Greek Golden Visa Has Backlog Worth €1.5 Billion as Applications Surge Ahead of Price-Hike

Buoyed by the long-heralded doubling of the minimum real estate investment requirements in 36 densely populated municipalities, set to take effect on August 1st this year, the Greek golden visa has seen application volumes reach all-time highs since the government first announced the reform in September last year.

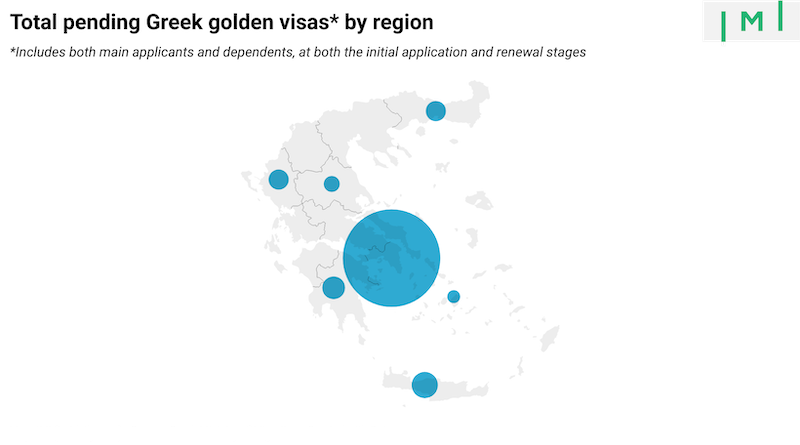

As of May 1st this year, pending golden visa applications number 15,847, distributed as follows:

- 5,114 initial applications pertaining to main applicants

- 8,125 initial applications pertaining to dependents

- 888 renewal applications pertaining to main applicants

- 1,720 renewal applications pertaining to dependents

In the six months to May 2023, Greece received an average of 786 applications a month, more than triple the average monthly volume of the preceding six months. While processing capacity has also expanded, it has been unable to keep pace with the sharp increase in applications, resulting in a backlog that has grown for eight consecutive months.

Indeed, the government has yet to process more than 700 files it received in the period before 2022:

Presuming an average Greek golden visa investment of EUR 300,000, the 5,114 unprocessed principal applicant applications alone are worth more than EUR 1.5 billion.

Attica, Greece's capital region, is home to about 4 in 10 Greeks, but to 8 in 10 of the nearly 16,000 unprocessed golden visa applications. The second-biggest backlog, far behind Attica, is Crete, where 838 applications are pending.

The program looks destined for a record year: By the end of the first third of 2023, Greece had already received 2,618 applications - i.e., some 60% of last year's total - indicating 2023 will see application volume reach well beyond all previous records. Approval volume, however, is less likely to break records: By May 1st, Greece had approved 1,090 applications, which is not on track to beat the 2019 approval record of 3,963.

Some 62% of those now holding initial Greek golden visas are Chinese, followed distantly by Turks (7%), Lebanese (5%), Russians (4%), and Egyptians (3%).

Among those holding already-renewed permits, however, the Chinese (late-comers to the Greek golden visa customer pool) are underrepresented at only 35%, followed by Russians (19%), Turks (11%), Egyptians (7%), and Lebanese (4%).

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.

IMI Pros who can help with the Greece Golden Visa

Want your profile featured in this list? Sign up for IMI Pro today

| . | . | Name | Expert based in | Areas of expertise | Program you'd like help with | Service language(s) | Get Started |

|---|---|---|---|---|---|---|---|

|

|

Adriano Vieira | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa, Chile Independent Means Visas, Chile Investor Visa | English, Spanish, French, Portuguese | |

|

Alexander Osetinskiy | 🇪🇸 Valencia, Spain | Residence and Citizenship by Investment, International Tax and Wealth Planning | UAE Golden Visa Spain Non-Lucrative Visa Spain Golden Visa Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa Turkey CIP | English, Russian | ||

|

|

Anastasia Barna | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Hungary Active Investor Visa Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Russian | |

|

André Gonçalves | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Vanuatu DSP/REO/VCP | English, Portuguese | ||

|

Antoine Saliba-Haig | 🇲🇹 Malta | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Latvia Investor Visa Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Maltese, Italian | ||

|

|

Aran Hawker | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Turkey CIP | English, Turkish | |

|

|

Ariane Real | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa Chile Independent Means Visas, Chile Investor Visa | English, Spanish, Portuguese | |

|

Asif Ali | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Portugal Golden Visa Turkey CIP Vanuatu DSP/REO/VCP | English, Punjabi | ||

|

Bastien Trelcat | 🇹🇭 Bangkok, Thailand | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Chile Independent Means Visas Chile Investor Visa Cyprus Golden Visa Dominica CIP France Talent Passport Business Investor France Talent Passport – Startup and Business France Talent Passport Startup and Business Creation France Citizenship by Descent France Financially Independent Person Greece Golden Visa Grenada CIP Italy Citizenship by Descent Italy Elective Residency Visa Italy Investor Visa Irish Citizenship by Descent Lithuania Citizenship by Descent Malta Permanent Residence Program Mauritius Permanent Residency Program Mauritius Active Investor Visas Mauritius Retirement Visa Monaco Carte de Séjour Namibia Investor Residency New Zealand Investor Visa Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista/Pensionado Visa Philippines Retirement Visa SRRV Philippines Special Investor Residence Permit Portugal Golden Visa Portugal D7 Visa Quebec Entrepreneurs for French speakers Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass Slovakia Citizenship by Descent South Africa Financial Independent Permit Spain Golden Visa Taiwan Golden Visa Thailand Elite Residence Program Thailand Long-Term Residency Thailand Retirement Visa Thailand Permanent Residency Thailand Citizenship | English, French, Chinese, Thai | ||

|

Calvin Mazlumyan | 🇺🇸 Los Angeles, US | Residence and Citizenship by Investment, International Real Estate | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Chile Independent Means Visas Chile Investor Visa Cyprus Golden Visa Dominica CIP France Talent Passport Business Investor France Talent Passport – Startup and Business France Talent Passport Startup and Business Creation France Citizenship by Descent Greece Golden Visa Grenada CIP Italy Citizenship by Descent Italy Elective Residency Visa Italy Investor Visa Irish Citizenship by Descent Lithuania Citizenship by Descent Malta Permanent Residence Program Mauritius Permanent Residency Program Mauritius Active Investor Visas Mauritius Retirement Visa Monaco Carte de Séjour Namibia Investor Residency New Zealand Investor Visa Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista/Pensionado Visa Philippines Retirement Visa SRRV Philippines Special Investor Residence Permit Portugal Golden Visa Portugal D7 Visa Quebec Entrepreneurs for French speakers Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass Slovakia Citizenship by Descent Spain Golden Visa Taiwan Golden Visa Thailand Elite Residence Program Thailand Long-Term Residency Thailand Retirement Visa Thailand Permanent Residency Thailand Citizenship | English, French, Spanish, Turkish | ||

|

Ceri Pratley | 🇹🇭 Bangkok, Thailand | Residence and Citizenship by Investment, International Tax and Wealth Planning | UAE Golden Visa Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Spain Golden Visa Spain Non-Lucrative Visa UK Innovator Founder Visa Grenada CIP Guernsey Investor & Entrepreneur Residency Greece Golden Visa Greece FIP Visa Italy Investor Visa Saint Kitts & Nevis CIP Cayman Islands Investor Visa Saint Lucia CIP Malta Permanent Residence Program Mauritius Permanent Residency Program Mauritius Active Investor Visas Mauritius Retirement Visa Netherlands Investor Visa Portugal Golden Visa Portugal HQA Visa Portugal D7 Visa Singapore Entrepass United States E2 Visa | Englis, Spanish, Afrikaans, Chinese, Arabic | ||

|

Charles Savva | 🇨🇾 Nicosia, Cyprus | Residence and Citizenship by Investment, International Tax and Wealth Planning | Cyprus Golden Visa Greece Golden Visa Malta Permanent Residence Program Malta MEIN Portugal Golden Visa | English, Greek | ||

|

Chloe Chen | 🇲🇹 Malta | Residence and Citizenship by Investment | Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Policy Portugal Golden Visa Turkey CIP | English, Chinese | ||

|

|

Christopher Lennon | 🇨🇦 Vancouver, Canada | Residence and Citizenship by Investment | Canada Startup Visa France Talent Passport Business Investor Portugal HQA Visa | English | |

|

|

Christina Georgaki | 🇬🇷 Thessaloniki, Greece | Residence and Citizenship by Investment | Greece Golden Visa; Greece FIP | English, Greek | |

|

Colin Bishop | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Dominica CIP Grenada CIP Saint Kitts & Nevis CIP | English | ||

|

Crystal Xie | 🇲🇹 Malta | Residence and Citizenship by Investment | Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Policy Portugal Golden Visa Turkey CIP | English, Chinese | ||

|

Csaba Magyar | 🇭🇺 Budapest, Hungary | Residence and Citizenship by Investment, International Tax and Wealth Planning | Hungary Active Investor Visa | English, Hungarian, German | ||

|

David Lawrence Lincoln | 🇵🇾 Asunción, Paraguay | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Argentina Rentista and Pensionado Residency Brazil Investor Visa (VIPER) Dominica CIP Grenada CIP Greece FIP Visa Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Latvia Investor Visa Malta Permanent Residence Program Malta MEIN Mexico Legal Residency Visa Portugal D7 Visa Portugal HQA Visa Portugal Golden Visa Paraguay Independent Means Visa Paraguay Investor Permanent Residency Program (SUACE) Turkey CIP Nicaragua Canada SUV | English, Portuguese | ||

|

David Lesperance | 🇵🇱 Gdynia, Poland | Citizenship by Descent, Residence and Citizenship by Investment, US Expatriation, International Tax and Wealth Planning, Family Office Advisory | Antigua & Barbuda CIP, Dominica CIP, Grenada CIP, Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Bahamas Economic Permanent Residence Cayman Islands Investor Visa Cyprus Golden Visa Greece Golden Visa Latvia Investor Visa Malta Permanent Residence Program New Zealand Investor Visa Panama Qualified Investor Visa Portugal Golden Visa Spain Golden Visa Austria Independent Means Visa Gibraltar Category 2 HNWI Residence Greece FIP Visa Ireland Independent Means Italy Elective Residency Visa Jersey High Value Residency Portugal D7 Visa Canada Startup Visa Panama Business Investor Visa UK Innovator Founder Visa Hungary Citizenship by Descent Ireland Citizenship by Descent Italy Citizenship by Descent Latvia Citizenship by Descent Poland Citizenship by Descent Bermuda Economic Investment Certificate (EIC) Program | English | ||

|

Demetris Demetriades | 🇨🇾 Paphos, Cyprus | Residence and Citizenship by Investment | Cyprus Golden Visa Greece Golden Visa Greece FIP Visa | English, Greek | ||

|

Dwayne Chauhan | 🇮🇪 Dublin, Ireland | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Dominica CIP Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa Vanuatu DSP/REO/VCP | English | ||

|

Ekaterina Mavrenkova | 🇨🇭 Zürich, Switzerland | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cayman Islands Investor Visa Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa United States EB-5 Thailand Elite Residence Program | English, Russian | ||

|

Elena Ruda | 🇦🇹 Vienna, Austria | Residence and Citizenship by Investment | Andorra Residence Without Lucrative Activity Antigua & Barbuda CIP Austria Independent Means Visa Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Italy Investor Visa Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP Hungary Active Investor Visa | English, Russian, German | ||

|

|

Eric G. Major | 🇬🇧 London, UK | Citizenship by Descent, Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Anguilla Permanent Residency Program Australia BIIP Investor Streams Cayman Islands Investor Visa Colombia Investor Visas M and R Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Germany Self-Employment Visa Guernsey Investor & Entrepreneur Residency United States EB-5 | English, French | |

|

Geoffrey DuBoulay | 🇱🇨 Saint Lucia | Residence and Citizenship by Investment | Saint Lucia CIP | English | ||

|

George Ganey | 🇺🇸 Washington DC, US | Residence and Citizenship by Investment | United States EB-5 United States E2 Visa | English, Spanish, Catalan | ||

|

|

Gökçe Emer | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Spain Golden Visa Greece Golden Visa Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN New Zealand Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, Turkish | |

|

Güvenç Ketenci | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Antigua & Barbuda CIP, Dominica CIP, Grenada CIP, Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cyprus Golden Visa Greece Golden Visa Malta Permanent Residence Program Portugal Golden Visa UK Innovator Founder VisaUnited States EB-5 United States E2 UAE Golden Visa Austria Independent Means Visa Monaco Carte de Séjour Vanuatu DSP/REO/VCP | English, Turkish | ||

|

|

Hakan Cortelek | 🇹🇷 Istanbul, Turkey | Citizenship by Descent, Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cayman Islands Investor Visa Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa United States EB-5 | English, Turkish | |

|

Hammad Farooqi | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP UK Innovator Founder Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Mauritius Permanent Residency Program Portugal D7 Visa Portugal Golden Visa Turkey CIP Vanuatu DSP/REO/VCP | English, Arabic, Chinese | ||

|

|

Hannah Ma | 🇸🇬 Singapore | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Malaysia M2H Visa Malta MEIN Policy Malta Permanent Residence Program Portugal D7 Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass South Korea Investor Visa Spain Golden Visa Spain Non-Lucrative Visa Thailand Elite Residence Program Turkey CIP UAE Golden Visa UK Startup/Innovator Visa United States E2 Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Chinese | |

|

Hany Mostafa Moawad | 🇪🇬 Cairo, Egypt | Residence and Citizenship by Investment, International Real Estate | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Egypt CIP Egypt Residence by Investment Program Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa Vanuatu DSP/REO/VCP | English, Arabic | ||

|

Huma Baig | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP UK Innovator Founder Visa Grenada CIP Greece FIP Visa Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Mauritius Active Investor Visas Mauritius Permanent Residency Program Mauritius Retirement Visa Portugal D7 Visa Portugal Golden Visa Turkey CIP Uruguay Independent Means Visa Uruguay Investor Visa Vanuatu DSP/REO/VCP | English, Hindi, Punjabi | ||

|

|

Imad Elbitar | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Andorra Residence Without Lucrative Activity Antigua & Barbuda CIP Austria Independent Means Visa Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Italy Investor Visa Malta Permanent Residence Program Nicaragua Investor PR Program Nicaragua Pensionado and Rentista Visas Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Paraguay Investor PR Program SUACE Paraguay Independent Means Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Uruguay Independent Means Visa Uruguay Investor Visa Vanuatu DSP/REO/VCP, Colombia Independent Means Visas | English, Arabic, German | |

|

James Hall | 🇸🇬 Singapore | Residence and Citizenship by Investment | Australia BIIP Investor Streams New Zealand Investor Visa | English | ||

|

|

Jasmin Lopez | 🇲🇽 Mexico City | Residence and Citizenship by Investment | Andorra Residence Without Lucrative Activity Antigua & Barbuda CIP Austria Independent Means Visa Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Italy Investor Visa Malta Permanent Residence Program Nicaragua Investor PR Program Nicaragua Pensionado and Rentista Visas Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Paraguay Investor PR Program SUACE Paraguay Independent Means Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Uruguay Independent Means Visa Uruguay Investor Visa Vanuatu DSP/REO/VCP, Colombia Independent Means Visas | English, Spanish | |

|

Jean-Philippe Chetcuti | 🇲🇹 Malta | Citizenship by Descent, Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Latvia Investor Visa Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Maltese | ||

|

Jerry Lewless | 🇺🇸 Orlando, US | Residence and Citizenship by Investment, International Real Estate | Bahamas Economic Permanent Residence | English | ||

|

Joana Ferreira Reis | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa | English, Portuguese, Spanish | ||

|

Joseph Iskander | 🇪🇬 Cairo, Egypt | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Egypt CIP Egypt Residence by Investment Program Greece Golden Visa Grenada CIP Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa Vanuatu DSP/REO/VCP | English, Arabic | ||

|

|

Kemal Nicholson | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa | English | |

|

Kenneth Camilleri | 🇲🇹 Malta | Residence and Citizenship by Investment, International Tax and Wealth Planning | Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Policy Portugal Golden Visa Turkey CIP | English, Maltese, Italian | ||

|

Kevin Hosam | 🇦🇬 Antigua & Barbuda | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Anguilla Permanent Residency Program Australia BIIP Investor Streams Bahamas Economic Permanent Residence Bermuda Economic Investment Certificate (EIC) Program Cayman Islands Investor Visa Colombia Investor Visas M and R Greece Golden Visa Latvia Investor Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Barbados Welcome Stamp Paraguay Investor PR Program SUACE Paraguay Independent Means Visa Uruguay Independent Means Visa Uruguay Investor Visa Andorra Residence Without Lucrative Activity Cambodia My 2nd Home Canada Startup Visa Cyprus Golden Visa Malaysia M2H Visa Monaco Carte de Séjour Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Vanuatu DSP/REO/VCP | English | ||

|

|

Kyle De Klerk | 🇲🇺 Port Louis, Mauritius | Residence and Citizenship by Investment, International Tax and Wealth Planning | UAE Golden Visa Antigua & Barbuda CIP Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Malta MEIN Portugal Golden Visa United States EB-5 Vanuatu DSP/REO/VCP Mauritius | English, Afrikaans | |

|

Laszlo Kiss | 🇲🇹 Malta | Residence and Citizenship by Investment | Antigua & Barbuda CIP, Dominica CIP, Grenada CIP, Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cyprus Golden Visa Greece Golden Visa Malta Permanent Residence Program Portugal Golden Visa UK Innovator Founder Visa United States EB-5 United States E2 UAE Golden Visa Austria Independent Means Visa Monaco Carte de Séjour Vanuatu DSP/REO/VCP Hungary Active Investor Visa | English, Hungarian | ||

|

Mana Hosseini | 🇨🇦 Toronto, Canada | Residence and Citizenship by Investment | Canada Startup Visa | English, Spanish, Farsi, Armenian | ||

|

Manpreet Kataria | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Malaysia M2H Visa Portugal Golden Visa Turkey CIP Vanuatu DSP/REO/VCP | English, Hindi, Punjabi | ||

|

|

Matías Apparcel | 🇨🇱 Santiago, Chile | Residence and Citizenship by Investment | Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa | English, French, Spanish, Portuguese | |

|

Melvin Warshaw | 🇺🇸 Boston, US | Residence and Citizenship by Investment, International Tax and Wealth Planning, US Expatriation | United States EB-5 United States E2 | English | ||

|

Mikkel Thorup | 🇵🇦 Panama City, Panama | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Brazil Investor Visa (VIPER) Colombia Independent Means Visas Colombia Investor Visa Costa Rica Independent Means Visas Costa Rica Investor Visa Cyprus Golden Visa Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Malta MEIN Malta Permanent Residence Program Mexico Legal Residency Visa Nicaragua Pensionado and Rentista Visas Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Paraguay Independent Means Visa Paraguay Investor Permanent Residency Program (SUACE) Uruguay Independent Means Visa Uruguay Investor Visa Vanuatu DSP/REO/VCP | English | ||

|

Mixue Qin | 🇲🇹 Malta | Residence and Citizenship by Investment | Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Policy Portugal Golden Visa Turkey CIP | English, Maltese, Chinese | ||

|

Mo Shaban | 🇭🇺 Budapest, Hungary | Residence and Citizenship by Investment | Hungary Active Investor Visa Hungary Citienship by Descent | English, Farsi | ||

|

Moataz Elzayat | 🇪🇬 Cairo, Egypt | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Latvia Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP Egypt | English, Arabic | ||

|

Mohamed Hassan | 🇪🇬 Cairo, Egypt | Residence and Citizenship by Investment | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Egypt CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Portugal Golden Visa | English, Arabic | ||

|

Mohamed Mousa | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Dominica CIP Spain Golden Visa Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Portugal Golden Visa Portugal D7 Visa Portugal HQA Visa | English, Arabic | ||

|

Mona Shah | 🇺🇸 New York, US | Residence and Citizenship by Investment | Antigua & Barbuda CIP Grenada CIP Portugal Golden Visa Saint Kitts & Nevis CIP Turkey CIP UK Startup/Innovator Visa United States EB-5 | English | ||

|

|

Murat Coskun | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Spain Golden Visa Greece Golden Visa Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN New Zealand Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, Turkish, French | |

|

Natalie Fridlender | 🇻🇳 Saigon (HCMC), Vietnam | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cayman Islands Investor Visa Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Russia Investor Visa | English, Russian | ||

|

Nerses Isajanyan | 🇦🇲 Yerevan, Armenia | Residence and Citizenship by Investment | English, Armenian | |||

|

Nicolas Salerno | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Monaco Carte de Séjour Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP UAE Golden Visa United States EB-5 | English, French, Spanish | ||

|

Ömer Kahraman | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment, International Tax and Wealth Planning | Turkey CIP | English, Turkish | ||

|

|

Pablo Ostrick | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment, International Tax and Wealth Planning | UAE Golden Visa Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Malta Permanent Residence Program Malta MEIN New Zealand Investor Visa Portugal Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, French | |

|

Patrick Peters | 🇨🇦 Montreal, Canada | Residence and Citizenship by Investment | Antigua & Barbuda CIP Canada Startup Visa Saint Kitts & Nevis CIP United States EB-5 | English, French, Arabic, Chinese | ||

|

|

Paul Girodo | 🇨🇦 Vancouver, Canada | Residence and Citizenship by Investment | Canada Startup Visa France Talent Passport Business Investor Portugal HQA Visa | English, French | |

|

Paul Williams | 🇬🇧 London, UK | Residence and Citizenship by Investment, International Real Estate | Antigua & Barbuda CIP, Dominica CIP, Grenada CIP, Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Cyprus Golden Visa Greece Golden Visa Malta Permanent Residence Program Portugal Golden Visa UK Innovator Founder Visa United States EB-5 Spain Golden Visa Vanuatu DSP/REO/VCP Canada Startup Visa | English | ||

|

Philippe May | 🇸🇬 Singapore | Citizenship by Descent, Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Anguilla Permanent Residency Program Australia BIIP Investor Streams Bahamas Economic Permanent Residence Bermuda Economic Investment Certificate (EIC) Program Cayman Islands Investor Visa Colombia Investor Visas M and R Greece Golden Visa Latvia Investor Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Barbados Welcome Stamp Paraguay Investor PR Program SUACE Paraguay Independent Means Visa Uruguay Independent Means Visa Uruguay Investor Visa Andorra Residence Without Lucrative Activity Cambodia My 2nd Home Canada Startup Visa Cyprus Golden Visa Malaysia M2H Visa Monaco Carte de Séjour Panama Business Investor Visa Panama Qualified Investor Visa Panama Rentista Retirado Visa Vanuatu DSP/REO/VCP | English, German, Chinese | ||

|

Priscilla Mifsud Parker | 🇲🇹 Malta | Residence and Citizenship by Investment, International Tax and Wealth Planning | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Latvia Investor Visa Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Maltese, Italian | ||

|

Reid Kirchenbauer | 🇹🇭 Bangkok, Thailand | Residence and Citizenship by Investment | Cambodia My 2nd Home Cambodia CIP | English, Khmer | ||

|

Roberts Valpiters | 🇱🇻 Riga, Latvia | Residence and Citizenship by Investment | Latvia Citizenship by Descent, Latvia Investor Visa | English, Russian, Hindi, Latvian | ||

|

Rogelio Caceres | 🇺🇸 Miami, US | Residence and Citizenship by Investment | Bahamas Economic PR Canada Startup Visa Cayman Islands Investor Visa Costa Rica Investor Visa Czechia Citizenship by Descent Hungary Citizenship by Descent Ireland Citizenship by Descent Italy Citizenship by Descent Latvia Citizenship by Descent Panama Qualified Investor Visa Poland Citizenship by Descent Portugal D7 Visa Singapore Entrepass Slovak Citizenship by Descent Spain Golden Visa Spain Non-Lucrative Visa UAE Golden Visa UAE Golden Visa United States E2 Visa United States EB-5 | English, Spanish | ||

|

Rosalind Cox | 🇻🇺 Port Vila, Vanuatu | Residence and Citizenship by Investment | Vanuatu DSP/REO/VCP | English | ||

|

Saadiya Saadat | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Latvia Investor Visa Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Spain Golden Visa Turkey CIP UAE Golden Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Farsi, Urdu | ||

|

Sam Bayat | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | Antigua & Barbuda CIP Dominica CIP Grenada CIP Saint Kitts & Nevis CIP Saint Lucia CIP Turkey CIP Malta MEIN Policy Australia BIIP Investor Streams Cayman Islands Investor Visa Greece Golden Visa Malta Permanent Residence Program New Zealand Investor Visa Portugal Golden Visa Spain Golden Visa Canada Startup Visa United States EB-5 | English, French, Farsi | ||

|

Sarrah Sammoon | 🇱🇰 Colombo, Sri Lanka | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Austria Independent Means Visa Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Jersey High Value Residency Latvia Investor Visa Malaysia M2H Visa Malta MEIN Policy Malta Permanent Residence Program Monaco Carte de Séjour New Zealand Investor Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass Sri Lanka Independent Means Visas Sri Lanka Investor Visas United States EB-5 | English, Sinhala | ||

|

|

Siren Chen | 🇨🇳Shenzhen, China | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Cyprus Golden Visa Dominica CIP Greece Golden Visa Grenada CIP Malaysia M2H Visa Malta MEIN Policy Malta Permanent Residence Program Portugal D7 Visa Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Singapore Entrepass South Korea Investor Visa Spain Golden Visa Spain Non-Lucrative Visa Thailand Elite Residence Program Turkey CIP UAE Golden Visa UK Startup/Innovator Visa United States E2 Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Chinese | |

|

Slava Apel | 🇨🇦 Toronto, Canada | Residence and Citizenship by Investment | Canada Startup Visa | English, Russian, Romanian | ||

|

|

Taymour Polding | 🇹🇷 Istanbul, Turkey | Residence and Citizenship by Investment | Turkey CIP | English, Turkish | |

|

Till Neumann | 🇨🇭 Zürich, Switzerland | Residence and Citizenship by Investment | Antigua & Barbuda CIP Cyprus Golden Visa Germany Self-Employment Visa Spain Golden Visa Greece Golden Visa Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, German | ||

|

Valentina Elsayed | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Canada Startup Visa Cyprus Golden Visa Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP Latvia Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, Arabic, French | ||

|

Vito Magagnino | 🇨🇭 Zürich, Switzerland | Residence and Citizenship by Investment | Antigua & Barbuda CIP Austria Independent Means Visa Germany Self-Employment Visa Greece Golden Visa Grenada CIP Malta MEIN Policy Malta Permanent Residence Program Portugal Golden Visa Saint Kitts & Nevis CIP Saint Lucia CIP UAE Golden Visa UK Startup/Innovator Visa United States EB-5 Vanuatu DSP/REO/VCP | English, German, Italian | ||

|

|

Werner Gruner | 🇵🇹 Lisbon, Portugal | Residence and Citizenship by Investment | Antigua & Barbuda CIP Australia BIIP Investor Streams Canada Startup Visa Dominica CIP Spain Golden Visa Greece Golden Visa Saint Kitts & Nevis CIP Malta Permanent Residence Program Malta MEIN New Zealand Investor Visa Portugal Golden Visa Turkey CIP United States EB-5 Vanuatu DSP/REO/VCP | English, French | |

|

Zaid Al-Hindi | 🇦🇪 Dubai, UAE | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Dominica CIP Egypt CIP Spain Golden Visa Grenada CIP Greece Golden Visa Jordan CIP Saint Kitts & Nevis CIP Saint Lucia CIP Malta MEIN Malta Permanent Residence Program Portugal Golden Visa Turkey CIP Vanuatu DSP/REO/VCP | English, Arabic | ||

|

Alnoor Kamani | 🇨🇦 Calgary, Canada | Residence and Citizenship by Investment | UAE Golden Visa Antigua & Barbuda CIP Anguilla PR Program Canada Startup Visa Dominica CIP Spain Golden Visa Grenada CIP Greece Golden Visa Hungary Guest Investor Program Hungary Active Investor Visa Saint Kitts & Nevis CIP Cayman Islands Investor Visa Saint Lucia CIP Latvia Investor Visa Malta Permanent Residence Program Malta MEIN Portugal Golden Visa Portugal D7 Visa Thailand Elite Residence Program Turkey CIP United States E2 Visa United States EB-5 Vanuatu DSP/REO/VCP | English, Arabic, Hindi | ||

| . | Name | Expert based in | Areas of expertise | Program you'd like help with | Service language(s) |