Frivolous, Unprofessional Actors: An Existential Threat to The IM Industry

Charles Savva

Cyprus

A significant portion of my daily routine involves assisting clients in navigating the misinformation they encounter online. What troubles me most are the unprofessional individuals tarnishing the reputation of the investment migration industry. There’s a tendency among these individuals to overpromise and under-deliver, accept deposits, direct clients to poor property investments, and in some cases, shut down companies and simply disappear. And then, of course, you have cases of outright fraud.

Such actions cast a negative light on the entire industry, and this has been particularly evident recently through several controversies and criticisms, shedding light on some of the potential pitfalls within the sector:

Legislative Actions and Criticisms

- In October, the European Commission announced several proposals it said would improve its ability to respond “more swiftly and decisively” to challenges like citizenship by investment programs by making the operation of such schemes grounds for the suspension of visa-free-travel to the Schengen area. This would significantly reduce (if not altogether eliminate) the attractiveness of all Caribbean passports obtained through investment schemes.

- The European Commission advised Albania against initiating a citizenship by investment program, saying it could hinder Albania’s progress toward EU membership. A similar warning was recently given to North Macedonia.

- In the United States, Congress introduced a bill named “No Travel for Traffickers Act” targeting countries with citizenship or residency by investment programs. This act aims to revoke certain visa privileges from countries offering “golden passports” due to concerns about lack of transparency and potential misuse by individuals of dubious character, with Russians being cited among the common beneficiaries of these programs.

- In the EU, there has been scrutiny and action against member states like Malta and Cyprus (the Cyprus CBI program was revoked in November 2020) over their citizenship by investment programs. These countries faced infringement procedures from the EU over concerns about applicants gaining EU citizenship without establishing genuine links to the countries. The EU says this lack of connection raises concerns about security, money laundering, tax evasion, and corruption.

- Last year, the UK scrapped its Tier 1 Investor Program amid a clampdown on Russian oligarchs’ access to UK residency. The program sustained criticism for enabling fast-track residency status in exchange for financial investments.

Changes in Program Requirements

- The Greek Golden Visa program announced an increase in the minimum investment amount from €250,000 to €500,000 for properties in specific regions, starting in late January 2023.

- Portugal ended all forms of real estate investment for its golden visa, to reduce the program’s alleged impact on property prices.

- Thailand raised prices for all categories of its Elite Visa program.

Program Closures

- Montenegro closed its CBI program after just a few years of operation on January 1.

- The Netherlands will close its golden visa in January after approving only ten cases in ten years.

Program-specific issues

A shocking and unprecedented controversy emerged in Saint Kitts and Nevis, where a number of Russian, Ukrainian, and Belarusian applicants faced retroactive rejection of their citizenship applications. These applicants had invested substantial amounts in the nation’s Citizenship by Investment Program (CIP), but the Citizenship by Investment Unit (CIU) later changed its mind by rejecting already-approved applications. Worse yet, the CIU had failed to reimburse the substantial contributions even after an 18-month delay. This incident raised legal and ethical questions and highlighted the lack of legal provisions for refunding the applicants’ donations in such scenarios.

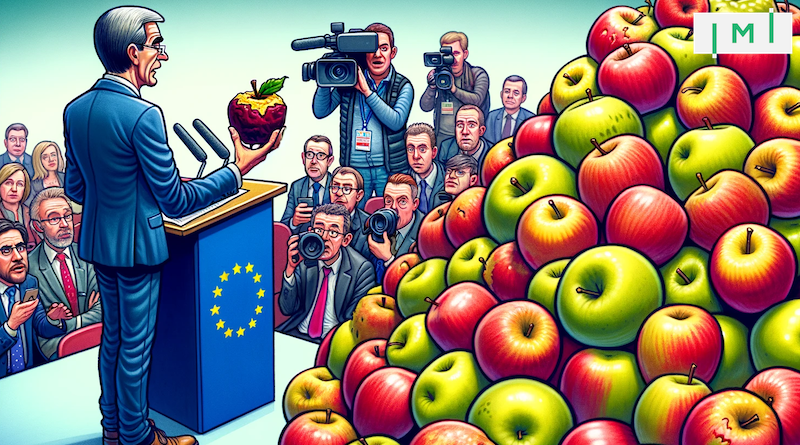

Bad apples risk spoiling the whole barrel

These incidents and changes reflect a trend of increased scrutiny and criticism directed at citizenship and residency by investment programs, raising questions about the ethical, legal, and security implications of such schemes.

The industry’s rapid growth has paved the way for a surge of unserious practitioners whose questionable practices tarnish the reputable image of investment migration. Their lack of diligence, transparency, and adherence to legal and ethical guidelines have cast a long, dubious shadow over the industry, making the quest for legitimate and fruitful migration pathways arduous for prospective investors.

It has not gone unnoticed that the Cypriot and Greek golden visa programs stand out in the EU for their robustness, popularity, and scandal-free operations. The Greek program’s surge in demand is a testament to its attractiveness. In Q1 2023, application volume increased by a staggering 259% year-over-year, a spike attributed to the government’s proactive announcement of increased investment requirements, which prompted a rush of applications. This proactive approach likely contributed to a sense of urgency and trust among investors, differentiating it from programs like Portugal’s that have faced setbacks.

In 2021 alone, 898 investors and 2,658 family members obtained the Greek golden visa, showing the program’s resilience and demand even during challenging times like the pandemic. By November 2022, a 50% year-on-year increase in applications was recorded, indicating sustained investor confidence and interest.

While the well-known and ignominious events that preceded the sudden closure of Cyprus’ erstwhile CBI program certainly contributed to the industry’s image problem, the country’s golden visa has remained unblemished. The program’s overhaul on May 1, 2023, which aimed at strengthening the program and reducing exploitation risks, showcased a commitment to integrity and transparency. The updated regulations are likely to bolster the program’s reputation and appeal by ensuring a more secure and transparent investment process.

At present, the Cyprus golden visa is the only EU permanent residency program open to Russians and mainly attracts applicants from Israel, Russia, Ukraine, China, and the Arab region. The program has never increased its investment threshold since its introduction in 2013. Furthermore, Cyprus property market prices continue to rise, especially in the coastal city of Limassol, despite speculation of a property market crash after the 2020 revocation of the citizenship by investment program.

The only drawback we wish to highlight is the delay in processing time of Cyprus golden visa applications. While government websites, as well as service providers, purport a 2-month processing time, we know the reality to be between 6 to 9 months at the time of writing this article.

Both the Greek and Cypriot programs have maintained their integrity, avoiding scandals that have marred other European schemes. This clean record, combined with their popularity and proactive governance, makes them arguably the best golden visa options in the EU. The statistics and regulatory enhancements reinforce their standing as leading choices for investors seeking residency through investment in Europe.

But as well-run and clean as these programs may be, that will be of little help if other programs – and their fly-by-night promoters – don’t adhere to ethical standards. It is up to each serious and ethical investment migration practitioner to highlight, warn against, and report mischievous market actors to protect the industry as a whole.

Charles Savva is the founder and Managing Director of Savva & Associates, and is based in Nicosia, Cyprus. He is Canadian-Cypriot and has lived in Cyprus since 2001.

With over 22 years of experience in the Cyprus professional services space, Charles’ areas of expertise include Cypriot tax, international tax planning, and investment immigration.

Since founding Savva & Associates in 2009, Charles has advised extensively in the areas of tax optimisation (personal and corporate), and assisted HNWIs and their families obtain EU citizenship or permanent residency via investment programs.

Prior to founding Savva & Associates, Charles obtained five years’ experience working with two major banks in Toronto, Canada, and was responsible for the Financial Reporting of publicly listed mutual funds. In Cyprus, he has worked for Big 4 accounting firms, as well as some of the largest professional services providers.

He has made numerous presentations at conferences worldwide regarding the uses of Cyprus in international tax planning, and is a frequent speaker at events dedicated to EU investment immigration solutions offering citizenship or permanent residency via investment programs.

Charles holds an MBA degree in Corporate Finance from the internationally renowned Schulich School of Business in Toronto, Canada, is a UK qualified Chartered Accountant, and a member of the Society of Trust and Estate Practitioners.

Apart from his native English, he is fluent in Greek.