Record Numbers of Americans Renouncing Citizenships Has Nothing to Do With The Pandemic

Reasonable Doubt

With David Lesperance

A contrarian expert on contingency plans for the wealthy delivers uncomfortable truths.

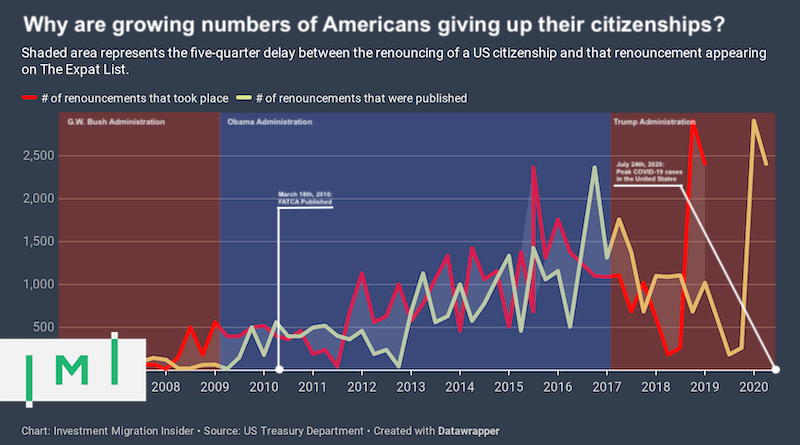

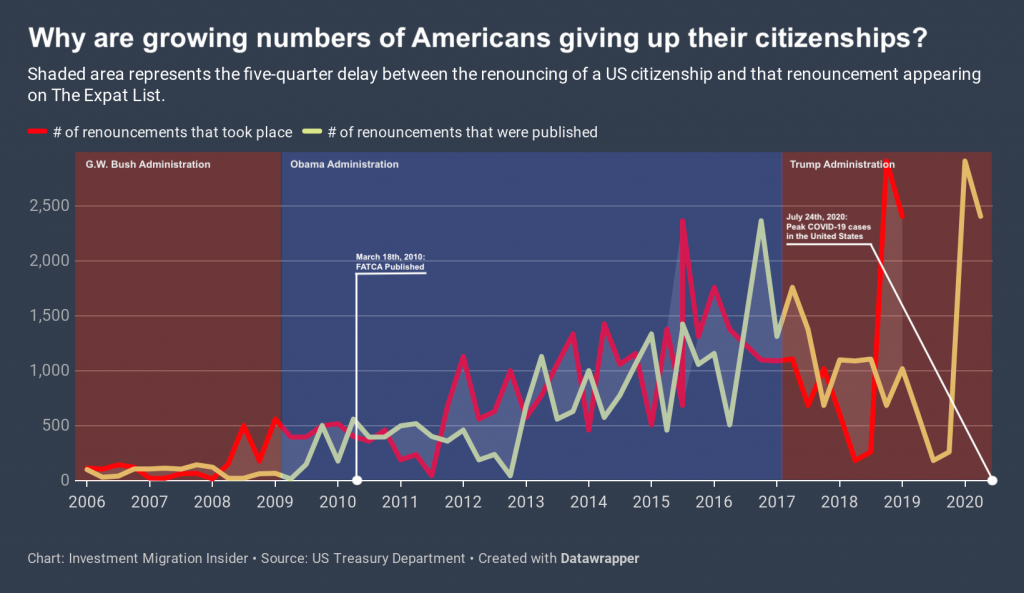

About four times a year, the US media write a flurry of articles about the latest “Expatriation List” (i.e. “The List”). The List is often incorrectly described as the number of Americans who had renounced US citizenship in the last quarter. Since the US is the only major country that has citizenship-based taxation, it is seen as a bellwether as to the attitudes of Americans towards their current crop of politicians.

Press reports on US expatriation are accurate in number but non-sensical in state causation

The most recent publication of The List was followed quickly by a press release by a self-anointed “expert” who claimed “the huge increase in US expats renouncing, from our experience, is that the current pandemic has allowed individuals the time to review their ties to the US and decide that the current political climate and annual US tax reporting is just too much to bear.” In short, that the pandemic and the US government’s reaction to the attendant crisis directly caused the large increase in the list over the past few quarters.

Such a statement exposed the “expert’s” complete ignorance of the subject in two obvious and indisputable ways. First, it takes approximately 12 to 18 months from the moment of renunciation until that renunciation appears on The List (a delay of between four and six quarters) because of the things that must happen between those two events:

- The information is sent to the Stare Department to confirm that the renunciation was properly carried out by the issuance of a Certificate of Loss of Nationality;

- An IRS 8854 must be filed with the IRS;

- Both the State Department and the IRS forward their information to the The Office of the Federal Register; and finally

- The OFR cross-references the information and publishes the most recent edition of The List.

In other words, the August 6, 2020 List was a reflection of events that occurred when Covid-19 was not even a twinkle in a bat’s eye.

Second, as a result of Covid-19, almost all American Citizen Services (ACS) at US missions abroad where closed for most of the spring. ACS offices are where renunciations must take place according to US law. As a result of a massive increase in the numbers of renouncing Americans over the past decade, ACS offices now only handle renunciation interviews on a pre-booked interview basis.

This has resulted in massive backlogs at some ACS offices, with wait times of well over a year for interviews. Therefore, as a result of Covid-19, no renunciations took place in the last few months, as all interviews were cancelled. Most ACS offices have yet to reopen interview reservations or rescheduling.

Expatriations will drop for several quarters in mid-to-late 2021 – but not because of who occupies the White House

Not only was the increase in the number of renunciations taking place not a result of the US government’s reactions to Covid-19, but I will go out on a not very thin limb and predict that, in about 12 to 18 months, there will be a massive drop-off of names on The List.

This will not be a result of a positive reaction to the winners of the upcoming November 2020 US elections. Rather, it will be a reflection of operational issues that occurred in 2020 as a result of Covid-19.

For those who want to know more about who is on The List, I will refer you to this blogpost, written in response to nonsense published after the last List was issued.

Expatriations will accelerate in the future – By how much will depend on the results of the upcoming elections

Wealthy Americans are well aware of the fact that the pandemic has brought on additional US government expenditure requirements. They are also aware of the reality that additional tax revenues need to be located in order to service this additional debt. Finally, they recognize the reality that the vast majority of the US population do not have any additional surplus income that they can contribute to this tax revenue need and that the burden will – and must – fall on them. They accept this future tax liability as a reality.

However, what they do not accept or appreciate is the increasing rhetoric shifting from “getting money to pay for necessities” to “taking money from bad people”. This is the type of negative commentary you get from Bernie Sanders and Anand Giridhradas.

The reality for many wealthy American families is that their choice in November is between:

a) Four more years of Trump chaos; or

b) Democratic tax policies which at a minimum will see capital gains double.

Therefore, it is not surprising that many of these families have chosen to react in the same manner as they would if they had discovered that their home was in the path of a wildfire. Specifically, engaging in fire prevention techniques (eg. tax harvesting and estate freezes); fire insurance (i.e. alternative citizenship and residences); and developing a fire escape plan (i.e. a personal and financial exit plan from the US tax system). For those interested in reading more about this preparation, I recommend this article.

The most significant takeaway from this latest expatriation list is that for every affluent American who is actually expatriating, 10 to 20 are getting a backup plan “just in case”. Future numbers on The List will be based completely on how many wealthy Americans decide to “vote with their feet”.

With the US government relying on the top 1% of American taxpayers for over 1/3 of total personal tax revenue, a loss of even a tiny number of these “golden geese” will have an asymmetric and permanent negative impact on monies available to pay for entitlement and pandemic recovery programs. Food for thought as the world focuses on the rapidly approaching US elections!

David Lesperance is a global leader of international tax and immigration advisors.

A published author in the field, his personal interest in these areas of law grew from his experience working as Canadian immigration and customs officer while studying law. Since being called to the bar in 1990, he has established his expertise with major law firms, his own law firm and as a private consultant. David has successfully advised scores of high and ultra high net-worth individuals and their families, many of whom continue to seek his counsel today. In addition he has provided pro bono advice to many governments on how to improve their Citizenship by Investment, Residence by Investment or Golden Visa type programs to better meet the needs of his global clients. David is supported by a team of professionals, some of whom have worked with him since the early 1990s.