How CBI-Specific Investment Assets Can Create a Moral Hazard Situation

Following recent televised revelations in Cyprus about the Cypriot CIP, one should abstain from making rash emotional statements and, instead, look at the strengths and weaknesses of the process, warts and all.

From a purely economic standpoint, the Cypriot CIP is reported to have brought around EUR 7 billion into the Cypriot economy, which is a resounding success regardless of how one feels about RCBI as such. Considering the financial obstacle course of 2008-2020, making the Cypriot passport available has been a very sound strategy economically.

The main question, therefore, is whether the incentives have been correctly aligned to avoid corruption and to ensure equitable use of the funds.

Arguably, property projects whose pricing is often speculative and volatile; where the projects themselves rely on or benefit from some form of extraordinary or special governmental approval and where a large amount of potential profit goes to sell-side individuals, raise the incentives for official corruption.

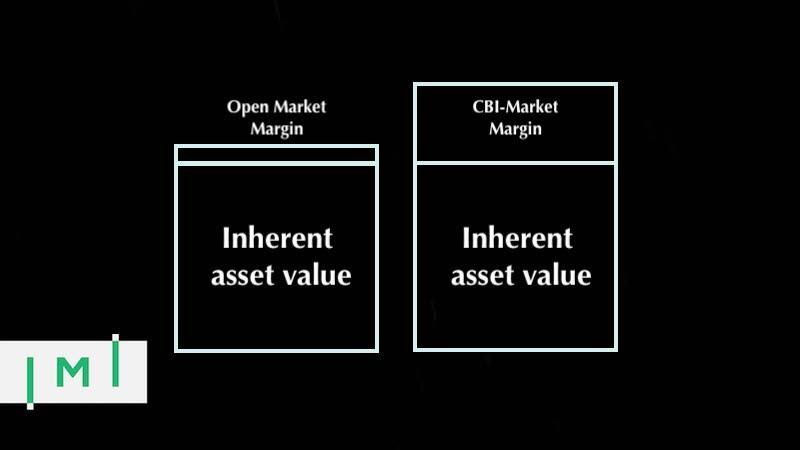

If the aim is to minimise these incentives, then investments in assets which have a value that is determined by a larger market than the CBI investors as a class themselves, and/or where there is no large profit or one that can be concentrated in a small number of hands may be preferable.

Many CIPs offer government bonds as an investment option. The price of these bonds are set, not by a small subsection of potential investors willing to pay a premium for the immigration-related benefits of the investment, but by the general bond market, which is composed of tens or hundreds of thousands of buyers and sellers (individual and institutional) from across the world. Margins are low, room to maneuver is absent, and neither promoters of nor investors in CBI are in a position to significantly impact the price.

This may be especially pertinent where, as in the Cypriot case, the naturalising state’s administration is relatively small and there is a greater chance of favours being traded.

The response is then to beef up anti-corruption defences by using time-honoured best practices and to create CIP products that do not allow for substantial profits (other than for the investors) to prevent their serving as the means to corruption.

In real estate, there can be substantial margins for the parties in the distribution chain. This is often a ’feature’, since it incentivises agents in the market to push for real-estate based CIPs and appeals to the investors who tend to like bricks-and-mortar. But such a feature can also be a negative externality.

The other limb of corruption minimisation may be general improvements of transparency in decision making, making the decisions as objectively benchmarked as possible and thus further raising the cost of attempting to corrupt government officials who will need to contort to justify irrational or apparently incorrect decisions.

A past criminal conviction can be a source of concern for applicants for CIP, even where the programme does not formally require the rejection of such applicants. This may be a reason for governments to make it clearer whether and how such information is taken into account, sparing applicants uncertainty and embarrassment, and possibly doing more to discourage attempts at impropriety, which could be informed by a perception that it is a comparatively easy route that might work.

Requiring a hypothetical applicant – such as Al Jazeera’s Mr X – to disclose criminal records from both their current and previous countries of residence might then be advisable in this context. Most CIPs already include this requirement and most naturalisation processes provide for the withdrawal of citizenship from those who fail to disclose such information or mislead.

It is as yet unclear whether the protections in place in the Cypriot system would have worked to prevent any improper pressure from them paying off. The appearance of impropriety itself is sufficiently troubling and a sufficient basis for public disquiet.

On the other hand, a properly built system is the best defence against human foibles and needs to be considered in the fullest proper perspective.

Having studied, lived, and worked in China for almost 8 years, Ivan has strong intercultural skills and extensive knowledge of China and East Asia. Prior to joining NBLO, Ivan was a lecturer in the Chinese department at the University of Plovdiv, Bulgaria. His personal interests include current affairs and social media. He is fluent in English and has professional knowledge of Mandarin Chinese.