Yes, American Citizens Can and Will Leave to Avoid Wealth Taxes

Reasonable Doubt

With David Lesperance

A contrarian expert on contingency plans for the wealthy delivers uncomfortable truths.

On Thursday Jan 28, 2021, Senator Elizabeth Warren appeared on CNBC’s “Squawk Box” and had the following exchange with journalist Sara Eisen (my edits for focus):

Eisen: Now [a wealth tax] might also chase wealthy people out of this country as we’ve seen has happened with, with other wealth taxes […]

Warren: I’m sorry. There is no evidence that anyone is going to leave this country because of the two-cent wealth tax […] Based on fact, the wealthiest in this country are paying less in taxes than everyone else. Asking them to step up and pay a little more and you’re telling me that they would forfeit their American citizenship, or they had to do that and I’m just calling her bluff on that. I’m sorry, that’s not going to happen.

Senator Warren’s statement is in line with those made by the academics who designed her and Bernie Sanders’ wealth tax proposals. In an October 2019 opinion piece in the Washington Post, Gabriel Zucman and Emmanuel Saez wrote that:

The situation in the United States is different. You can’t shirk your tax responsibilities by moving, because U.S. citizens are responsible to the Internal Revenue Service no matter where they live. The only way to escape the IRS is to renounce citizenship, an extreme move that in both Warren’s and Sanders’ plans would trigger a large exit tax of 40 percent on net worth.

In short, Senator Warren and these academics argue that wealthy Americans cannot or will not leave the US tax system. Unfortunately, the reality is that they can and do leave – in record numbers!

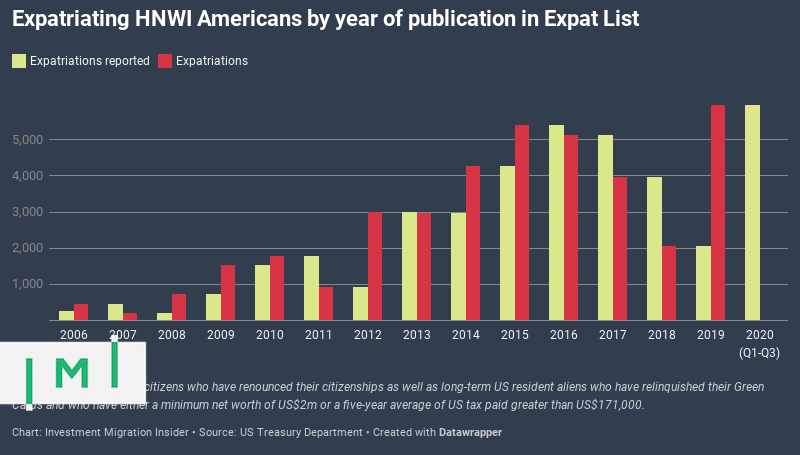

Earlier this week, the US government issued its latest quarterly “Publication of Individuals, Who Have Chosen to Expatriate”, which lists 660 names. In order to understand if this number supports or disproves Senators Warren and Sanders, one must understand some key elements on what this list represents and how it is compiled:

1) The List does not contain a list of every US citizen who has renounced US citizenship;

2) The List does contain the names of US citizens who have renounced US citizenship as well as long-term US resident aliens who have relinquished their Green Cards and who have either a minimum net worth of US$2M or a five-year average of US tax paid greater than US$171K;

3) Once the $2M is reached, there is no indication whether the person had a net worth of $2.1M, $200 million or $2 billion;

4) The List reflects renunciations and relinquishments that occurred 12 to 18 months previously, due to the time required by the government to process the event and subsequent tax reporting deadlines for net worth or tax payments.

As is evident from the above graph, the number of reported HNWI expatriations in a single year had reached a new all-time high already by the third quarter of 2020, i.e., with 25% of the year left to go.

So, in rebuttal to Senator Warren and her academic fellow travelers, I would point to the record numbers of wealthy Americans who are renouncing their US citizenship or giving up their green cards. Their motivations are usually not the result of a single tax proposal but the cumulative impact of local, state, and federal tax-the-rich policies.

In particular, I would note that this week’s listed departures occurred in mid-to-late 2019. This was exactly at the time that Senators Warren and Sanders were at their peak of pushing their Wealth Tax proposals during the democratic primaries.

Since late 2019, the pandemic has struck and accelerated the movement to overcome the major hurdle for wealthy Americans to leave: life inertia. As has been well documented, COVID has driven previously avowed lifetime wealthy New York and Silicon Valley residents to abandon their prior lives for the more tax-friendly environments of Florida and Texas. They have made the first big step. And if one follows the Newtonian principle that “a body in motion tends to stay in motion,” these same golden geese are also equipping themselves to legally and completely sever all of their future US tax liabilities. You can read my deeper analysis of the implications of that phenomenon here.

David Lesperance is a global leader of international tax and immigration advisors.

A published author in the field, his personal interest in these areas of law grew from his experience working as Canadian immigration and customs officer while studying law. Since being called to the bar in 1990, he has established his expertise with major law firms, his own law firm and as a private consultant. David has successfully advised scores of high and ultra high net-worth individuals and their families, many of whom continue to seek his counsel today. In addition he has provided pro bono advice to many governments on how to improve their Citizenship by Investment, Residence by Investment or Golden Visa type programs to better meet the needs of his global clients. David is supported by a team of professionals, some of whom have worked with him since the early 1990s.