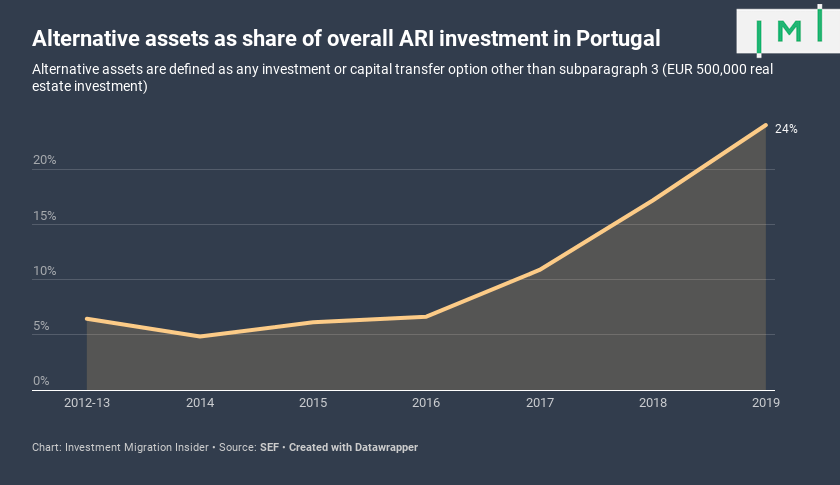

1 in 4 Portugal Residence Investors Now Opt for Alternative Assets

The share of investors who pick options other than the conventional EUR 500,000 property purchase has more than tripled in the last three years.

Portugal’s Borders and Immigration Service, the SEF, today released figures covering the full year of 2019. Thanks to its new reporting format, we now have access to somewhat richer data on applicant preferences. While until recently, the SEF provided statistics on only the two broader investment categories – real estate and capital transfer – they have now begun to report on the respective subclasses of both categories.

Portugal’s ARI offers eight specific investment option subparagraphs (from the SEF’s website):

- Capital transfer with a value equal to or above 1 million Euros;

- The creation of, at least, 10 job positions;

- The purchase of real estate property with a value equal to or above 500 thousand Euros;

- The purchase of real estate property, with construction dating back more than 30 years or located in urban regeneration areas, for refurbishing, for a total value equal to or above 350 thousand Euros;

- Capital transfer with a value equal to or above 350 thousand Euros for investing in research activities conducted by public or private scientific research institutions involved in the national scientific or technologic system;

- Capital transfer with a value equal to or above 250 thousand Euros for investing in artistic output or supporting the arts, for reconstruction or refurbishment of the national heritage, through the local and central authorities, public institutions, public corporate sector, public foundations, private foundations of public interest, networked local authorities, local corporate sector organizations, local associations and public cultural associations, pursuing activities of artistic output, and reconstruction or maintenance of the national heritage;

- Capital transfer of the amount of 350 thousand Euros, or higher, for the acquisition of units of investment funds or venture capital fund of funds dedicated to the capitalisation of companies, capital injected under the Portuguese legislation, whose maturity, at the moment of the investment, is, at least, of five years and, at least, 60% of the investments is realized in commercial companies with head office in national territory;

- Capital transfer of the amount of 350 thousand Euros, or higher, for constitution of a commercial society with head office in the national territory, combined with the creation of five permanent working jobs, or for the reinforcement of the share capital of a commercial society with head office in national territory, already existing, with the creation or keeping of working jobs, with a minimum of five permanent jobs, and for a minimum period of three years.

The data set released today shows that, while the conventional EUR 500,000 real estate investment option remains the investor favorite, its share of overall ARIs has fallen from 93% in 2016 to just 76% in 2019. The most popular alternative investment – subparagraph 4, which stipulates a EUR 350,000 investment in buildings constructed more than 30 years ago – has seen its share of the total grow prodigiously since 2016. That year, only one in a hundred investors chose “fixer-uppers”; in 2019, this share had risen to one in six, as 214 ARI applicants opted for older properties.

A total of seven ARI investors picked the recently introduced EUR 350,000 Venture Capital/Fund Investment option, all in 2019. The number of applicants who chose the EUR 1 million bank deposit option (subparagraph 1) has remained stable at around 5% of the total since the start.

In the program’s seven-year history, only 17 investors have chosen the job creation option, which mandates the generation of ten full-time positions. Not a single applicant has ever been approved under subparagraphs five and six (scientific research and cultural heritage contributions, respectively).

1,245 main applicants and 2,192 of their family members received approvals in 2019 as a whole, a figure 12% below that of 2018 and the lowest recorded since 2015. Overall investment during the year saw a corresponding decline; applicants injected EUR 742 million in the program in 2019, down from EUR 849 million in the preceding year.

Since November 2012, Portugal’s ARI has raised EUR 4,992,253,830.95, just EUR 7.7 million short of a historic EUR 5 billion.

While Chinese (54%), Brazilians (11%), Turks (5%), South Africans (4%), and Russians (4%) remain the largest applicant nationalities on a cumulative basis, 2019 saw the entrance of Americans among the top five nationalities.

In 2019, 65 Americans (about 5% of the total) obtained ARIs, while only 31% of recipients were Chinese, their lowest annual share on record and a far cry from the more than 85% share Chinese nationals held just four years ago.

Want to know more about the Portuguese golden visa? To see recent articles, statistics, official links, and more, visit its Program Page. To see which firms can assist with applications to the program, visit the Residence & Citizenship by Investment Company Directory.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.