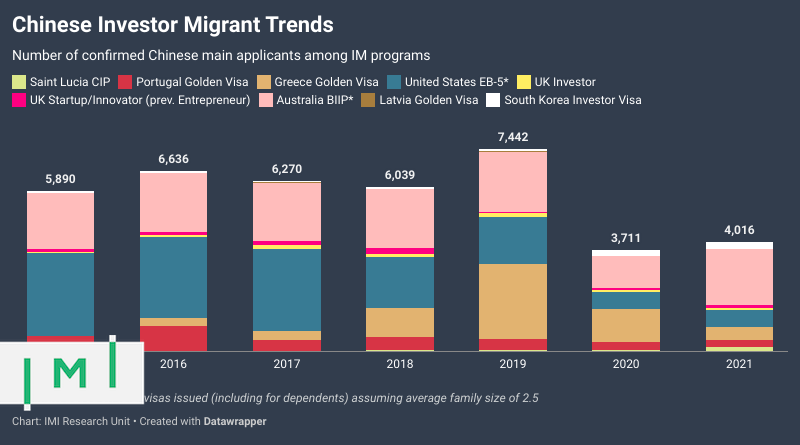

Chinese Investor Migrant Data 2021: Application Volume Still Far Below 2019 Levels

While the contours of recovery from 2020’s sharp reduction in Chinese participation in investment migration programs are becoming apparent, the market remains severely depressed.

With the belated arrival of full-year 2021 figures from a number of major programs, we’ve been able to create an overview of trends in the Mainland China investment migration market.

In the below detailed chart, we’ve shared the raw data available to us, including on those programs for which we have incomplete data. It shows a downward trend that began in 2020 and which has continued into this year.

Note: In the case of three programs – US EB5, Australia BIIP (of which the SIV is a part), and Canada Startup Visa – only the number of visas issued (i.e., including not only the main applicant but also dependents) is provided. In these instances, we have assumed an average family size of 2.5 to arrive at a presumed main applicant figure. It won’t be perfectly accurate but not far off the mark either.

If we strip away the programs for which data is missing and conducting an apples-to-apples comparison, however, the picture painted is one of cautious recovery; overall Chinese participation in the programs for which data is available for all seven years under consideration show an uptick of about 8.2% year-on-year.

At an estimated 2,063 Chinese main applicants, Australia's BIIP represented the single-largest destination program in this demographic group, followed by the US EB-5 program and the Greek Golden Visa.

In relative terms, Saint Lucia's CIP saw the most precipitous rise in Chinese main applicant approvals. The difference in Chinese nationals' approval volume for the program rose from 53 in the 2019/20 fiscal year to 129 in FY2020/21, an expansion of 143%.

The second-sharpest improvement (Chinese approvals up 80% year-on-year) was observed under Australia's BIIP. That has less to do with any particular changes in Chinese demand (spots in the BIIP are perennially oversubscribed) and more to with base effects: The combination of artificially low approval numbers recorded in 2020 (when applicants were prevented from traveling to Australia) and the Australian government's decision to nearly double its BIIP intake quota in 2021.

In its last full year before closing, the UK Investor Visa recorded 79 approvals of Chinese main applicants, a 68% improvement on the 47 logged in 2020 but still significantly behind the 147 approvals in 2019.

Latvia's golden visa, once a popular program among Chinese investors, did not record a single Chinese approval in 2021, while Greece saw the number of Chinese approvals reduced to 478, a total that's actually 61% lower than the corresponding number for 2020.

The Chinese absence is felt in investment migration destinations globally. As recently as in 2018, Mainlanders accounted for an absolute majority of historical cumulative applications in some two-thirds of the largest residence by investment programs.

Last year, Chinese investors did not make up an absolute majority in any programs for which we have data.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine - online or offline - for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.