Turkish Home Sales to Foreigners in 2021 Up By 5x Since 2013, Home Values Up 30% YoY in Real Terms

The demand for property in Turkey continues to grow at an astonishing rate. The numbers are outstanding; investment appetite unrelenting; the market restless. And the future? It looks quite profitable for those who join the fray.

Turkey’s popularity as an investment destination is remarkable by any standard, but what makes it so unique is how quickly it is expanding internationally. Especially its housing market.

An increasing number of foreigners are investing in property in Turkey, a matter undoubtedly aided by the Turkish Citizenship by Investment Program (CIP), which up to 2021 saw 19,630 people naturalized through the purchase of over 30,000 properties.

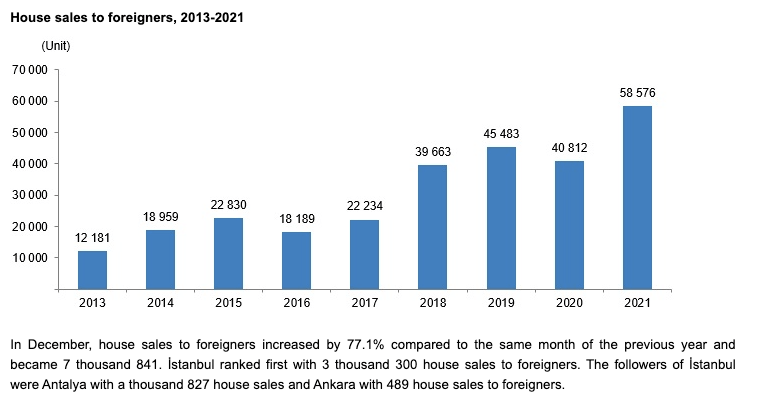

Although the CIP plays a significant part in attracting foreign investors, the trend of global high-net-worth individuals investing in Turkey isn’t new. Turkish property sales to foreigners in the past eight years have an Average Annual Growth Rate (AAGR) of 26%. The number of sales to foreigners in 2021 was four times greater than in 2013.

Between January 2013 and August 2022, foreigners purchased a staggering 323,522 residential properties, 70% of which stem from the period between January 2018 and the third quarter of 2022.

2022 is set to break the already-lofty 2021 record; residential property sales to foreigners in Turkey climbed 54.9% YoY in February of this year. The final quarter of 2022, which historically is the busiest time of the year for the Turkish housing market, remains to be counted, so we can expect the growth trend to continue.

What makes the matter more noteworthy is the internationally diverse composition of home buyers. No single major investor group dominates the market, and investors are from every imaginable locale are taking part.

Since 2013, Iraqis have been the largest buyer group, accounting for about 16%, followed by Iranians at 11.7%, and Russians at 8.9%. This distribution is far from constant. Considering 2022 in isolation, for example, Russians have been the largest cohort with 22% of all purchases, while Germans are among the top five. 2021 saw UK nationals among the top four, while Saudi Arabia had the second largest share after Iranians. House purchases in Turkey by Americans in 2021 went up a whopping 127%, exceeding the total of the two years prior.

Demand is genuinely global.

Turkey itself remains a significant attraction; pleasant weather, first-rate food, a diverse culture, and a high standard of living. Such features go a long way toward explaining the increase in foreigners visiting Turkey: International tourist arrivals grew 115% YoY in June, and Germans (up 40%) and UK nationals (up a dizzying 2453%) made up the most significant tourist groups.

Turkey’s many inherent qualities aside, the main demand driver is the investment environment the country has cultivated. The residential property appreciation rate grew an astounding 173% YoY in July; adjusted for inflation, that rate comes down to a still-impressive 30%. That represents a massive arbitrage gain for real estate investors, especially when given more context and compared to other prominent real estate markets targeting foreign investors.

By comparison, Portugal’s housing market, buoyed by the Golden Visa, saw a 12.9% increase, Greece mustered 9.2%, and the UK achieved a 9.9% increase.

In purely numerical terms, arbitrage gains in Turkey’s housing market are virtually unmatched and provide excellent value for money.

Turkey’s average house price per sqm is around 9,000 TL, which translates to anywhere between 500-700 USD on average due to the TL’s constant flux. In Istanbul, prices per sqm have an average of 1,051 USD.

Compared to Portugal, where the average residential property price is 1,454 EUR per sqm, or the UK (not London, but the whole of the UK) where a square meter of property would average 3,000 GBP, Turkey offers a clear advantage in terms of getting greater value for money.

The lower initial cost and massive arbitrage gain make investing in Turkey a uniquely exciting opportunity. The increasing number of tourists, as mentioned above, also opens the door for tremendous ROI possibilities through short-term or touristic rentals.

Turkey’s CIP is the world’s most popular for good reason. The country’s unique geopolitical status offers applicants something distinctive, the living standard is excellent, and the investment environment is unique. Demand will continue to grow, and so will the profits for those savvy enough those to take advantage of the right opportunity at the right time.

To know more about Turkey’s CIP or about investing in real estate in Turkey’s most exciting cities, contact CIP Turkey today via our website.