP/REO/VCP | English, Arabic | https://www.imidaily.com/zaid-al-hindi/#ask||Ask this IMI Pro a question | |

|

Alnoor Kamani | 🇨🇦 Calgary, Canada | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Anguilla PR Program Canada Startup Visa Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Hungary Guest Investor Program Hungary Active Investor Visa Saint Kitts & Nevis CIP Cayman Islands Investor Visa Saint Lucia CIP Latvia Investor Visa Malta Permanent Residence Program Malta MEIN Portugal Golden Visa Portugal D7 Visa Thailand Elite Residence Program Turkey CIP United States E2 Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Arabic, Hindi | https://www.imidaily.com/alnoor-kamani/#ask||Ask this IMI Pro a question | |

| . | - | Name | Location | Expertise | IM Programs | Service language(s) | Get Started |