Investment Migration in the EU Crossed Historic €5 Billion FDI Milestone in 2019

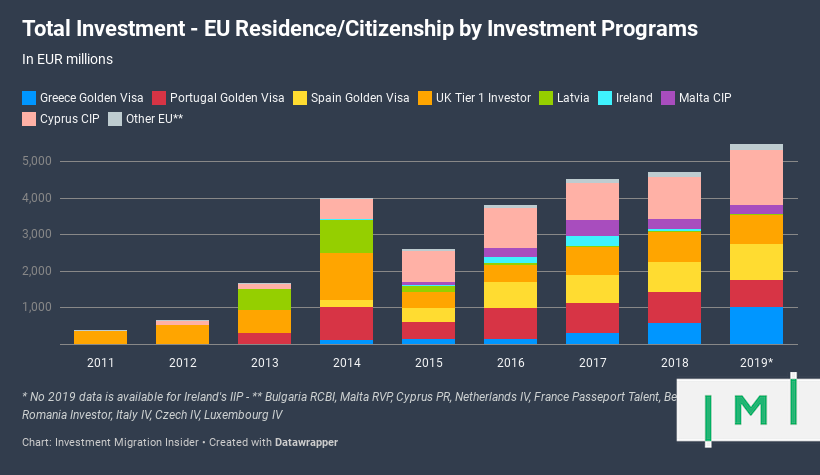

2019 was the best year on record for investment migration in the European Union. Conservatively estimated, EU-based residence and citizenship by investment programs accounted for foreign direct investment amounting to at least EUR 5.5 billion, crossing the five-billion mark for the first time, and doubling the amount raised just four years prior.

Data and assumptions

For each program, we have used official sources for investment amounts where available. This is the case for

- The Malta IIP

- Portugal’s golden visa

- Cyprus CIP

- Ireland IIP

For those programs that don’t report precise investment amounts, we have assumed historical average investment amounts remained constant. The following are our assumptions:

- Greece golden visa: Average investment of EUR 300,000, multiplied by the number of main applicants.

- Spain golden visa: Average investment of EUR 700,000, multiplied by the number of main applicants.

- UK Tier 1 Investor visa: GBP 1 million prior to 2015, GBP 2 million thereafter, multiplied by the number of main applicants.

- Latvia investor visa: minimum investments assumed for each of the program’s three investment options, multiplied by the number of main applicants choosing the corresponding option.

Mediterranean locomotives

Three programs alone – the golden visas of Greece and Spain, as well as the CIP of Cyprus – were responsible for 60% of the aggregate in 2019, raising a combined EUR 3.5 billion. In 2016, the same three-program combination accounted for less than EUR 2 billion in investments.

While the EU’s investment migration market, in terms of FDI, has grown 14-fold since 2011, the number of programs has gone from 3 to 25 in the same timeframe. In 2011, the overall FDI raised through investment migration programs in Europe amounted to less than half a billion euros, implying a compound annual growth rate of 34% over the period.

Though, in aggregate, the market has grown consistently, the fortunes of the individual programs that constitute it have not always coincided. For three programs – those of Cyprus, Spain, and Greece – 2019 was the highwater mark, while the residence program in Ireland and Malta’s IIP peaked in 2017. Meanwhile, the heydays of the UK’s Tier 1 and Latvia’s investor visa are already six years in the past.

It would not be inaccurate to characterize 2020, so far, as an annus horribilis for the global economy as a whole, and the investment migration sector is unlikely to come away from it unscathed either. Among Europe’s programs, statistics for the first six months of the year are only available for the golden visas of Greece and Portugal, whose divergent paths make for poor indicators of a generalizable European RCBI-trend for the year.

While the Greek program saw its approval volumes pummeled by the pandemic, Portugal experienced all-time highs in May and June following a brief spell in the doldrums during March and April, placing its first-half 2020 figures roughly on par with those of last year. Greek authorities have recently enacted a variety of policy amendments that will allow for remote-application to the program that should see it rebound in Q3 and Q4, while Portugal is so far on track for a statistically unremarkable year.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.