Despite Pandemic, A Record-Summer for Hong Kong Overseas Property Expos

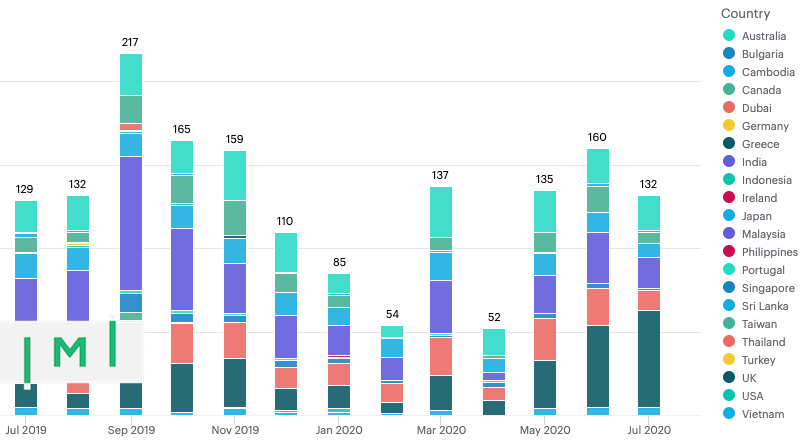

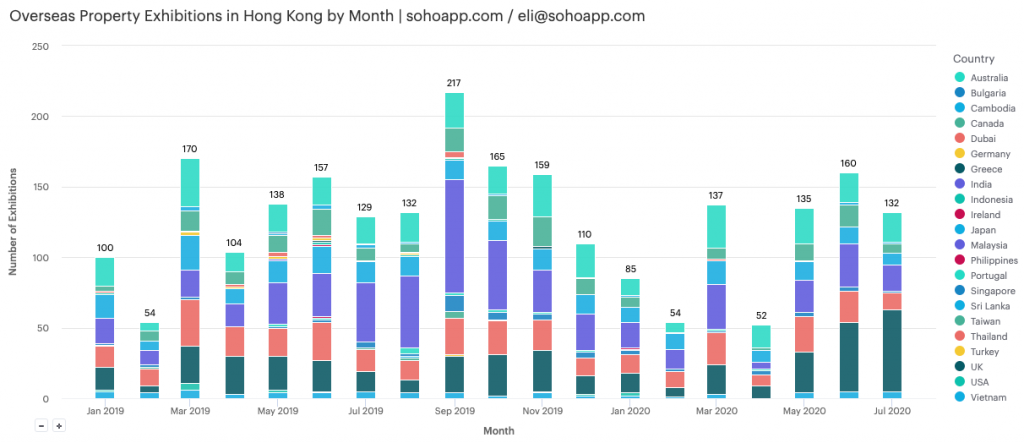

We’re in the midst of a global pandemic that has changed the world forever in ways that we are still coming to terms with and which will likely continue into 2021. Yet, overseas property exhibitions continue to take place in Hong Kong at near-record numbers. Despite seeing dips during each wave in Hong Kong (there have been three), the impact on overseas property exhibitions is lighter with each wave and exhibitions continue at a pace of around 30 every week.

Since 2018 I’ve been tracking overseas property exhibitions, primarily across three cities in Asia – Singapore, Kuala Lumpur, and Hong Kong. The latter had its first encounter with Covid-19 in January and we saw a drop in exhibitions, though they picked up through March. Overseas property exhibitions were still happening in Kuala Lumpur and Singapore until March, when both those cities went into lockdown, and only recently started one-on-one exhibitions at the end of July.

Over the last 12 months, we’ve seen a number of trends, from a change in the venues of exhibitions, the marketing of overseas property as well as which countries the projects being offered in Hong Kong are coming from.

12 months ago, it wasn’t uncommon to see projects from 15-20 different countries over the course of a month. From February 2020, however, the countries offered to Hong Kong buyers have narrowed significantly to fewer than 10 in a typical month. One of the reasons behind this is familiarity – agents felt that consumers would be less likely to purchase if they were unable to travel or haven’t been to the focus country/city before. Developers and master agents also cannot make the journey to Hong Kong to help drive sales.

Protests and unrest in the second half of 2019 saw record numbers of overseas property exhibitions take place in the SAR; most weeks had 35+ exhibitions, even reaching 50+ in one week.

Malaysia out

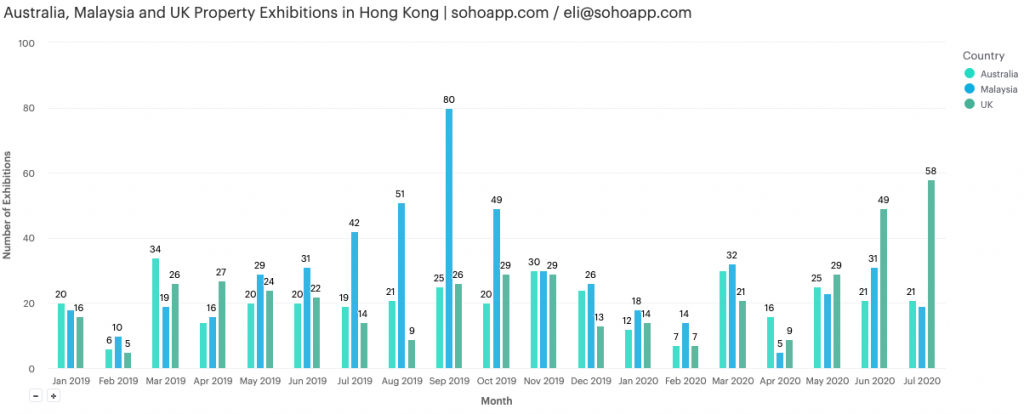

Besides looking at options to shift capital abroad, locals were also looking for an immigration ‘plan B’. Malaysian property gained unprecedented levels of interest. From July to October 2019 there were 222 exhibitions for Malaysian property, peaking at 80 in September and regularly commanding 30%+ of all exhibitions in Hong Kong. However, since October, Malaysia’s share of overseas property exhibitions dipped below 30% and often under 20%.

So far in 2020, there have been only two weeks where there were 10 or more exhibitions for Malaysian property. Contrast that with 2019, where there was a run of 17 weeks of 10+ exhibitions for Malaysia property from mid-July. In the last three weeks of July 2020, Malaysia represented less than 15% of exhibitions in Hong Kong (less than four per week) and continues to decline.

As reported by IMI, Malaysia’s MM2H was the most popular investment visa in the world last year. This is essentially halted at the end of 2019 with over 90% of applications being rejected and officially suspended in July 2020.

The UK in

Towards the end of May 2020, property from the UK started to gain traction after a relatively lukewarm start to the year, exhibition-wise. The national security law enacted in Hong Kong, the UK’s response to that (offering a path to citizenship for BN(O)s, as well as the UK’s stamp duty holiday and a foreign buyer tax coming next year, has seen interest in UK property reach previously unseen levels in Hong Kong.

What’s more interesting is the percentage of UK exhibitions as a total of all exhibitions; having been above 30% since mid-June, UK property exhibitions accounted for more than half of the city’s total in the last two weeks of July. This trend is continuing into August and is not likely to change in the short term.

Although, in the near term, absolute exhibition numbers will drop in August (due to the ‘3rd wave’ in Hong Kong), the UK will maintain its strong market share for the short to medium term. Immigration is driving a growing share of property demand for Hong Kongers, which has led to demand for a wider range of property types as well as lower per-project sales (as there are more projects).

The nature of the demand for overseas property in Hong Kong has changed markedly over the last 12 months – premiums are now placed on properties that come with immigration benefits.

For the latest trends in overseas property investment, detailed in hundreds of graphs with data from thousands of property exhibitions, contact me. Use it to plan when to launch, where to launch, find new channel partners and identify trends to maximise your sales results.