7 Ways HNWIs Sabotage Their Own Backup Plans – Part II

Reasonable Doubt

With David Lesperance

A contrarian expert on contingency plans for the wealthy delivers uncomfortable truths.

This is the second installment in a two-part article. See 7 Ways HNWIs Sabotage Their Own Backup Plans – Part I.

In almost three decades of assisting High Net Worth families with their back-up plans, I have often observed certain behaviors that undermine their ability to fully achieve their goals. This two-part article outlines seven of the most common self-sabotaging behaviors, and the lessons to be drawn from them.

LESSON FOUR: Cheap is Expensive:

Unfortunately, I am sometimes retained by a client who had already attempted to put together their own back-up plan and suspected (or realized) afterward that their plan might have major flaws. This situation is often the result of my now-client being talked into a particular RBI or CBI by a salesperson posing as an advisor. The key giveaway is that unlike qualified and experienced advisors, salespeople do not start with an examination of the client’s situation, goals, and family history. They also do not outline negative factors such as timing, future taxation, or physical presence requirements. Their objective was to sell and earn their commission.

Purchasing a CBI or RBI without this essential first step being properly and fully completed is a recipe for failure. An equivalent situation is a frugal client wishing to build a family home and making his/her first step to visit a construction materials store rather than an architect. When approached in the store, the salesperson immediately suggests they buy a particular brick, “because it’s on sale” or “it’s our bestseller” or “it has some special feature”.

Without a qualified back-up plan “architect” first examining the family’s needs, goals, existing business and financial structures, and budget – and applying appropriate legal codes (aka laws) – it is impossible to build a proper back-up plan.

LESSON FIVE: The Cost of Failure is Higher than the Cost of a Proper Back-up plan:

Inevitably HNW clients first consider getting a back-up plan for themselves and their families because they want to avoid significant negative situations such as massively increased taxation, a disintegrating political climate or living conditions in their home countries, or an increased chance of being targeted by governments or others because of their religion, politics, or financial success.

Given the potential impacts of those things that they seek to avoid, it is essential that the client understand the real world “costs” of a back-up plan that fails in times of future crisis. Depending on the individual’s situation, the ultimate cost can range from significant tax payments all the way to complete loss of liberty assets and life.

When HNW individuals and their advisors go through the decision-making process required for an effective back-up plan, they must always remember “What is the cost of failure?”

LESSON SIX: Hidden risks are unidentified and under-appreciated:

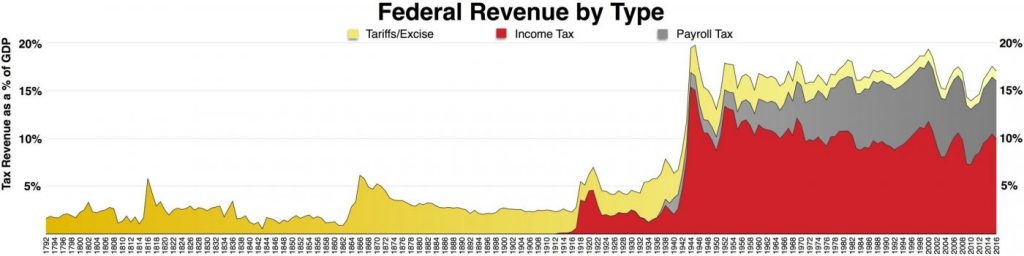

In many countries, it is considered a great gift to children to arrange their birth in a country that grants instant citizenship (aka birthright citizenship or ius soli). In my three decades of experience, by far the jurisdiction of choice has been the US. What most expecting HNW parents do not know is that the US is almost unique in the world in using citizenship as one of its automatic qualifiers for worldwide taxation. So this “gift” could ultimately come with quite a price tag in the form of tax and financial disclosure of the entire family’s wealth.

Over the years when I advised HNW clients on this issue, they usually dismissed my concerns. While agreeing I might be correct legally, they noted that the US did not have the means to locate their child’s non-US assets or to collect US tax on same. For practical purposes, they were correct – until 2007. That’s when the UBS Whistleblower tax evasion scandal completely rewrote the rules of the game.

Today, as a result of the Foreign Account Tax Compliance Act, and other US government tax-evasion detection techniques, these children are now readily identified as US taxpayers. The nasty surprise occurs when they reach an age when their parents begin to pass family assets into their hands.

Given that many HNW parents have operated their entire lives never having to make any financial disclosures to anyone and paying little or no tax, the sudden exposure of the entire family’s wealth through an American child is a financial disaster beyond their experience or comprehension.

While the uncovering of hidden American taxpayers and their assets is an example of a danger which can take a few years to materialize, other landmines are easier to spot. For example, some of my clients are from countries with strict rules against dual citizenship. On more than one occasion I have stopped a new client from acquiring a second citizenship from a country in a manner which could have resulted in disclosure through on-line publication.

Another often overlooked landmine is acquiring a residence or citizenship that will bring the client and family members into an unfavourable family law regime. Even if the client’s own marriage is solid, statistically half of the next generation will divorce. Divorce has a devastating impact on long-term family wealth. Remember that “While income tax is a percentage of Income….Divorce is a percentage of Capital!”

A proper back-up plan will identify as many of these hidden landmines as possible. Clients also need to monitor the emergence of new dangers arising out of changing life circumstances or legislation and take steps to avoid their impact.

LESSON SEVEN: The Back-up Plan is not “Livable”:

Several times a year I will receive a call from a client who has just gone through an audit, lawsuit, or divorce. Their initial question is “Can you move me to a rock in the middle of the ocean where there is no tax and no lawyers?” My standard response is “Certainly…but you better pack a gun…..because within 6 months either your family will want to kill you or you will want to kill yourself”.

This opening exchange inevitably leads to a valuable discussion about the essential elements of the client and their family’s personal and business lives. This will start with essentials such as access to certain types of medical, educational, travel, and business services. After covering the essentials we then move onto preferences such as weather, language, time zone, culture, and urban/rural lifestyle.

This type of frank discussion is absolutely critical to the ultimate success of a back-up plan, as it will require different levels of commitment from various family members to acquire and possibly maintain various elements. A full examination of the dangers to be avoided and opportunities realized is essential, both in the boardroom AND at the breakfast table.

Final Thoughts

For many people, their ancestors’ decision to leave “the old country” and immigrate had a profound impact on their lives and the lives of their descendants. Similarly, the quality and effectiveness of a back-up plan could be THE major financial and lifestyle choice that someone makes for themselves and their family. By following the Seven Lessons you can rest assured that your back-up plan will be optimized and you will have done your very best to avoid personal and financial catastrophes on the one hand and to reap enormous benefits for your children, grandchildren, and beyond on the other.

David Lesperance is a global leader of international tax and immigration advisors.

A published author in the field, his personal interest in these areas of law grew from his experience working as Canadian immigration and customs officer while studying law. Since being called to the bar in 1990, he has established his expertise with major law firms, his own law firm and as a private consultant. David has successfully advised scores of high and ultra high net-worth individuals and their families, many of whom continue to seek his counsel today. In addition he has provided pro bono advice to many governments on how to improve their Citizenship by Investment, Residence by Investment or Golden Visa type programs to better meet the needs of his global clients. David is supported by a team of professionals, some of whom have worked with him since the early 1990s.