Five Real Estate and Residency Combinations for US$150,000 or Less

James Nuveen

Medellín

In a world where investment and mobility are available as a package deal, real estate is no longer just about “location, location, location.”

Today, it’s also about value and opportunity, especially for those looking to couple their investment with residency in a country that shows promise.

Cunning investors and builders of residency and citizenship portfolios, especially those from rich-world countries who already enjoy a high degree of travel and settlement freedom, are well served by looking beyond Caribbean passports and EU golden visas. Discerning diversifiers of geopolitical and financial risk can build an international property portfolio while simultaneously picking up complimentary residencies (ideally with a path to citizenship) in two-birds-one-stone maneuvers.

Below, for the benefit of such investors and their advisors, we’ve put together five jurisdictions where you can double dip in real estate investment and a valuable residency program without breaking the bank.

1. Cambodia ‘My Second Home’ (M2H) Program

Requirements and Benefits

Cambodia’s M2H program invites foreigners to get residency by acquiring property. An investment of more than US$100,000 in real estate or a Cambodian business will set them on the path to residency – for them and their families.

And while Cambodia also offers direct citizenship through investment for investments exceeding US$245,000, long-term residency for five years can also lay the groundwork for naturalization.

The Cambodian passport, however, isn’t particularly useful. With visa-free access to just 54 countries, none of which are in Europe or North America, it’s unlikely (for most people) that this citizenship will provide much of a net gain in terms of freedom of movement or settlement. This citizenship is principally of interest to those who have a particular interest in Cambodia, or those who wish to be able to invest in the country on the same terms as locals (such as owning land outright).

Real Estate Landscape in Cambodia

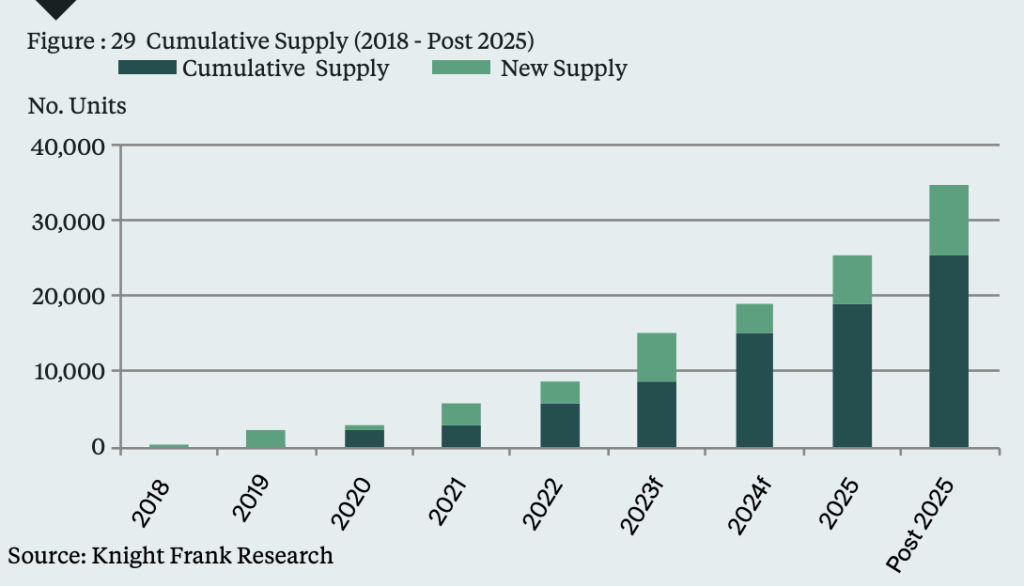

Foreign investment drives interest in the Cambodian real estate market. The residential housing market supply seems at a pivotal point of growth. Hotspots like the capital Phnom Penh and tourism magnet Siem Reap show steady price appreciation.

With a budget of US$100,000, investors can target apartments or condos in emerging districts. The current average price per square meter in Phnom Penh hovers between $1,800 and $2,500, suggesting ample room for upside, considering the country’s fast economic and demographic growth rates.

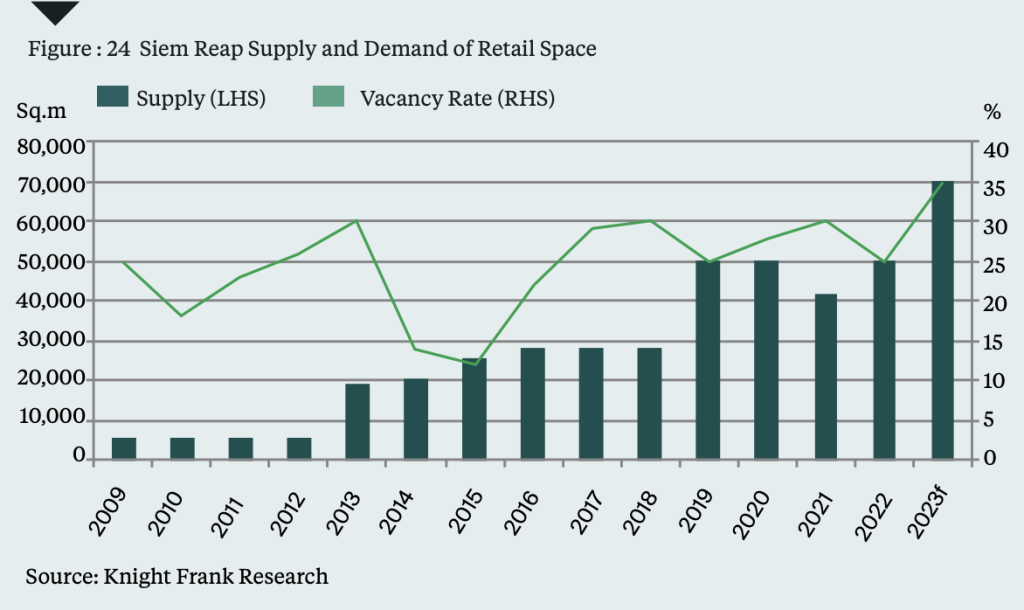

The retail sector, however, may be oversaturated as both supply and vacancy rates trend upward.

Become an IMI Pro today and get:

- Your IMI Pro profile page in IMI

- Access to the IMI Data Center

- Access to all our Private Briefings

- Unlimited articles

- All IMI Research Unit reports

- +++

2. Georgia Investor Visa Program

Requirements and Benefits

A minimum investment of US$100,000 in real estate qualifies you for the Georgian Investor Visa. While Georgia is transparent about its difficult ten-year route to citizenship through investment, those who end up qualifying can enjoy a host of benefits, including visa-free travel within the Schengen Area and to 116 countries and territories globally.

While you may maintain your temporary residency status with no physical presence in the country as long as you keep your investment, permanent residence requires physical presence of nine months a year for five years, a requirement that turns off many investors from pursuing the latter permit.

Real Estate Landscape in Georgia

Foreign direct investment in Georgia has nearly doubled from its pre-pandemic highs. Foreign investment is predominantly concentrated in the capital Tbilisi as well as in the seaside city of Batumi.

Prices in Tbilisi, the country’s hottest market, average around $1,100 per square meter. Thus, a minimum budget of US$100,000 can garner quite a spacious, modern apartment in the heart of the capital. Moreover, rental yields are some of the world’s highest – more than 13% gross yield, according to GlobalPropertyGuide.com – in part thanks to the sudden recent influx of a large Russian diaspora.

3. Nicaragua Investor Visa Program

Requirements and Benefits

One of the most affordable residency and real estate combos in the world, Nicaragua offers an Investor Permanent Residency Program with a minimum investment of just US$30,000 in real estate, a local business, or a government-approved forestry or agricultural project.

Along with other minor requirements, the maintenance of said investment allows for citizenship in just two years. With access to 126 countries, including the Schengen Area, the Nicaraguan passport is far stronger than most assume.

Wondering about physical presence demands? There are no specific details. However, in my experience, investment migration professionals advise investors to stay at least a month per year in Nicaragua.

Real Estate Landscape in Nicaragua

As in many destinations favored by digital nomads, short-term rentals are the hottest sector in Nicaraguan real estate. This level of interest is likely to grow, thanks to several factors that make Nicaragua an attractive lifestyle destination:

- Relative safety (at least in a Latin-American context)

- First-rate climate

- Low cost of living

- Ease of investment

- Territorial taxation (foreign income, properly structured, can be tax-free)

- Proximity (geographic and time-zone-wise) to North America

At just $758 per square meter, real estate is ultra-affordable in Managua and far more affordable elsewhere in Nicaragua. Granada is another favorite amongst investors and stands at just $557 per square meter (and falling).

Investors can opt for luxurious apartments or even consider commercial spaces to maximize ROI.

4. Costa Rica Investor Visa Program

Requirements and Benefits

Costa Rica invites foreign investors to participate in its Investor Visa Program with a minimum property investment of US$150,000, leading to permanent residency in three years and citizenship in seven. Note, however, that permanent residency requires physical presence of 180 days a year.

The second strongest passport on this list, Costa Rican citizenship grants visa-free access to 149 countries, including the Schengen area.

Instead of investing at least US$150,000 in real estate or moveable assets, you may invest US$150,000 in a Costa Rican business or US$100,000 in an approved forestry project.

Real Estate Landscape in Costa Rica

Identified as a hotspot for its tropical weather, lower property taxes at .25%, and proximity to North America, Canadians and Americans have flocked to the country in increasingly large waves over the last decade.

Housing prices, as a consequence, have seen surged in the last few years: 12% in 2022 and a forecast 15% in 2023. Investment interest has been particularly strong in San José and Limón on the coast.

Prices in San José average around $1,500 per square meter, making it feasible for investors to acquire prime properties on a modest budget. But prices are rising: In August this year, the average home in the capital sold for nearly US$600,000.

5. Brazil VIPER Investor Visa

Requirements and Benefits

Finally, the strongest passport featured on our list is that of Brazil.

Brazil’s Permanent Residency Investor Visa (VIPER) program is another affordable path to Latin American residency and eventual citizenship. At just US$28,000, you must invest in “innovative activities” that boost the economy and create ten jobs. However, only in certain circumstances would investors go this route.

Instead, most invest either US$93,000 in a Brazilian business, US$126,000 in real estate in Brazil’s north and northeast, or US$185,000 in other regions of Brazil.

To obtain citizenship, the applicant must maintain the investment for at least three years. Once a citizen of Brazil, investors enjoy visa-free access to 169 countries worldwide, including those in Europe.

Real Estate Landscape in Brazil

Despite the growth rate of Brazil’s real estate market slowing, São Paulo and Rio de Janeiro remain investor favorites. Interest, however, is rising precipitously in regional coastal cities like Fortaleza and Florianópolis.

Prime property prices in Sao Paulo and Rio de Janeiro are between US$2,500 and US$3,500, while tier-two cities like Fortaleza average US$1,450 per square meter, up US$200 in just a few years.

Beyond just acquiring a property, the above countries offer robust residency options for investors, expats, and global migrants.

If you enjoyed this article, subscribe to IMI Daily’s newsletter and be the first to know of breaking investment migration news around the world. Or consider IMI Pro, the investment migration professional’s indispensable resource.

James quit his corporate job in 2021 to find freedom and grow a remote business from Latin America, while teaching others to do the same.