First-Half 2020 Investment in Portugal’s Golden Visa Already 52% of 2019 Total

That 2020 should be a good year for business – any business – is a counterintuitive notion. Nonetheless, Portugal’s golden visa, amid lockdowns and travel restrictions, is on track to see its greatest number of approvals since 2016.

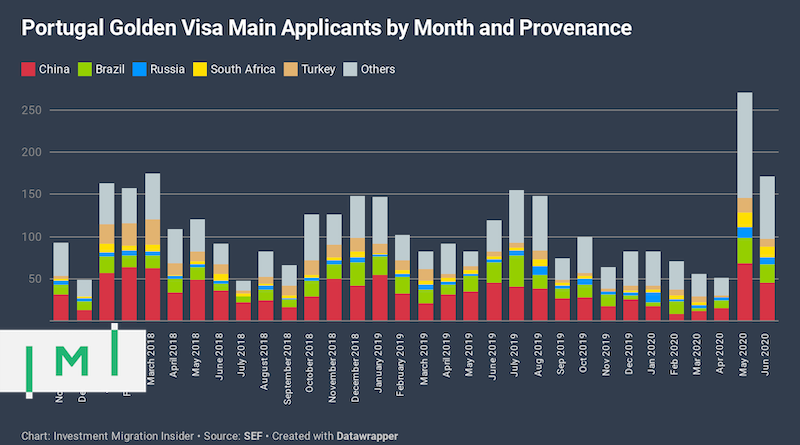

171 main applicants and 293 of their family members obtained residence permits in Portugal by investment in June. The numbers are significantly lower than those of May – Portugal’s best month on record – but still represent the program’s second-best month since the program’s inception in 2012. In the first six months of the year, 700 main applicants have been approved, two-thirds of whom in the last two months alone.

The program saw a capital influx of EUR 89 million in June, bringing the total by the 2020 half-year mark to EUR 383 million, 52% of the 2019 total, which places the program within range of a record year.

In June, 26% of applicants (45 of them) were of Chinese origin, 13% were Brazilians, while South Africans accounted for some 8%. On a cumulative basis, the top five nationalities have remained the same since late 2017:

- Chinese: 52%

- Brazilians: 11%

- Turks: 5%

- South Africans: 4%

- Russians: 4%

Just three years ago, Chinese investors made up four-fifths of the program’s application volume, but recent years have seen Portugal steadily diversify its applicant source countries to the point where no single nationality make up more than a quarter of the total.

Diversification is also apparent within the program’s investment options; while the share of applicants who chose “alternative assets” (here defined as any investment option other than the EUR 500,000 real estate investment stipulated in subparagraph 3) amounted to only 6% in 2016, it has risen steadily and sharply since then. In the first half of 2020, 34% of investors have opted for unconventional investment options, up three percentage points from last month and up 10 ppt since 2019.

Among the alternative routes, the fastest growth – in absolute terms – is observed in the EUR 350,000 real estate investment option (subp. 4) while, in relative terms, it is the venture capital/investment fund option that has grown the most prodigiously, tripling in popularity over the last year.

Judging by the numbers alone, Portugal is the undisputed “winner” of 2020 so far among golden visas; the pandemic has walloped its fiercest competitors, Greece and Spain. But while Portugal’s application volumes are impressive in the context of residence by investment programs, they still pale in comparison to the Turkish citizenship by investment program, which has been naturalizing 4,000 main applicants a month during their peak outbreaks (thanks to remote-processing) and which is currently raising an average of US$17 million per day, about five times what Portugal has been raising during the same period.

Want to know more about the Portuguese golden visa program? To see recent articles, statistics, official links, and more, visit its Program Page. To see which firms can assist with applications to the program, visit the Residence & Citizenship by Investment Company Directory.

Properties that can qualify the buyer for residence permits in Portugal:

No listings foundSee more properties that come with residence/citizenship opportunities in IMI Real Estate.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.