Special Tax Regimes: How to Live in Greece and Pay a Single-Digit Tax Rate

The following article is an excerpt from our new report:

11 Special Regimes for

Low-Tax Living in High-Tax Europe

How you or your client can legally pay a single-digit tax rate and live in eight otherwise high-tax Western European countries.

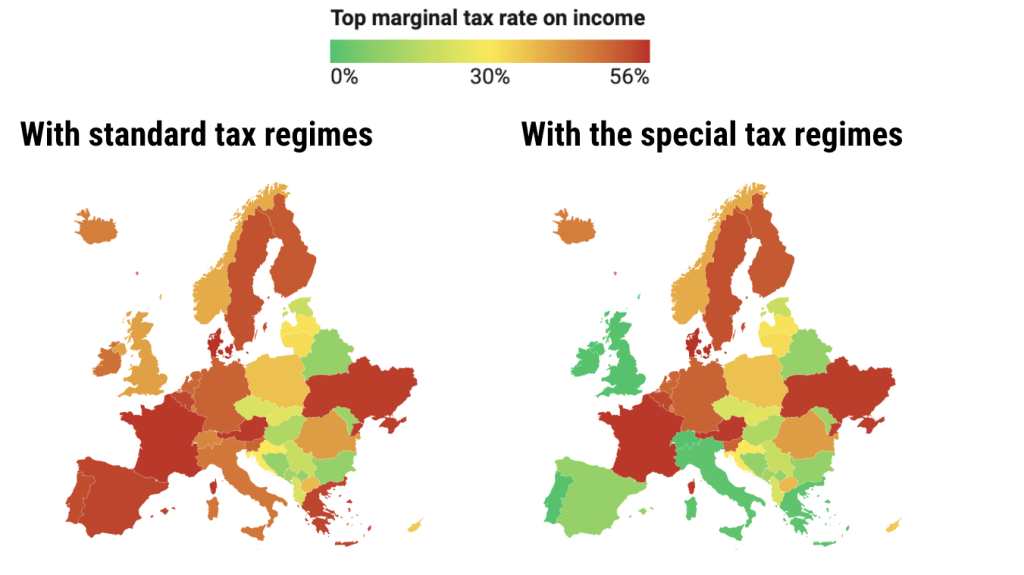

The report is for those attracted to Western Europe for its lifestyle proposition but deterred from residing there full-time by high levels of taxation. The report will show how you (or your client), by participating in special tax regimes that Western European governments have expressly designed to soften the fiscal blow for foreigners, can have your cake and eat it too.

Greece offers two particularly attractive special tax regimes; the Non-Dom Regime for Investors and the Non-Dom Regime for “Retirees”. Below, we’ll outline the eligibility requirements, principal tax benefits, and limitations of both.

The Non-Dom Regime for Investors

Key Indicators

- Maximum duration: 15 years

- Years of non-tax-residence required to qualify: 7 of the last 8 years

- Extendable to family members? Yes

Executive Summary

The Greek Non-Dom Regime for Investors allows individuals who invest €500,000 in Greek assets to pay a lump sum tax of €100,000 per year, regardless of the size of their income or wealth. Most common asset classes are eligible, and the individual may invest through a company.

The regime is also available to family members through the payment of an additional tax equal to €20,000 per adult family member per tax year.

Foreign-sourced income is entirely exempt from taxation under this scheme, as are assets held abroad. Income derived from within Greece is subject to standard Greek tax rates. The scheme is open to both Greeks and foreigners.

What are the eligibility requirements?

To be eligible, applicants must

- Not have been Greek tax residents for 7 of the 8 years prior to their transfer of tax residence to Greece;

- Demonstrate that they, their immediate family members, or a legal entity in which they hold the majority of the shares, have invested at least €500,000 in real estate, businesses, transferable securities, or shares of legal entities based in Greece.

What are the principal tax benefits?

Under this regime, individuals pay a lump-sum tax of €100,000 a year for a maximum of 15 fiscal years, regardless of the amount of income earned abroad.

It is possible to extend the regime to any direct relatives by paying an additional tax equal to €20,000 per adult family member per tax year. Family members included in the special regime in this manner are also exempt from the statutory Greek taxes on inheritance, gifts, and parental grants.

Taxpayers who choose the regime are not obligated to declare any income earned outside of Greece and will not be subject to any taxes on foreign assets.

The €500,000 minimum investment can comprise up to three separate investments, and the applicant may conclude the investment(s) up to three years after the initial application.

Which categories of income qualify for reduced taxation?

Under the Non-Dom Lump Sum scheme, any and all foreign-sourced income is exempt from taxation, while income earned in Greece is subject to standard Greek tax rates.

Non-dom regime tax residents in Greece may not use tax paid overseas on income to reduce the tax liability of the aforementioned individuals in Greece. For example, a taxpayer living in Greece on the non-dom regime cannot reduce his or her €100,000 Greek tax burden by demonstrating payment of withholding tax on the same income in another country.

If individuals who have chosen the non-dom status receive taxable income within Greece, Greek authorities will tax it according to the general provisions of the Greek tax code.

Non-dom regime participants who fail to pay the lump sum tax in full will lose their special status and will be liable for taxation on all their global income beginning with that same tax year.

The Non-Dom Regime for “Retirees”

Key Indicators

- Maximum duration: 15 years

- Years of non-tax-residence required to qualify: 5 of the last 6 years

- Extendable to family members? No

Executive Summary

The Greek Non-Dom Regime for “Retirees” (many types of passive income, not just those from pensions, qualify) allows for a 7% flat tax on pensions and other income such as dividends, interests, and capital gains earned from a foreign source.

This special status is limited to 15 consecutive years and does not apply to family members.

If the individual has already paid tax on the foreign income in another country, he or she is entitled to apply for tax credits and deductions against the 7% in Greece.

The regime is open to Greeks and foreigners alike.

What are the eligibility requirements?

To qualify for the 7% flat tax, an applicant must

- Earn a pension or pension-like income from a foreign source. This may include public or private retirement scheme payments, but also dividends, interests, annuities, capital gains, and so on;

- Not have been considered a tax resident of Greece for 5 out of the previous 6 years before transferring tax residence to Greece;

- Transfer from a country that has an active tax administrative cooperation agreement or double taxation avoidance treaty with Greece.

What are the principal tax benefits?

Pensions and withdrawals from non-Greek private pension schemes will be subject to an annual flat rate of 7%. Foreign income, such as dividends, interest, and capital gains, are also taxed at 7%.

Tax credits and deductions for international double taxation may be applied against the 7% tax if it has already been paid at source. The special regime is valid for up to 15 consecutive years.

Which categories of income qualify for reduced taxation?

Most forms of passive income arising from outside of Greece qualify for the reduced 7% tax rate. Applicants are not exempt from any applicable Greek inheritance or gift tax for movable property located outside of Greece.

This special status is not extendable to family members, who would have to qualify for the reduced rate in their own right.

Residency in Greece for Non-EU/EEA Nationals

Financially Independent Persons Visa (FIP)

Third-country nationals can obtain a renewable Greek FIP visa if they can prove they have a sufficient independent income. After 5 years of temporary residency, they may apply for permanent residency in Greece. To become a citizen of Greece after 7 years of residency, they must show integration into the country, which includes mastery of the Greek language. To keep their residency status, they must spend at least half the year in Greece and become a tax resident. Learn more

Investor Visa: “Golden Visa”

The Greek Golden Visa, the most popular residence-by-investment program in Europe over the last four years, offers visa-free travel throughout the Schengen area and settlement rights in Greece. While a variety of asset classes are available to applicants, the majority opt to qualify by investing a minimum of €250,000 (€500,000 in certain areas) in real estate on the open Greek market. Participants who can master the Greek language are eligible for Greek citizenship after seven years of de facto residence, during which the applicant must also be a tax resident. Learn more

Special thanks to Alexander Varnavas of Varnavas Law for quality-controlling the above content.

To learn more about how you or your client can live a low-tax life in high-tax European countries, see our report.