The Gambia Gambit: Developing The West African CBI Market Beyond Nigeria

As IMI has previously noted, most international investment migration firms that expand into sub-Saharan Africa start with Nigeria. That’s natural, of course, because Nigeria, after all, is by far the most populous country in Africa. Numbering some 206 million, Nigeria’s headcount is nearly double that of the second-most populous African country – Ethiopia – which has a considerably lower GDP per capita.

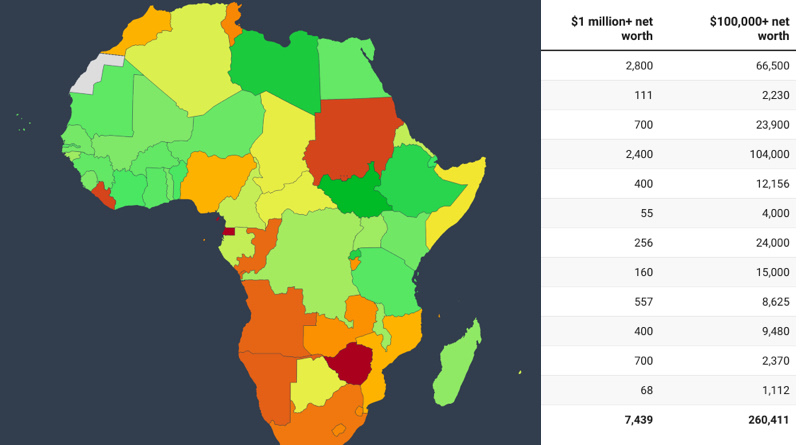

But even the biggest of pies, when split between enough dinner guests, will leave some hungry. At least eight international RCBI-firms – and countless smaller, local ones – have a presence in the Nigerian market. As evidenced by the below graph from the IMI Data Center, however, coverage in the region is sparse outside of Nigeria.

Prospective investor migrants in the region have precious few specialists to turn to. Many of them, however, are but a short flight away from Banjul, capital of The Gambia:

Citizenship by investment is for the mass affluent - not just millionaires

Some 124 million people - 7,000-odd of them with a million dollars or more to invest and an estimated 260,000 with free assets in the six figures - live within a three-hour flight radius of Banjul International Airport.

You might assume that having a few hundred thousand dollars in investable assets is not enough for an individual to consider spending US$100-150,000 on Caribbean citizenships for themselves and their families. But we know, from countless personal experiences, that when the need is sufficiently pressing, many will part with half their savings to fulfill their dreams of alternative citizenship.

And if ever there were a region in which the need for alternative citizenship was pressing, it would be the westernmost parts of West Africa. Without exception, the mobility and settlement freedoms these countries' passports offer are dismal. The number of visa-free destinations they wield range from 49 (Liberia) to 68 (The Gambia).

Entering a bigger market through a safe and stable side-door

When we open an office in this small, relatively remote country, we aim to serve a far greater regional market. The history of investment migration is replete with examples of firms (successfully) targeting a larger market indirectly through a smaller, stabler jurisdiction close by: Hong Kong for the Mainland China market, Latvia for the Russian one, Dubai for well-heeled Indians, and so on.

In terms of GDP, Western West Africa, along with Central East Africa, is the fastest-growing region on the continent. With the exception of Liberia, all the countries within The Gambia's three-hour flight radius grew by more than 5% in the year that immediately preceded the pandemic. The same cannot be said for Nigeria, the country that international IM firms reflexively take aim at first when entering sub-Saharan Africa; its economy expanded by only a modest 2.2% in 2019.

If we zoom out and take a decade-long perspective, the differences in growth trajectories become even more pronounced. In the last ten years, average GDP growth rates among countries in The Gambia's backyard (with the exception of Cape Verde) have all exceeded that of Nigeria. Indeed, Nigeria's GDP is smaller today than it was in 2012 (look it up), despite its population's swelling by 23% over the same period. Being a huge, African country isn't necessarily the same as being an "emerging" market.

Why The Gambia?

Why, exactly, did we pick The Gambia for our venture into West Africa? Why not one of the larger countries in the same region, like Ghana or Senegal, which are also under-served and mostly free of competition?

A number of compelling reasons are behind our decision to set up in The Gambia:

In the first instance, note that the country is an island of (relative) stability in a region of political turmoil. According to The Global Economy, The Gambia is the 7th most politically stable country in Africa (out of 53) and the 81st most politically stable globally (out of 194).

In fact, political stability in The Gambia is only slightly lower than in France (78th) and considerably greater than in Greece (87th). Nigeria, by contrast, is among the world's least politically stable jurisdictions, ranking 185th globally, just behind Pakistan and just ahead of Palestine. In Western West Africa, only the remote archipelago of Cape Verde ranks higher than the Gambia for political stability. So, while we're certainly targeting the aforementioned larger markets in the broader region, we prefer to do it from The Gambia.

Many Ghanaian, Senegalese, and Ivorian entrepreneurs and business owners - also those with under a million dollars to their name - will be perfectly happy to fly into The Gambia with their families, spend a few days at a resort, and complete the paperwork for a CBI-application. Indeed, a non-negligible proportion of them will prefer conducting the sensitive business of investment migration outside of their home country, well beyond the ken of their home governments, business rivals, or excessively garrulous second cousins, for precisely the same reasons a Beijing businessman might fly to Hong Kong (or maybe Singapore, these days) to do the same.

Another good reason to pick a smaller country is that getting close to the top brass. We consider it unlikely that the President of a large country like Nigeria, for example, would grant an audience in his private residence to the regional director of a relatively small firm (by non-IM industry standards) like ours. In The Gambia, however, we have already held a number of meetings with President Adama Barrow, who has given us a warm welcome to the country.

Finally, part of our decision to make The Gambia our West African base was that I am myself a native of Banjul. I have spent many years of my life overseas and I understand intuitively the value of building and maintaining international business relationships.

I want to see my compatriots succeed internationally. It pains me to witness the geographic barriers limiting the best and brightest of my countrymen in their international business dealings. Online video calls can only take them so far. They need the freedom to travel overseas to engage in negotiations, oversee exports, and manage relationships.

NTL is here to help make that possible. Contact us today to learn precisely how we can help you and your family break free from the limitations imposed upon you by accident of birth.

Interested in contributing a sponsored feature? Email us on cn@imidaily.com and see all our promotional options here.