100 Investors Have Chosen Portugal’s Golden Visa Fund Option so Far in 2022, China Volume at Record Low

The SEF’s golden visa statistics for may showed 16 investors were approved under the program’s investment fund option, bringing the annual total to a record 100 fund investments, already well ahead of last year’s total of 81, even as seven months remain in the year. The figure implies Portugal will record 240 fund investments before the year is over.

The 100 fund investors, who all filed their applications prior to the January 2022 application freeze, contributed a combined EUR 35.2 million (indicating golden visa applicants invested no more than they needed to), a figure that comfortably exceeds the 2021 total of EUR 28.6m.

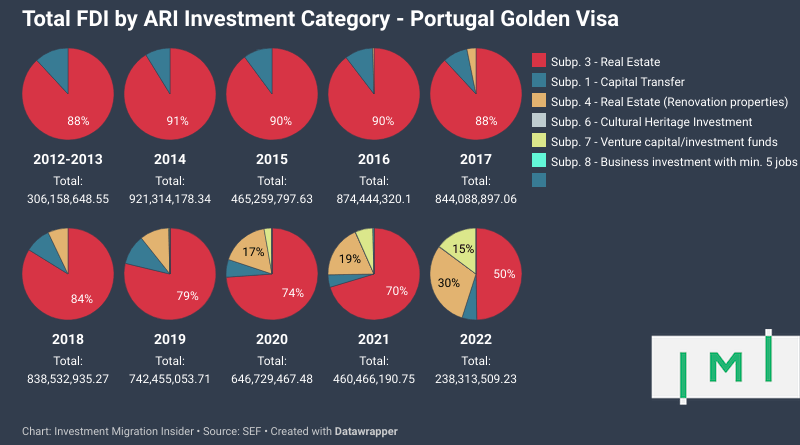

Fund investment, the fastest-growing golden visa investment category, continues to account for an ever-greater share of the program's overall capital inflows, rising geometrically each year since its introduction; 0.4% in 2019, 2.7% in 2020, 6.2% in 2021, and close to 15% so far in 2022.

As noted previously in IMI, though a causal link cannot be established for lack of nationality-specific investment preference data, the fund investment option's growing popularity has correlated strongly with the growth in applications from the US: Portugal Golden Visa Fund Investment Soars as Americans Become Top Applicant Nationality.

The precipitously rising demand from US applicants of the last few years contrasts with the trend observed among Chinese applicants; Accounting for an absolute majority of Portugal golden visa investors from the program's beginning and until as recently as 2016, Chinese participation has reached a nadir this year: So far in 2022, only 15% of applications have been Chinese nationals.

During the month of May, the program saw 112 main applicant approvals, which translated into capital inflows amounting to EUR 53.8 million.

Five months into 2022, figures show the program is well on its way to outperforming last year's 865 approvals. The 494 applications approved by the end of May imply a full-year figure of 1,186, roughly on par with 2020's total.

At the same time, however, the per-investor capital contribution has dropped steadily, from a high of EUR 661,000 in February 2020 to an average of EUR 482,000 so far this year. While this year's changes to the program may raise that average (the fund investment option now requires a minimum investment of EUR 500,000 rather than EUR 350,000), applicants may also choose to further concentrate on the cheaper options for renovation-based real estate in low-density areas.

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine - online or offline - for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.