Portugal Golden Visa Funds Beyond Real Estate: Invest in Football Clubs, Entertainment, or Renewable Energy

BlueCrow Capital

Sponsor

The Portuguese Golden Visa saga is coming to a close. After months of uncertainty and speculation, the government released the final draft of the Mais Habitação and, since it was the Socialist Party that made the final amendments, it has passed parliament and is expected to be promulgated by the President of the Republic in the next few months.

The bill’s final version ensures the Golden Visa will survive, but it wasn’t apparent for months that this would be the outcome. In February, when announcing the Mais Habitação bill, Prime Minister António Costa made clear that the days of the Golden Visa, one of the world’s most popular residency-by-investment programs, were coming to an end.

Bedlam ensued as industry stakeholders and Golden Visa holders scrambled to make sense of what happened, especially since the proposed bill had a retroactivity clause that would essentially condemn those who had already applied for or obtained their Golden Visa to meet the new investment and physical residence requirements.

The Portuguese government also failed to offer any grace period, adding to the confusion.

Mais Habitação is a massive bill that aims to mend the Portuguese housing crisis. The Golden Visa is but a small fraction of the entire document, but stakeholders made their voices heard, highlighting the unconstitutionality of the retroactivity within the bill, the hundred of millions of investments at stake, and the effect it would have on FDI and local employment.

To their credit, the parliament members listened, and a new draft was published in April, and local Portuguese lawyers, developers, and fund managers continued to lobby for the Golden Visa.

This activity culminated in the final draft of the bill, which ensures the Golden Visa will continue in a limited form, removing the capital investment and the real estate investment categories as eligible qualification channels.

The remaining investment categories are the cultural heritage and artistic contribution (€250,000), scientific contribution (€500,000), job creation, and – most importantly – the VC and investment fund category (€500,000). However, the changes don’t stop there, as the new bill imposes further restrictions on investment funds.

What kinds of funds will now qualify for the golden visa?

Funds that focus their investments on residential property will no longer be eligible under the Golden Visa. Those who invest in other areas or conduct a mixture between property investment and otherwise but maintain a majority of their investments in areas other than real estate will be eligible.

This change means that, once the bill passes, investors must be wary of their chosen fund’s activity and investment areas, making it more critical than ever for investors to conduct thorough research.

The government’s haphazard approach to announcing and handling the Mais Habitação bill has pushed many prospective investors to apply, which has created a backlog of applications. We expect a higher number of applicants to rush their files before the law is enacted, adding to that backlog, so a quick but thoughtful approach is advised.

Why Investment Funds Surviving Is A Blessing

Not only does the Golden Visa get to survive to fight another day, but it maintains one of its best investment categories.

The investment fund option never matched the popularity of the real estate category, but it made wide strides in the Golden Visa's latter years.

Applications under the fund option grew almost 500% between 2019 and 2023, increasing from just 0.56% of all applications to an impressive 28.57% during that time period, and we expect the percentage to grow during the second half of the year.

Some argue that the increase in applications under the fund option was primarily due to the Portuguese government removing residential properties in high-interest areas such as Lisbon and Porto from the Golden Visa, a theory that does hold up but doesn't tell the full story.

Fund investments more than doubled between 2020 and 2021, before the change in the real estate regulation was even announced. Fund investments were on the rise, and they have maintained that exponential growth rate.

The growing interest in funds did coincide with the increase in American applicants, and although the data is not comprehensive enough to clearly define whether it was the primary catalyst of the growth in fund applications, it does make sense as investment funds are a standard investment asset class in the US, unlike other parts of the world.

Investors from the East may not be too excited about the prospect of putting their money into an investment fund, but that is typically due to how these investments are regulated and perceived in their home country.

The reason US citizens are open to funds is that this asset class is highly regulated within the US, making it a safe and efficient option to increase one's wealth while diversifying an investment portfolio.

This mindset translates well under the Portuguese Golden Visa fund option, as VC and investment funds are also strictly regulated in Portugal, as the Portuguese Securities Market Commission (CMVM) is responsible for overseeing funds and their activities, and it does a fantastic job.

The high level of regulation and oversight the CMVM sets makes Portuguese funds some of the safest on the planet and an excellent investment option.

The profit margin also plays a massive role in attracting more investors to the fund option, as ROIs are typically higher in funds compared to real estate, and non-resident investors are exempt from capital gains tax.

Typical residential real estate rental ROI ranges between 2-5% at its best, and you still have to cut the property management fee out of that. Funds can provide a wider range of returns, depending on the fund management methodology, investment areas, and fund structure.

Fund ROI can come anywhere between 4-8% on average, with some funds being able to provide rates that can reach around 15-20%, a far cry from what real estate can offer.

They take less input and management, are extremely safe, and provide an optimal route to diversifying wealth while being able to liquidate the investment quickly and without hassle through a clear and simple exit strategy.

Hence, Portugal's retention of the Golden Visa, while good news in itself, is bolstered by the government's willingness to keep one of the most important - and profitable - investment streams in the form of the fund option.

Qualifying funds for every taste and risk profile

At BlueCrow, we aim to provide investors with unique fund options that offer diversity, security, and profitability, and we can confidently do so through our array of top-tier investment funds.

Our Bluecrow Growth Fund, launched in 2018 was the top-selling fund used by Golden Visa seeking investors. Its diversification, profitability, and liquidity provided beyond 2025 and its attractiveness to Portuguese investors were crucial to its success.

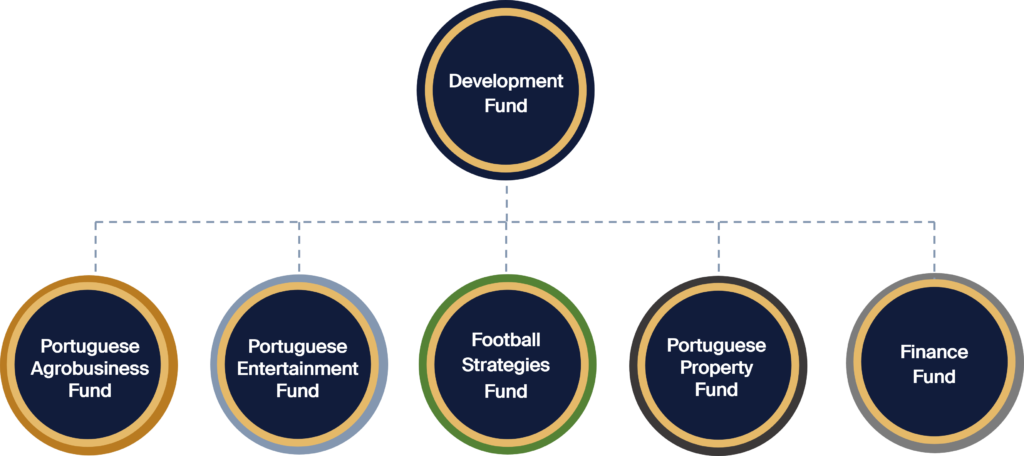

Now, we are launching BlueCrow Development Fund which provides investors with a diversified, limited-risk, high-return portfolio through an effortless process. Investors can choose the subfunds that resonate with their tastes and objectives, hence getting an investment that actually pays back instead of just being an end to a mean.

The diversity within our Bluecrow Development Fund is extremely wide, and our financial and management expertise allows us to capitalize on opportunities rarely found in the Portuguese or European market. We will help investors choose the subfunds that align most with their needs, and we have something for everyone.

The first fund that we have launched is the Football Strategies subfund. It’s a completely new investment strategy, offering investors the returns available to international tycoons the like Sheikh Mansour, Dietrich Mateschitz, the Agnelli Family or Stanley Kroenke. Who wouldn't want to own a football club and participate in its development?

The Finance subfund focuses on investing in renewable energy by financing established industry pioneers and market leaders throughout three different continents. This specific fund will alight income distribution, paying a yearly dividend yield of 8%, and income capitalization.

Our property-oriented funds invest in operation a mixture of real estate leisure and hospitality or farmland. They provide an excellent option for those who want to remain within the real estate sector but also want to qualify for the Golden Visa.

The Portuguese Entertainment Fund an alternative investment option eligible also for GV investors, will provide less income distribution, but an objective income and risk profile. The objective of this fund is to invest in new entertainment and leisure projects that will revolutionize Lisbon and Porto social life.

We launched and well the Agrobusiness subfund that will invest in 3 different types of properties. It will focus on the new and highly profitable agrotech projects related to high intensive production of food products and in forestry and CO2 absobtion in the wild.

At Blue Crow, we offer investments that actually make sense with higher-than-average returns and extensive risk mitigation. Our funds are the optimal route to Portugal's Golden Visa while also being the best way to safeguard and enhance your wealth.

To know more about what Blue Crow has to offer, contact us today via our website.