Forget Everything You Thought You Knew About China’s Investment Migration Market

Mr. Lu’s Tea Leaves

With Luc Lu

A seasoned veteran of the Chinese RCBI industry keeps readers abreast of overarching trends in the world’s biggest investment migration market.

“Hi, Luc. Business is getting harder and harder. Winter is coming. Can we work together to find a way out?”

More than one industry peer has raised questions using words to that effect with me in the last few months. Their marketing budgets have been decimated or even canceled. Their lead-generation methods have reverted to those employed a decade ago; telemarketing (through the procurement of user data from third-party organizations followed by identification of those users’ level of immigration demand by individual phone calls). This is an absurd practice, not merely because it violates a number of laws but because it has an extremely low success rate.

The era of big immigration firms with big marketing budgets has come to an end. Once sought-after bidding campaigns for Baidu keyword marketing (where companies would vie for higher search engine rankings on the most attractive keywords) has been out of favor for a long time already. On many occasions, we’ve seen the employees of immigration firms actually outnumbering the clients attending the program presentation.

Carnage

Winter isn’t coming; winter is here. The other day, I received several pieces of bad news. A handful of giant immigration firms of nationwide renown launched staff reduction plans, closed their branches in some cities, and had suffered financial troubles as delivery-side firms reneged on their commission payments; outraged applicants gathered outside the headquarters of another large-scale immigration firm, protesting that they had been defrauded.

Negative industry news has reached my ears in successive waves this year. The flurry of resumes that IMI Asia has received indicated that the number of Chinese investment migration professionals looking for jobs is soaring. Nearly three-quarters of the applications we’ve received have come from the large-scale firms, those with headcounts (until recently) in the hundreds.

The performance of China’s investment migration market has plunged to a multi-decade low. Who is to blame?

Is it the Chinese RCBI firms, who sacrificed their clients’ interests at the altar of preposterous profit margins? They must take part of the blame, certainly. But the international, program-side firms are complicit as well. They enjoyed just as wide a profit margin but shifted virtually all the risk to their client-side partner firms in China.

The leading international RCBI advisories dragged their feet on entering the domestic Chinese markets on the pay-a-reasonable-fee-for-Chinese-agent-expertise model because the pay-commission-for-Chinese-agent-sourced-successful-applicants model was that much more appealing. Foreign companies often complain that Chinese agents ask for too high of a commission (and they do, it’s true) but they don’t appreciate that the Chinese agents have no other option because a) it’s often their only source of revenue beyond, perhaps, a small client fee and b) they aren’t always paid all the commissions they are owed and, as such, must leave in a compensatory margin for defaulters.

IMI is a by-the-industry-for-the-industry publication. Our target audience are the service providers, not the B2C readers. But so far this year, IMI Asia (which operates our very popular Chinese WeChat page, which has nearly 6,000 subscribers and 15-20,000 monthly readers) has received more direct customer inquiries than through all of 2019 combined.

Time and time again, we have to clarify that we do not provide investment migration services and that we are merely an industry media outlet that presents readers with objective information. But the direct-client inquiries keep on coming. What this tells us is that while the companies in the business are going through its darkest hour in decades and laying off thousands right now, that isn’t because of a lack of demand. Far from it. Demand is as strong as ever, perhaps stronger.

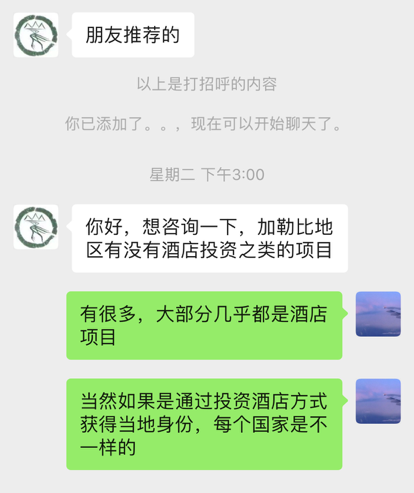

Here’s an example of the types of conversations I am having these days.

Screenshots from Luc’s WeChat conversations

Direct client 1: One of my friends introduced me to you.

Direct client 1: Hi. Are there any hotel investment programs in the Caribbean region?

Me: There are a lot of hotel investment programs.

Me: Of course, if you want to acquire a second citizenship by investment in a hotel in the Caribbean, each country has different requirements.

Direct client 2: Hello!

Direct client 2: I would like to consult with you about European immigration programs.

Direct client 2: Do I have to pay you a consulting fee?

Me: Hi, go ahead.

Me: No, you don’t have to.

Direct client 2: Many thanks!

The investment migration industry, like any industry, seeks development opportunities in times where the market is unsettled. Confronted with the current deluge of uncertainties, risk-averse HNWIs have a pressing need for a Plan B. Under current circumstances, stimulating demand for migration is easier than ever. The pent-up demand frantically seeks a release, so frantically, in fact, that HNWIs are turning to media companies just to get a consultation.

On the other hand, the former obstacles that stymied the Chinese market, such as licensing requirements and restrictions on business models (previously, foreign firms were limited to B2B only, lest they be hounded out of China), have gone with the pandemic wind.

The rules of the game have changed.

Nobody cares about where you come from, nobody cares whether your model is B2B or B2C. The only criterion by which the market now judges you is whether you can win the confidence of applicants and dispel their doubts about your professionalism and good faith business philosophy. There can no longer be any doubt; a paradigm shift is taking place in the world’s largest investment migration market. Perhaps even globally.

This sea change is good news for international RCBI firms, whether they hope to capture Chinese clients by entering the market directly and competing head-to-head with local outfits or by joining hands with reliable local partners. While the policy tendencies of the government in Beijing can appear contradictory or enigmatic at times (alternating between the befriending and alienation of foreign governments along seemingly inconsistent patterns), they have steadfastly continued to simplify rules and facilitate foreign companies’ entry to China. A Singaporean that I advise through my separate consulting firm is setting up an immigration firm in China. Going through the legal formalities of setting up an entity has only taken him a month. That same process would have taken, at best, 9 months just a year and a half ago.

In the Chinese investment migration market’s three-decade history, the gap between supply and demand has never been greater. A unique mix of circumstances – peaking demand, the disintegration of big companies thanks to deregulation, severely reduced trust in traditional RCBI companies, and changing lead-generation methods – has brought about a momentary schism between HNWIs wanting to migrate and the institutions available to meet their demand.

Nature, they say, abhors a vacuum. This gap won’t last forever.

Luc Lu is a decade-long veteran of the Chinese Investment Migration Industry, founder of several firms in that market, and official partner of Investment Migration Insider, responsible for China-based activities.