Portugal Golden Visa Fund Investment Has Quadrupled in Just Two Years

121 investors and 138 of their family members received golden visas in November, records published this week by the SEF show. The approvals pertain to investments totaling EUR 65.6 million, a 41% year-on-year improvement.

Since the program's opening about a decade ago, it has raised foreign investment amounting to EUR 6.7 billion, a feat only surpassed by one other EU golden visa; that of Spain.

The top applicant nationality group in November was Americans, who accounted for 18 of the 121 approvals, followed by British nationals (14), Chinese (13), Brazilians (10), and South Africans (10).

With just one month left in the year, approvals for American investors outnumber those for Chinese by a slim margin, with 192 approvals to 188, making the former the leading investor nationality so far in the year. Indeed, American demand for the program has surged since the pandemic, and American golden visa investment in Portugal has all but tripled in just two years.

So even has the number of investors from the US and China been throughout the year that this year's top applicant nationality will only be determined in December.

The golden visa's primus motor in the early years, the Chinese have seen their proportion of the program fall gradually since 2014 and has reached a historical nadir in 2022; only one in six investors this year has been Chinese, down from four out of five eight years ago.

Just as the program has seen its investor source-country profile diversified from a single dominant contingent to a more evenly distributed one, investors' asset class preferences have similarly grown increasingly heterogeneous, and at an even faster pace: Whereas approvals under the Subparagraph 3 real estate option accounted for eight out of ten approvals as recently as three years ago, this route has made up only 56% in 2022.

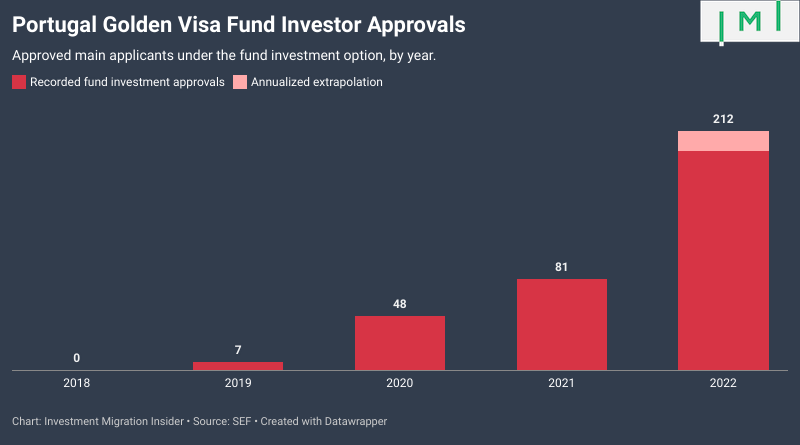

While the "alternative" asset classes have all seen their shares of the program grow since then, the greatest relative growth has been observed in the fund investment category, approvals under which have more than quadrupled in the last two years alone.

If you like data-driven articles like this one, you'll love the IMI Data Center, home to more than 350 graphs and charts covering dozens of residence and citizenship by investment programs, the world's largest collection of data on the investment migration market.