From

IMI Research Unit

11 Special Regimes for

Low-Tax Living in High-Tax Europe

How you or your client can legally pay a single-digit tax rate and live in eight otherwise high-tax Western European countries.

ABOUT THE REPORT

Western Europe, for all its flaws, remains among the world’s foremost regions in terms of quality of life. Characterized by comparatively high degrees of material well-being, security, and political predictability – and a uniquely old-world charm – life on the continent appeals to a global audience.

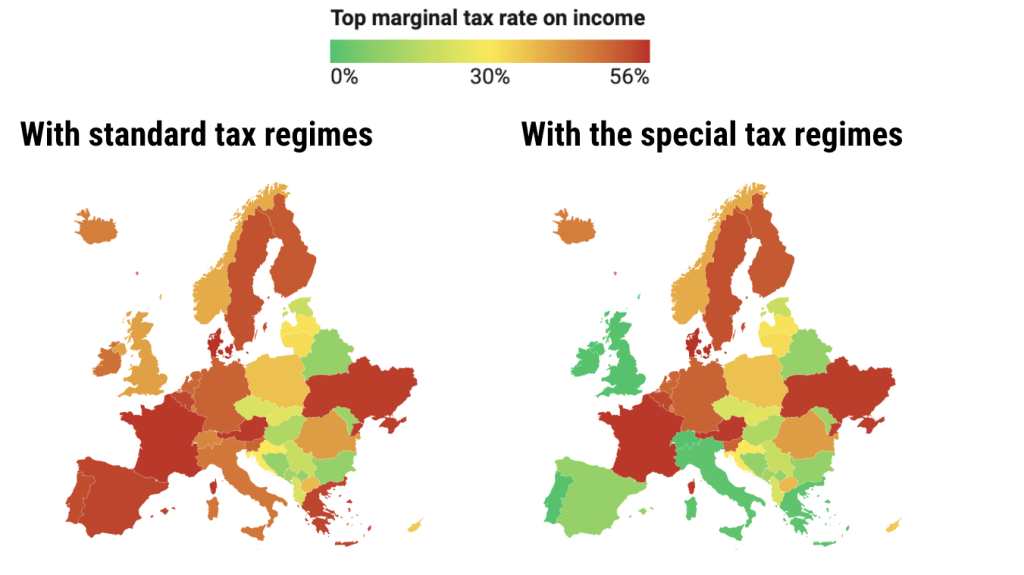

But the region has its drawbacks, chief among which are the almost uniformly heavy tax burdens it imposes on both individuals and companies.

This report is for those attracted to Western Europe for its lifestyle proposition but deterred from residing there full-time by high levels of taxation. The report will show how you (or your client), by participating in special tax regimes that Western European governments have expressly designed to soften the fiscal blow for foreigners, can have your cake and eat it too.

Our guide covers 11 preferential tax regimes in Western Europe:

– Greece

– Ireland

– Italy

– Malta

– Portugal

– Switzerland

– United Kingdom

We have only included tax regimes that enable a single-digit effective tax rate in otherwise high-tax countries (defined as having a top marginal income tax of 30% or higher).

This report does not, therefore, concern itself with European countries whose ordinary tax rates are already low – such as city-state tax havens like Monaco, Gibraltar, or Andorra – nor with larger countries with relatively low standard rates, such as Hungary, Estonia, Czechia, and so on.

Western Europe’s preferential tax regimes take various forms, each catering to particular classes of tax residents. Some are particularly favorable to those who receive high passive incomes, such as in the form of dividends, capital gains, interest, rental income, royalties, and similar.

Other regimes are better-suited to those with high professional incomes, such as senior company executives, athletes, remote-workers, and social media influencers. By the same token, some of the regimes will only make fiscal sense for those whose income is in the millions, while others enable provide exceptionally low rates of tax even for employees earning a modest income.

Europe is a high-tax continent but, if you take advantage of the growing number of special regimes, it can be a veritable tax haven.

REPORT CONTRIBUTORS

In preparing the report, we consulted with specialists in each of the special regimes. The following legal experts have quality-controlled our chapters:

56 pages

February, 2023

This report is FREE for IMI Club Pro members.

Not an IMI Pro member?

BUY THE REPORT FOR €199

IMI Club members-only benefits:

- ✓ Unlimited articles

- ✓ Full access to the IMI Data Center

- ✓ Full access to our databases

- ✓ Full access to partner reports

- ✓ Preferential access to IMI Research Unit reports

- ✓ Free access to the Market Eligibility Index

- ✓ Listing of your profile as an IMI Expert

- ✓ Exclusive interviews

- ✓ Read IMI on the iPhone and Android apps

- ✓ Free access to our resume bank

“Thanks to IMI Club, I am never that one guy in the meeting that hasn’t heard about the latest RCBI program price cut or rule change. Getting those regular alerts is simply necessary for me to stay on top of this rapidly-changing market.”

Eric G. Major

CEO, Latitude Residency & Citizenship

PROGRAM SELECTION TOOLS

IMI Program Pages

Program Comparison and Filter Chart

Pre-Filtered Program Selections

Portugal Golden Visa Funds Comparison and Filter

EU Citizenship by Descent Policies

DATA & STATISTICS

IMI Data Center

IM Firms’ Global Office Distribution

CBI Banned Nationalities

REAL ESTATE

IMI Real Estate

CBI Real Estate Watch

Approved CBI Real Estate Developments

DIRECTORIES & LISTS

The RCBI Company Directory

Approved CBI Agents Lists

Blacklisted CBI Agents

Investment Migration Jobs

Investment Migration Events

RANKINGS & INDICES

The IMI CBI Transparency Index

The Passport Index-Index

Investment Migration Market Eligibility Index

LEARNING TOOLS

History of Citizenship by Investment

Books on Investment Migration

Caribbean CBI Documentary Series