Top 10 Investment Migration Programs Approved 100,000+ Investors Just in the Last 4 Years

The number of approvals granted to investor migrants by the ten largest investment migration programs over the last seven years has remained remarkably constant. Although the global total number of approved main applicants has increased steadily during the period, the aggregate number of approvals among the top ten programs – in isolation – vascillated at 27-29,000 for the last four years.

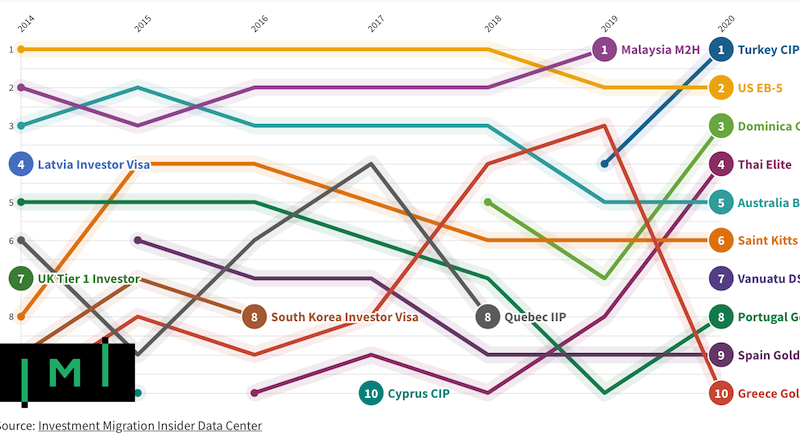

The composition of the top 10 has also been relatively stable for the last seven years: Of the ten largest programs in 2020, half were among the top 10 also in 2014. Five programs – the US EB-5, the Australia BIIP, the Saint Kitts & Nevis CIP, the Portuguese Golden Visa, and the Greek Golden Visa – have been in the top 10 for each of the last seven years, although Greece just barely made the list in 2020.

Latvia, which in 2014 was the world’s fourth-largest investment migration program, has since disappeared from the top 10 altogether and, in recent years, has not even been close to making the cut.

The Greek golden visa, which prior to the pandemic was racing toward the top spot (which, in Europe, it wrested away from Portugal in 2018), saw its fortunes reversed in 2020, as approval volumes fell by nine-tenths.

The US EB-5 program was the undisputedly largest program in the world until 2019, when Malaysia’s M2H program finally overtook it. The Malaysians, however, were only able to hang on to their pole position for a single year before its own government suspended the program, leaving it to Turkey’s astonishingly popular CIP to take the lead in 2020, just two years after launching in earnest. Vanuatu’s DSP, another sharp riser, ranked 7th in its inaugural year on the list.

The UK Tier 1 Investor visa has appeared only once in the top 10 over the last seven years; in 2014, just prior to the program’s doubling of investment minimums, when it approved 1,172 applications.

Note that the figures for Saint Kitts & Nevis’ CIP are based on rough estimates (with an error margin of ± 500 files), while we have no figures for Dominica prior to 2018 nor for Quebec IIP after the same year.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.