Investor Migrants Becoming More Sophisticated, Favoring Fund Investment Over Real Estate

Portugal’s recent focus on promoting private equity investment funds for Golden Visas are a sign investor migrants are now more aware of the importance of tax and exit strategies

Since the establishment of the Portuguese Golden Visa program in 2012, it has gone on to become one of the most popular immigration routes for investors worldwide. The simplicity of the program coupled with the minimum engagement requirements has entrenched it in the world of investment migration as one of the most coveted programs globally.

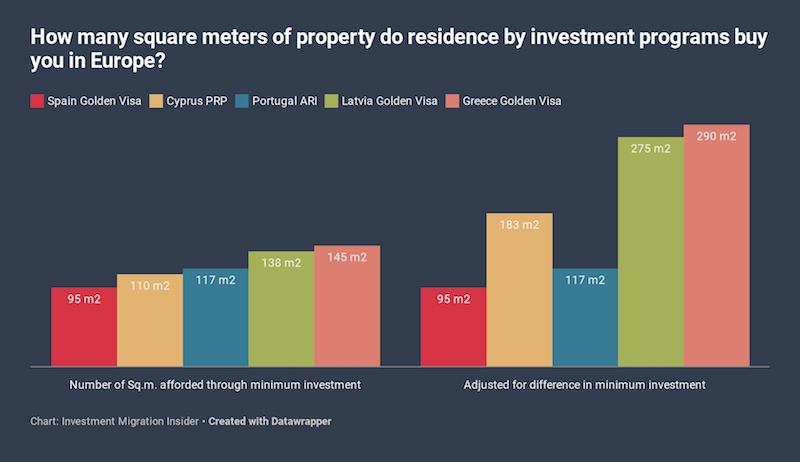

The Portuguese golden visa comes with a plethora of investment options; be it capital investment, entrepreneurship coalesced with job creation, private equity funds, or – most commonly – purchase of real estate. Investors overwhelmingly favor the latter and that’s no surprise considering real estate is globally recognized as a “safe investment”.

Clients are getting smarter about the investment part of residence by investment

Popular opinion is shifting, however; private equity funds have increasingly gained traction throughout the past year. With various private equity and venture capital funds officially registered in the regulatory governmental body “Comissão do Mercado de Valores Mobiliários” (CMVM), investors have a smorgasbord of options to choose from.

One of the more market-changing factors that have come into play only recently, however, is the growing awareness of and familiarity with CBI and RBI programs among investors worldwide. Potential investors have are, to a much greater extent than just a few years ago, acquainted with the benefits and pitfalls of various programs, Portugal’s golden visa among them, due to the wealth of information now available online, as well as the exponential increase in the number of investment migration firms in the market. This has made investors RCBI-investors more sophisticated; they’re now raising higher-level questions in client meetings.

Long gone are the days where the key issue of the program was merely the minutiae of what kind of residence permit is granted, or how many rooms are in the target property. Investors are now more aware of the hidden costs and potential complications such as taxation, property management, and exit strategy.

Enter private equity and venture capital funds

Portugal’s golden visa has the option of investing EUR 350,000 in qualified private equity and venture capital funds to qualify for the residence permit. This option has simplified the process for investors who wish to rid themselves of the ensuing engagement requirements that accompany real estate investments.

Funds come with a fixed return on investment (ROI) and, consequently, the applicant knows exactly what they will be receiving and can free themselves of the rigmarole of property rentals and management. Funds also prove to be a great option for those concerned about taxation. Unlike real estate investments, qualified tax investments enjoy a tax exemption, meaning that no taxes are imposed on the investor’s ROI. There is no taxation concerned with the initial investment or transactions, unlike on real estate, which is accompanied by multiple disbursements, such as title transfer fees, stamp duties, etc.

The most important factor, however, is the exit strategy. Funds offer an elegant solution to this matter; once the time comes for the investor to liquefy their investment, the fund management company transfers the amount to the investor’s bank account. Simple, efficient, and hassle-free.

One of the most important questions a potential investor should always ask their immigration consultant is “how will I get my investment back?”. Many programs offer real estate investment options, but the rarely mentioned predicament that comes along with that is that not all investors are able to liquefy their properties after they have reached the end goal, be it residency or citizenship.

Read also: Brookes: The Ticking Time Bomb of CBI Real Estate – Investors Have No Clear Exit Strategy

Investors are increasingly concerned with this dearth of exits. This may be due to previous experiences from friends or relatives who went through the process, their knowledge of real estate market processes, or even due to immigration consultants now spreading awareness about this issue.

A residency or citizenship application is a lengthy process, as well as a complicated one. The last thing investors want is to end up with a frozen amount of money that was used for a certain objective, that they cannot now liquefy due to external factors.

Portugal’s funds offer a solution to this predicament, and savvy investors are reaping the rewards.

Portugal itself may be promoting this investment option for its own benefit as well. Funds operate in a structure similar to that of the American EB-5 visa. Loan capital that is invested in projects and developments among other fields. Funds contribute to job creation, domestic development, and increased prosperity in areas other than just the real estate market.

The Investment Migration Council (IMC) issued a research paper titled “Re-thinking Immigrant Investment Funds” in which it highlighted the benefit to both investor and country. Investment funds may well be the future of investment migration programs. And Portugal is aiming to be one step ahead of the pack.

Want to know more about the different options of the Portugal Golden Visa? To see recent articles, statistics, FAQs, and more, visit its Program Page. To see which companies can assist with applications to the Portugal Golden Visa, visit the Residence & Citizenship by Investment Company Directory.

Ahmad Abbas is Director of Content Services at Investment Migration Insider and an 8-year veteran of the investment migration industry.