Whichever Way SCOTUS Rules in Moore Case, The Result Will Be More US Citizenship Renunciations

Reasonable Doubt

With David Lesperance

A contrarian expert on contingency plans for the wealthy delivers uncomfortable truths.

Over the last six months, there has been significant press in the US about a particular tax related case called Moore v. United States. We can summarize a deep-dive explanation of the case as “Can the US federal government tax unrealized capital gains?”

The Supreme Court of the United States (“SCOTUS”) heard the verbal arguments on December 5th, 2023, but their written decision is not expected until June or July of 2024.

The issue I want to explore in this article is how the upcoming SCOTUS decision in the Moore case will impact wealthy Americans who are contemplating triggering a “fire escape plan” to expatriate from the US. For those who are unfamiliar with Expatriation Planning, I recommend that they review the IMI report on this issue that Melvin Warshaw and I co-authored.

Who is and (and is not) on the Expatriation List?

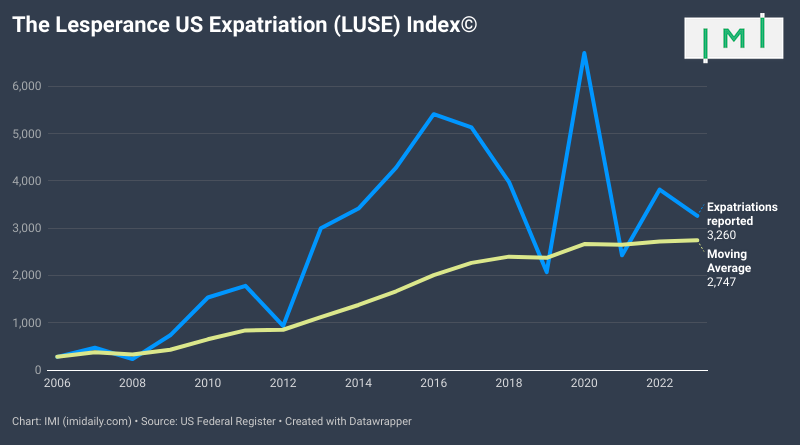

As the most recent Expatriation List notes, the pace of wealthy Americans who are renouncing US citizenship has continued to accelerate. Will the decision in Moore increase or decrease the trend of wealthy Americans who are expatriating? To properly understand the much misunderstood “list,” I recommend that readers take some time to review my article on how the list is compiled: Record Numbers of Americans Renouncing Citizenships Has Nothing to Do With The Pandemic.

How will the SCOTUS decision in the Moore case impact the expatriation trend?

Leaving the constitutional arguments to others, it is worthwhile to look at the predictable consequences of this forthcoming decision on the phenomenon of expatriation, no matter which way the SCOTUS comes down:

SCOTUS decision option A: Lower Court is Overturned (i.e., taxing unrealized capital gains is unconstitutional)

This would have the impact of opening the expatriation floodgates as Internal Revenue Code (“IRC”) s.877a (AKA the Expatriate Exit Tax) would be deemed unconstitutional.

With the Exit Tax eliminated, the major “cost barrier” holding back UHNW Americans from expatriating would be eliminated. A dramatic example would be if Elon Musk renounced his US citizenship: He would no longer need to pay a gigantic capital gains bill. With Canadian and South African citizenship in hand, he wouldn’t even need an ESTA to visit the US in the future!

SCOTUS decision option B: Lower Court is Upheld (i.e., taxing unrealized capital gains is constitutional):

There has been a significant amount of discussion about how SCOTUS upholding the lower court’s decision in Moore would allow the US government to introduce a future Wealth Tax. If this is the decision of SCOTUS, the Billionaire Tax proposal could quickly become the law of the land.

The section of this potential future tax law on “Covered Expatriates” is horrendous. As a result, any prudent wealthy American should immediately equip themselves with the ability to expatriate and should actually pull the trigger between the date of a Democratic trifecta in Nov. 2024 and the swearing in of a new administration.

Why the billionaire tax bill would turn this expatriation flood into a tsunami

Under the current Expatriation Tax rules, Covered Expatriates (i.e., more than $2m net worth, etc.) are required to mark all of their assets to market pursuant to IRC s.877a. However, the Billionaire Tax proposal ramps up the tax hit significantly in four major ways.

First, the Billionaire Tax proposal calls for the elimination of the current deferral election currently permitted by IRC s.877A.

Second, the Billionaire Tax proposal calls for IRC s. 877 to apply to Covered Expatriates for the 10-year period after expatriation. Specifically, certain categories of income and gains that would otherwise not be taxed to a normal nonresident alien will continue to be treated as US-source income and taxed to the Covered Expatriate for 10 years after termination of US taxpayer status.

In practice, income on gains from sales of US stocks and securities are designated as having a US source and is taxable in the hands of a Covered Expatriate.

Third, the normal Substantial Presence Test will not apply to Covered Expatriates. Rather, if the Covered Expatriate spends more than 30 days in the US in any year during the ten-year period following expatriation, they will be treated as a US person for tax purposes subject to US tax on worldwide income for that year.

As a final blow, the Billionaire Tax proposal states that all of a Covered Expatriate’s worldwide assets will again be deemed sold once more at the end of the ten-year period. In short, the Exit tax hits Covered Expatriates upon renunciation of US citizenship or relinquishment of long-term Green Card status and again 10 years later to capture any gains in the decade after their departure!

When a Covered Expatriate compares the “one and done” deemed disposition Exit Tax under the current Expatriation Tax regime to the proposed ramped-up tax liability under the Billionaire Tax regime, the decision to expatriate before a new Democratic administration comes to office becomes obvious.

What should wealthy Americans do now?

The current version of the Billionaire Tax proposal is supposed to only apply to those American taxpayers who have more than $100m in net worth. However, historically, all tax proposals start by targeting the “super-rich,” but quickly, the definition of “rich” expands downward.

Therefore wealthy Americans who are not yet worth $100M would be well advised to equip themselves with the fire insurance of a second citizenship and a fire escape plan of an integrated tax and expatriation tax strategy.

Those who do not already possess the fire insurance of a second citizenship need to take note that the time needed to obtain the same is at least 9 months in most cases. That is why many HNW Americans are already actively seeking second citizenships and not waiting until the Moore decision is rendered in June 2024 (only five months from the November 2024 election).

In short, don’t wait until the fire marshal confirms that the “Tax the Rich Wildfire” is about to engulf your fiscal house before seeking the fire insurance of a second citizenship and a fire escape plan.

David Lesperance is a global leader of international tax and immigration advisors.

A published author in the field, his personal interest in these areas of law grew from his experience working as Canadian immigration and customs officer while studying law. Since being called to the bar in 1990, he has established his expertise with major law firms, his own law firm and as a private consultant. David has successfully advised scores of high and ultra high net-worth individuals and their families, many of whom continue to seek his counsel today. In addition he has provided pro bono advice to many governments on how to improve their Citizenship by Investment, Residence by Investment or Golden Visa type programs to better meet the needs of his global clients. David is supported by a team of professionals, some of whom have worked with him since the early 1990s.