Portugal Golden Visa on Track for Best Year Since 2019

77 main applicants and 125 of their family members received Portugal golden visas in August, records from the country’s Borders and Immigration Service (SEF) show. This resulted in investments totaling EUR 37.6 million, a slight improvement on the EUR 35.3 million raised in August last year.

Already by the end of August, the SEF had approved 806 golden visa applications since the beginning of the year. Unless the program sees an unseasonably low number of approvals in September, 2022 approval volume will exceed last year's total already by the end of this month.

The SEF has approved an average of 100.75 applications a month so far this year, implying the total volume for 2022 will reach 1,209, the highest annual number recorded since 2019.

Among the factors driving the upward trend has been the continually-increasing interest from Americans, a contingent that so far this year accounts for nearly one in five applicants (145 of 806), the largest single share of the program among any nationality. They are closely followed by the Chinese, who have made up 134 out of 806 approvals (17%) in 2022.

On a cumulative basis since the program's beginning, Portugal has now approved 11,060 main applicants, roughly half of whom have been Chinese.

The historically largest qualification route - the EUR 500,000 Subparagraph 3 investment in residential real estate - has this year been displaced by the Subpragraph 4 renovation property investment category, which so far this year accounts for four out of ten approvals.

The fastest-growing category in proportional terms, however, remains the fund investment category, which has doubled in size three years in a row to now make up 18% of approvals. The category is on track to nearly triple its number of applicant approvals in 2022 compared to the preceding year.

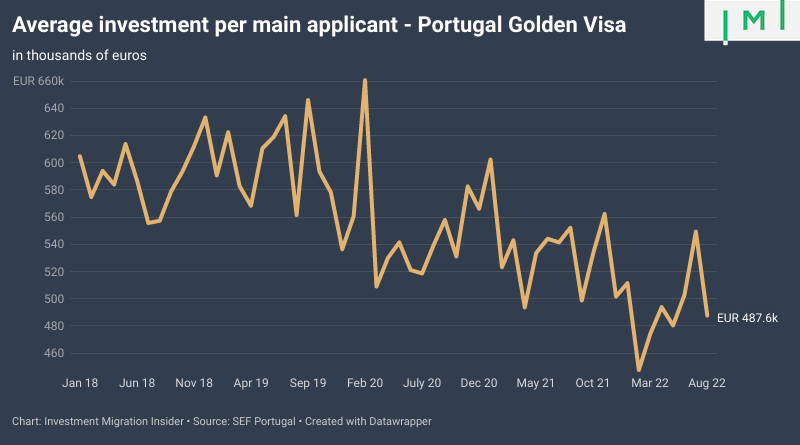

The rise of alternative (and lower-priced) fund investment and renovation property categories have contributed to a falling per-applicant average investment in recent years, which in August stood at EUR 488,000, down from a peak of EUR 660,000 in 2019.

That trend, however, is likely to see something of a reversal as the effects of price increases for certain categories (notably fund investment and deposits) instituted at the beginning of this year become apparent in the statistics as applications filed in 2022 reach the approval stage.