Is The UAE The New Switzerland?

Holborn Pass

IMI Official Partner

The rise of the UAE from a small GCC country to a global economic goliath has been rapid and fascinating. The small country is now a vital cog in the modern globalized world and is giving Switzerland a run for its money.

One glaring difference between the UAE and Switzerland, though, is how easy it is to get a residence permit in the country.

Thanks to one of the world’s simplest – yet often overlooked – Golden Visas, getting a long-term residence permit in the UAE is a straightforward matter.

Those who invest AED 2 million (approximately $545,000) in an approved investment fund can obtain a 10-year Golden Visa, while an investment of the same amount in real estate will get them a five-year residence permit.

A new change in the law has made this even simpler for real estate investors, as they now only need to invest half of the required amount (approximately $273,000) upfront to obtain their residence permit, and then they have five years to complete the rest of the amount to renew.

This makes the UAE’s Golden Visa one of the most affordable worldwide, and considering that the housing market in the UAE is a dynamic one, especially in Dubai, it is an economic program that packs an investment that is simple, can be completed in installments, and can pay back through significant rental yields and arbitrage gains.

The first quarter of 2023 saw apartments appreciate at a rate of 15.8%, and their rent yield grew at an impressive 17.4%, considering that the country’s inflation rate of 4.83% in 2022 was nearly half of the global average (8.7%), investors can look to make substantial profits in the UAE housing market while simultaneously getting a long-term residency permit.

So getting to the UAE is easy; that is a major draw, but it isn’t the only one, as the country in general, and Dubai in particular, is one of the best places to live in 2023 for a multitude of reasons.

A Global Financial Hub

Switzerland’s economy, financial and banking services sector, (historically) lenient taxation laws, and political neutrality are what molded it into the brand destination it is today. But if you take a close look at the UAE in general, and Dubai in particular, you’ll recognize a familiar pattern.

The UAE’s GDP in 1973 was a dismal $2.85 billion, but thanks to proper planning and growth, the entire story changed. The country’s GDP at the turn of the millennium was about $105 billion, and in 2022, it recorded a high of $507 billion, a whopping 177 times its value just fifty years ago.

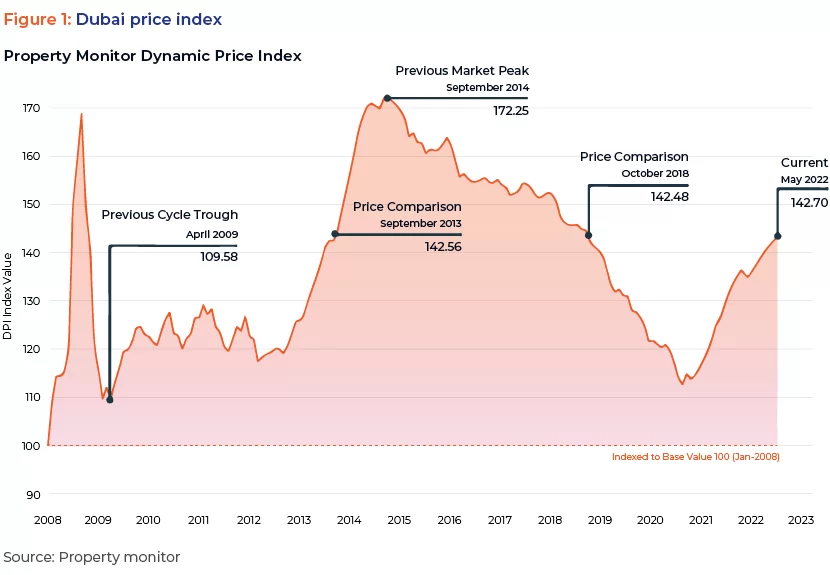

Economic growth in the UAE, spearheaded by Abu Dhabi and Dubai, has been rapid and astonishing to watch. But it isn’t rushed; this transformation has been precise, thoroughly considered, and planned to perfection. Even when the country hit a snag in the mid-2010s, it recovered quickly and adopted new measures to hedge against a future real estate bubble.

It was also one of the world’s most adept countries in handling economic recovery from the pandemic, highlighting the nation’s dynamic economy, proper leadership, and tenacity.

During the global shutdown, the UAE didn’t just try to make ends meet; it took tangible steps toward improving the situation. It ranked second worldwide in terms of ICT adoption to address working issues, and it has maintained the aspects of innovation that proved to be evolutionary, even after the pandemic’s effects faded.

The UAE is the place to be. Whether you are an entrepreneur or a serial investor, you’ll find that the international heart of the country, Dubai, is one of the best – if not the best – destinations in the modern world.

Much like Zurich and Geneva, Dubai has built its foundation on a robust financial services sector bolstered by the government. It is home to 23 local banks and 28 international ones, and its fintech industry is one of the fastest-growing worldwide.

Dubai offers a high level of financial privacy and autonomy, and considering that the country does not levy income tax, it is more financially reasonable to set up a base in Dubai rather than the high-taxing nation of Switzerland.

Even though mainstream media loves attaching negative connotations to low-tax countries, that isn’t the case with the UAE. The country’s financial sector is one of the best regulated in the world, and it operates on a transparent yet efficient framework that allows for optimal processing and comfort.

The Numbers Don’t Lie

Taking a closer look at some statistics gives a better picture of what makes the UAE such an interesting place.

The country ranked 16th overall on the World Bank’s Ease of Doing Business Index, above monumental economic nations such as Germany, Canada, and Switzerland. Setting up a business in the UAE is seamless, and even though the country is considering implementing corporate taxes, they come with numerous exemptions and tax breaks, ensuring that it continues to attract more businesses to its shores.

Almost everything is done online, enabling quick company registrations and a smooth entry into the market. The simplified tax setup also makes it easier for entrepreneurs to set up branches or subsidiaries and integrate them into their global network without the dreadful taxation structuring that you’ll find in other countries.

The country’s strategic location in the middle of the map is another major draw for entrepreneurs, as it allows them to conduct business with the Far East and Far West all within a single 9-5 business day.

Dubai’s port is also one of the busiest in the world, making the city a prime spot for those engaged in international shipping. The government puts in a lot of effort to ensure it remains a global shipping hub, as evidenced by the 22% Y-o-Y growth in imports during 2022 in Dubai.

The UAE currently ranks 6th worldwide on the World Bank’s International Logistic Performance Index, surpassing major economic giants like Spain, France, and Japan.

The market is dynamic and growing. Dubai’s financial market assets grew a whopping 30% between 2011 and 2021, and it is showing no signs of slowing down, thanks to how popular it is becoming among global HNWIs.

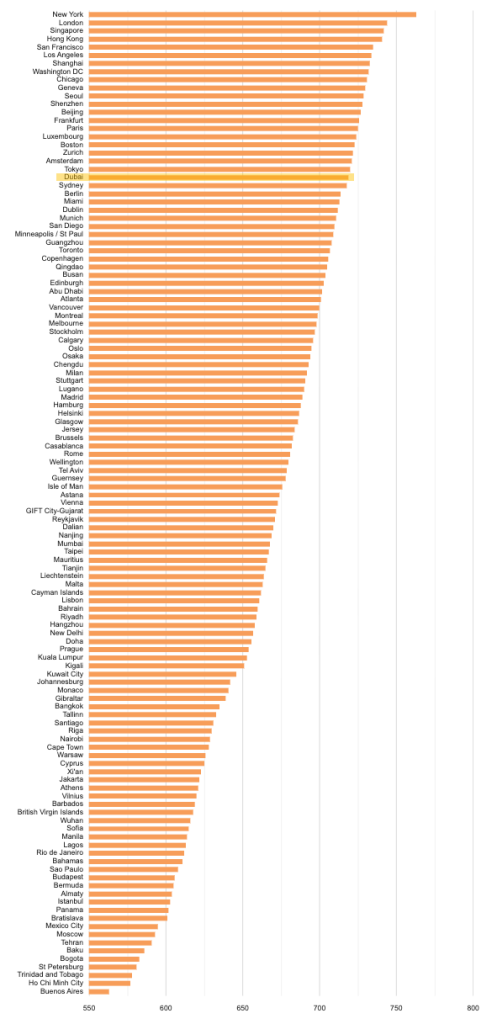

The Global Financial Centers Index ranks Dubai 22nd worldwide in terms of financial services, one spot above Geneva and just two spots shy of Zurich, further highlighting that the UAE has closed the gap with Switzerland.

With its access to Eastern and Western markets alike, the UAE has become the transcontinental economic leader in the region, but it is not all about the money; the country itself is a major attraction.

Living The Good Life

The quality of life in the UAE is spectacular. The country’s infrastructure is second to none; it boasts outstanding healthcare and educational institutes, and it is one of the safest places to live on Earth.

Dubai, in particular, is a remarkable new or second home, primarily because of how internationalized it is. Holborn Pass’ Managing Director, Pablo Ostrick, highlights this facet of Dubai as one of the most attractive to foreigners because “it is so simple to integrate into the community. It is mainly made up of expats, so everyone is experiencing the same journey, and the stringent safety laws of the country mean that everyone feels safe walking down the street, which is critical when moving to a new country.”

The culture in the city is unique; Ostrick also speaks from his own experience, saying: “It is as if everyone just unanimously decided they wanted to create the best atmosphere possible. There is this unspoken understanding among the city’s population, and the government is bolstering that feeling through intricate planning and development.”

He points out that “there is no city in the world where you can find such outrageous architecture and massive mega-projects but simultaneously have a feeling of complete serenity.”

The numbers back up his claims, as the UAE ranks high on the UN’s Human Development Index, a tool the UN uses to gauge a country’s quality of life, education system, healthcare, infrastructure, rights, and overall development.

The UAE has an impressive score of 91.1% on the index, edging out the EU’s average of 90.1%, but what is more impressive is that it keeps getting better, having registered an average score growth rate of 0.8% throughout the years of 2011-2021 (the latest issue of the index).

The country scores particularly high in safety and stability, and that political stability is key to long-term relocation. But it isn’t just about the peace; the UAE’s neutrality, much like that of Switzerland, is key in attracting HNWIs who want to put their money in a safe place that isn’t at odds with any major political axis.

The country’s endless entertainment venues, massive shopping malls, family-friendly environment, and pleasant weather all add to its allure.

True, it may get hot in the summer, but as anyone who has experienced the remarkably well-air-conditioned venues in the country will tell you, ten months of pristine weather make up for two months of turning on the AC.

Life in the UAE is serene but exciting. Profitable and safe. It is the epitome of what a small country with high ambitions can do. To label the UAE as the new Switzerland would be a disservice because the Emirati government has managed to create something unique to itself. It isn’t a replica of any other country; it is itself, and that is all it needs to be.

How Holborn Pass Can Help You Get To Dubai

Holborn Pass is an arm of Holborn Assets, a leading financial services and wealth management company with decades of experience dealing with investors and HNWIs throughout the globe.

Our expertise in investment migration is perfectly complimented by our background in wealth management, as we can provide bespoke services tailored to your specific needs.

Our team can help you obtain the UAE Golden Visa through an investment that actually makes sense, and then go above and beyond by helping you create a robust wealth management framework in one of the world’s most critical financial centers.

To know more about the UAE Golden Visa and how Holborn Pass can elevate your investment migration experience, email Pablo.Ostrick@holbornassets.com