Pandora Papers: Lessons for Investment Migration Advisors and Clients

Reasonable Doubt

With David Lesperance

A contrarian expert on contingency plans for the wealthy delivers uncomfortable truths.

The news cycle has again been dominated by a news blitz from the International Consortium of Investigative Journalists (“ICIJ”). This is the same group that brought you the Panama Papers and the Paradise Papers. They have given this latest release the moniker of the “Pandora Papers”.

How should I look at the individual stories described in the Pandora Papers or similar leaks?

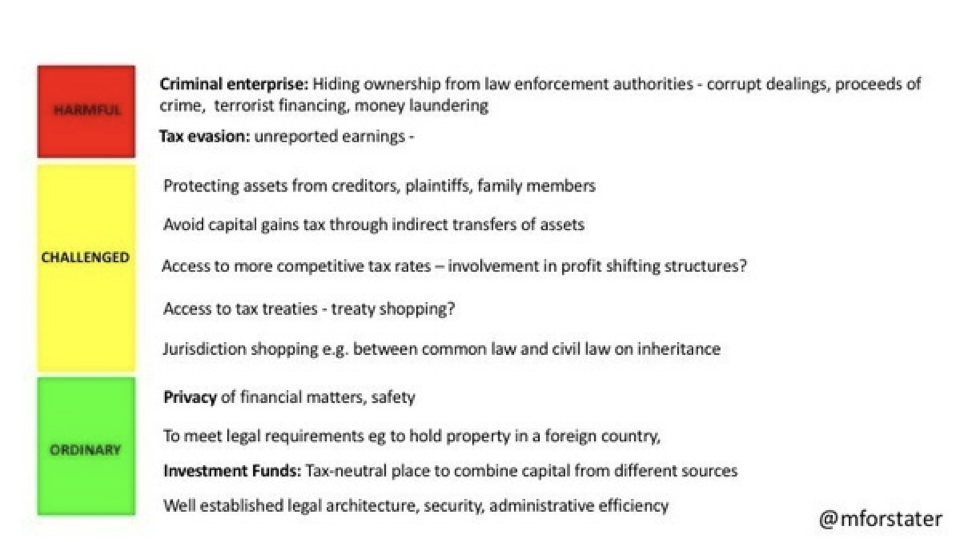

When reading any story on the Pandora Papers or any of the ICIJ’s prior releases, it is essential to evaluate where this “revelation” falls on the below paradigm, created by well-known tax justice advocate Maya Forstater, and adjust your outrage accordingly:

Although I would question Ms. Forstater’s designation of some or most of the Yellow Zone items as really Green Zone, in the Pandora Papers, the disclosures about Congo President Denis Sassou-Nguesso were clearly in the Red Zone. In stark contrast, the listing of Elton John’s purely vanilla international structure was clearly in the Green Zone.

Will there be future “Papers”?

The first thing to understand is that no matter what one may think of the ethics of the matter, the disclosure of personal financial information by groups such as ICIJ will continue in the future. That is simply the reality of the world in which we now live. As a result of US legislation – such as FATCA and its offspring the Common Reporting Standard – financial institutions and other offshore and onshore entities now gather documentation in electronic form. That electronic information can be downloaded or transferred at a moment’s notice. Long gone are the days when Tom Cruise’s lawyer character in The Firm needed to spend days photocopying and sneaking out paper files.

Once accessed, the sending of information by insiders to ICIJ is equally simple. Those insiders may be legitimate whistleblowers who are out to reveal Red Zone activities. Others may be disgruntled employees who are motivated by the glee of embarrassing completely legitimate financial activity by the “rich and famous” or their former employers. As demonstrated by the ICIJ, too many journalists are not shy about disclosing Yellow or Green Zone information as they philosophically despise not only illegal tax evasion but also perfectly legal tax avoidance. It also sells newspapers and makes great clickbait.

What can wealthy clients who are not engaging in nefarious Red Zone activities do to protect their privacy?

Accepting this distasteful reality is the critical first step to planning a defense. If someone organizes their tax situation so that they are either a) not tax resident in any jurisdiction; or b) clearly not liable for tax on their international structure, this puts the power back into their hands. In short, the perfect rebuttal to accusations of tax evasion or even tax avoidance is to point out that one is not subject to tax or financial disclosure by any jurisdiction.

In such a case, journalists like the ICIJ will be loath to publish personal financial information for fear of a lawsuit. The key reason that Elton John was named but not Mick Jagger, is that Mick Jagger is not resident in a taxing jurisdiction like the UK. Jagger has also shown a willingness to launch litigation where he feels his rights have been impinged upon.

Leaving one’s current tax jurisdiction depends upon individual circumstances. For Americans, that means having an expatriation strategy ready to execute at any time. For non-Americans, it means having an effective and practical plan to become non-resident.

In all cases, the design of a legally airtight “Fire Escape Plan” involves professional tax advice working in concert with the acquisition and loss of relevant residence/citizenship and domicile status. The key to success is having the Fire Insurance of alternative citizenship and residence permit work seamlessly with the Fire Escape Plan to ensure one does not jump out of their current tax pot and into somewhere else’s tax fire!

So the lesson of the Pandora Papers is that wealthy families should now add the protection of financial privacy to the long list of motivations such as tax the rich policies, civil unrest, political divisiveness, etc. to secure a Backup Plan.

David Lesperance is a global leader of international tax and immigration advisors.

A published author in the field, his personal interest in these areas of law grew from his experience working as Canadian immigration and customs officer while studying law. Since being called to the bar in 1990, he has established his expertise with major law firms, his own law firm and as a private consultant. David has successfully advised scores of high and ultra high net-worth individuals and their families, many of whom continue to seek his counsel today. In addition he has provided pro bono advice to many governments on how to improve their Citizenship by Investment, Residence by Investment or Golden Visa type programs to better meet the needs of his global clients. David is supported by a team of professionals, some of whom have worked with him since the early 1990s.