Apex’ Kenny Green: Without CIP-Unity, Caribbean Economies Will Not Survive

This article was contributed by Kenny Green, Managing Director of Apex Capital in Dominica.

All for one and one for all, united we stand divided we fall.

This quote, attributed to Alexandre Dumas as used in the novel the Three Musketeers, aptly describes the challenge we face in the Caribbean. The economic survival of the small countries of the Caribbean, in particular those of the Eastern Caribbean, rests on a strange dance with the developed world.

The region and the Caribbean diaspora watched dispassionately as the Windward Islands’ banana industry was decimated by the removal of the banana subsidy under the guise of engaging free trade. Who can forget that many Caribbean islands lent support to the American invasion of Grenada, and yet less than 15 years later, Carl Lindner, the Republican billionaire who owned Chiquita Dole lobbied both the Democrats and Republicans into treating the Caribbean banana industry as a threat to global free trade? All 3% of its market share. It would be laughable if it weren’t true.

The Caribbean islands didn’t know how to lobby and had no resources to do so. Its citizens, both in the region and in the diaspora, were not well informed and in no position to resist. This was prior to the advent of social media, a world in which the large corporations were accountable to no one.

Read also: Antigua PM Lambasts CIP-Critics, SKN PM Urges Emphasis on Harmonization

Truth be told, left to the free market, there was no banana industry.

Then there is the offshore banking industry. Surely it is in need of regulation, not decimation once again as the FATF and OECD swoop in to blacklist countries in the region. There is nothing happening in the Caribbean which isn’t happening tenfold in Delaware and Nevada.

Again, the rest of the region watches idly as nascent shoots get crushed, even whilst the status quo keeps on trucking along. There is no consensus as to the importance of self-determination, and so it becomes a political football rather than an economic plank to be defended. More must be done from a unified communications point of view in asking for consistency.

Then there was the online gaming industry, which had the illusion of a fight. This where Antigua took the United States to the WTO and won – and won again when the United States appealed. The Americans felt that the same rules of open trade that they administered on our banana industry surely could not apply to them.

The result? Nothing. The United States has not paid one cent to Antigua. Indeed Antigua is left in the odd position of appealing to the US to settle on an international judgment they actually won.

Just to add some salt to the wounds, there was the dot-com crash in 2000, and the subprime mortgage disaster of 2008, both caused by reckless financial mismanagement and lack of oversight in the US in the main. In the latter case, the United States simply printed more money and bailed out its companies whilst the region, which caught the cold, was left to fend for itself on life support for a disease it did not create.

Are you getting a consistent picture?

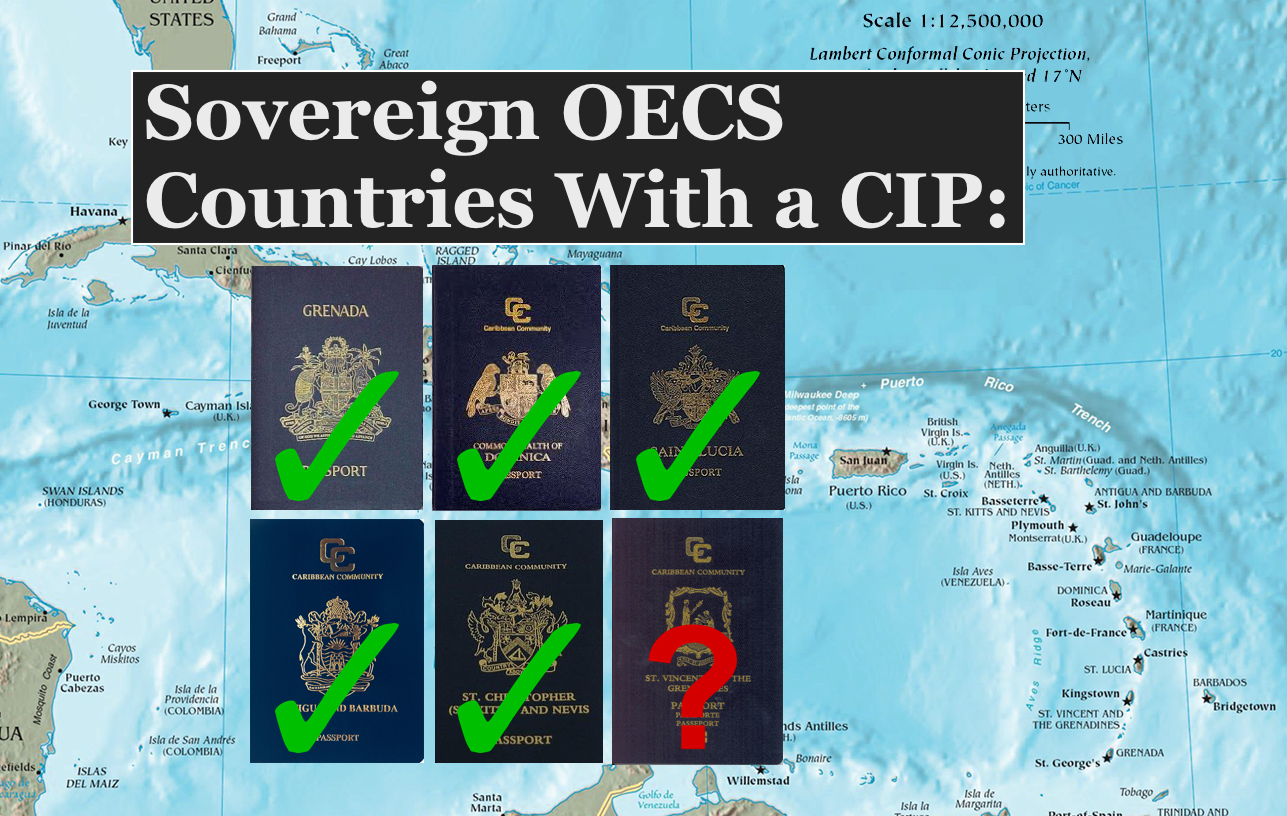

How do we talk about, market, and protect the business of economic citizenship, and more importantly the right to self-determination? The Caribbean is actually a pioneer. St Kitts and Dominica, next to Canada, are amongst the oldest citizenship programs in the world.

[perfectpullquote align=”left” cite=”” link=”” color=”” class=”” size=””]”Across these islands, despite the bluster and political acrimony associated with the programs, every successive government, no matter what their political leaning, and contrary to their pronouncements, have taken on the programs.”[/perfectpullquote]

Across these islands, despite the bluster and political acrimony associated with the programs, every successive government, no matter what their political leaning, and contrary to their pronouncements, have taken on the programs. There is, strangely enough, a unanimous political consensus if you get past the noise.

However, that consensus is not reflected in the guardianship of the program as a national, regional, and international imperative from a communications point of view. It is too sexy a political weapon.

Read also: US Govt. Would Favor Caribbean CIP Unification, Says Saint Lucia’s PM Chastanet

The sale of economic citizenship is not an attack on national sovereignty. Our economies have been battered into submission primarily by conditions we cannot control. Free trade killed what indeed were colonial industries of production in agriculture. Our market access was based on our serving colonial relationships, not as a trade partner, equal or otherwise.

Tourism is highly dependent on infrastructure investment and availability that increasingly comes with the yoke of increased debt which is then used as a weapon against our economies. The financial services industry is jealously guarded by the OECD under the guise of regulation. Agriculture has to be subsidized. It cannot finance itself.

Economic citizenship programs are a clear attempt by our economies to barter the conditions under which we live, and the reliability of our identities, for capital in order to preserve the way of life of our citizens. Increasingly, with the beginnings of programs in Montenegro, and Moldova, and with the re-tooling of the Canadian and US EB5 programs, the business is becoming more competitive. There are now upwards of 30 citizenship programs globally. Yet, still, Caribbean people persist in fighting amongst themselves.

The issue here is not abandoning of sovereignty. It is about survival. Indeed the biggest threat to sovereignty is debt. Crippling debt from non-performing loans on large tourism developments across these islands. Crippling debt from public financing to build infrastructure and provide services. Crippling debt from subsisting public services such as health and education that cannot be paid for by taxation. These are not trifling issues.

Marketing the programs to the local population requires a sobering reality to take hold.

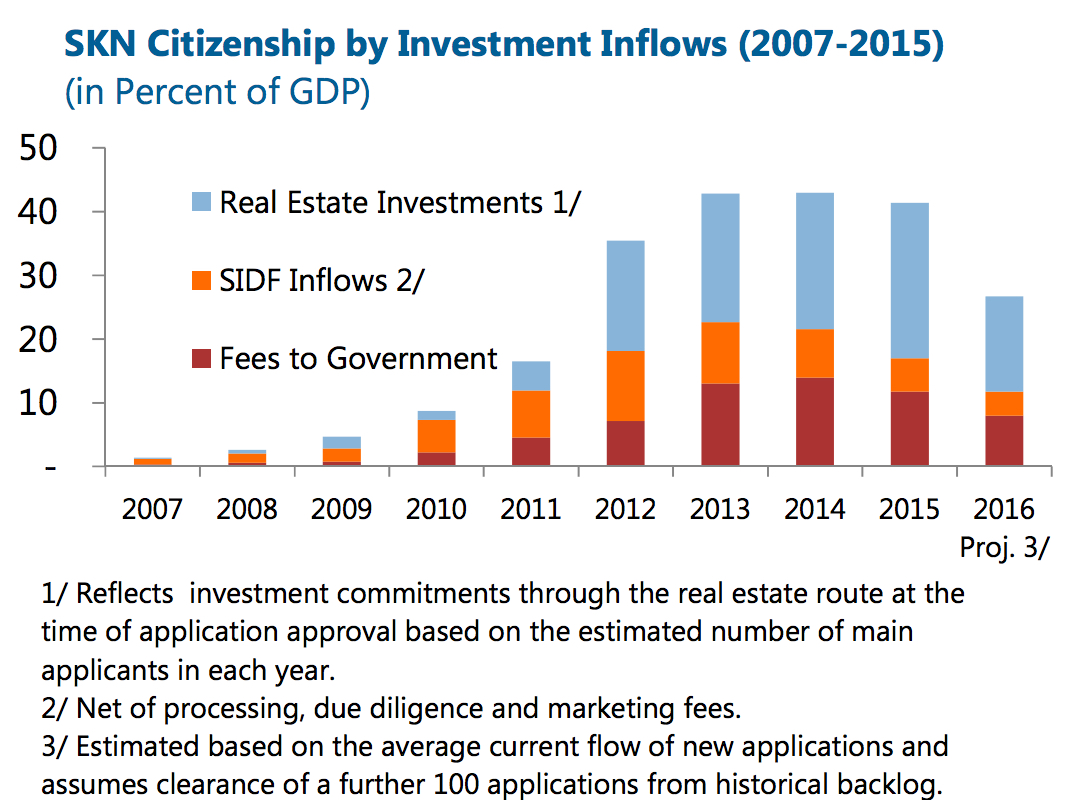

The first point of communication has to be that CBI is vital to the survival of our economies. The improvement in St Kitts’ economy, and the ability of Dominica, for example, to even be able to pay its public service without pause after its largest national disaster are proof of the value of the programs.

The reduction in debt-to-GDP is the most important macroeconomic milestone for many of these economies and CBI is the most important tool in order to attain this.

In addition, the ability of small economies to finance infrastructure at less risk than conventional debt financing is a critical benefit. In Dominica, bereft of any brand hotels and with a shortage of quality hotel room space, the Kempinski, the Anichi, and Jungle Bay projects are vital to the building of a viable tourism economy. In St Kitts, the advent of the Park Hyatt, the ongoing Hilton project, in Antigua, projects such as Tamarind Hills, and in Grenada the Kawana Bay, Silver Sands and Petite Calivigny developments give great hope to improved tourism infrastructure.

Read also: Come Together, Right Now, Over CIP – Developer Warns of Full-blown Price War

Creating a unified marketing platform that talks to the benefits regionally and internationally as much as locally is critical. Industry initiatives which allow the general public to discuss the program openly with stakeholders rather than simply through innuendo and bluster are critically needed. In addition, it is also important to conduct a valuation of the real value in GDP and employment terms of CBI to the OECS countries who engage in this industry.

When the Caribbean Tourism industry took grasp of the attacks on individual members, they formed the Caribbean Tourism Association and began to communicate as one voice. The nations of the OECS engaged in CBI must do the same through the Citizenship by Investment Program Association (CIPA). It is no longer reasonable, especially considering the swiftness of new media, to stay silent. It is also no longer reasonable for political opposition to want to burn the programs down in order to unseat governments, whilst not taking accountability for what will happen next.

There is now an urgent need for CIPA to have proper PR support, to deal with industry issues as an industry leading body, and to announce both policy and program initiatives on a common platform.

It also means that Governments have a responsibility to be even more open. It is true that the due diligence standards that the Caribbean employs are as tough as any other programs, including the US EB5 and the UK Tier 1 investor programs.

[perfectpullquote align=”right” cite=”” link=”” color=”” class=”” size=””]“No one advocates for the stock market to be shut down because there are SEC-violations”.[/perfectpullquote]

However, due diligence is not preventative medicine. No one advocates for the stock market to be shut down because there are SEC-violations. It is a best case investigation of the past of individuals who seek to qualify to acquire the benefits of our citizenships. Getting DD companies to be part of the advocacy communications in the Caribbean should be an important byproduct of the relationships with the programs primarily because the programs hinge entirely on the completeness and credibility of the investigative work done.

Overall, there should be recognition that the programs are important, are working, and deserve to exist without being threatened both from inside and outside.

If this is not done soon, the constant sniping of the programs by our own citizens will create another banana/offshore banking/gaming industry crisis which will be a pyrrhic victory for those who feel they must burn the house down to remove the current occupants.

To summarize the needed actions to be able to solidify a common methodology, I recommend the following operational and communication approaches going forward.

1. CIPA must have a more public profile, putting its brand on events and standing out as the standard bearer globally for CBI programs in the Caribbean. There should be a clear division between the commission relationship for marketing agencies and the responsibility of being the communications brand for the program. The two are unrelated and one of these functions is not being served.

2. CIPA must have a voice to respond via PR to any aspersions and attacks on members and governments.

3. Common standards across the industry must be highlighted, in particular the due diligence platforms and providers, and communicated more openly. Who are the players and what are their standards?

4. CIPA must serve to educate local populations on the most basic aspects of citizenship by investment and to talk beyond the raw data of GDP contribution or the projects themselves.

5. The Prime Ministers of the different CBI islands should coordinate their communication to overarching industry challenges as one voice.

6. CIPA must be empowered to run a cross-OECS communication exercise, independent of the individual governments, and evangelized and managed by professionals who service the industry as well as those who observe it.

7. The Governments can agree to provide a statistical base of information to CIPA to be able to communicate to public stakeholders and indeed grant it an office home, in one of the CBI jurisdictions.

In order for the communication to have increased credibility, there is another piece to this puzzle. There is a need for increased protection for economic citizens as investors in real estate programs, and the creation of needed regulation which can take the industry more into mainstream investment management.

Regulation passed across all of the jurisdictions as a cooperative legal framework is a must in order for there to be a strong basis for the Caribbean to continue to be standard bearers.

This is now serious business, and the attendance of the IMF amongst others is a clear recognition of how seriously this industry is now being taken. However, with that recognition comes a responsibility to make it work even better.

There are gaps in oversight over real estate projects which allow for unsuspecting new economic citizens being used to create white elephants. Governments, as well as developers, should never be seen to be beneficiaries whilst investors get zero return and infrastructure projects fail.

Whilst the citizenship real estate projects all have embedded risk in the same way mainstream real estate does, the primary difference is the oversight that can be created over the escrow process and the demands for developer equity to be front-loaded as a condition for creating ‘skin in the game’. Citizenship has value and projects utilizing that value should be vetted more carefully.

In addition, whilst it remains a sticking point for the OECD in dealing with the OECS islands who manage CBI programs, tax residency is a key next step which should be engaged. Economic citizens who choose to abide by the laws of our land and assimilate into our culture can be vital recurrent value adds to our economies, as investors, homeowners, business owners and residents. It is time to fuel that next stage to build a level of sustainability into economic citizenship.

Evangelizing tax residency is important. Whilst the so-called first world poaches much of our human resources, in particular in the health and education fields, they attack higher net worths who want to make the reverse journey. We must defend and promote the right of individuals to have the choice to make the Caribbean their chosen tax residence and the place where they would rather keep and spend their money.

Speaking about the imbalance in the public domain is a critical marketing communication exercise. Creating a unified media communications strategy to tackle this is possible and is viable. We have a story which is critical to tell and collectively, the stable grouping of democracies in the OECS can defend the right to attract a new type of resident.

It is equally important for the Caribbean diaspora to understand the dynamics at play. The world has changed, and the idea that transient Caribbean nationals who could easily be the primary victims of insularity would promote the same is anathema to what our reality as global citizens has been. CIPA should have an active social media presence, replicating its data and representation at events to the world.

Creating public discussion points over CBI is another key way to help stakeholders understand the business of CBI and the value of the programs. It is understandable that individual governments do not want to get bogged down in discussing the programs. However, it is unreasonable to leave a void of information to be filled by unreliable sources. Either CIPA has to be empowered to communicate more, or the programs appoint a real advocate to lobby and deliver answers to critical queries.

In the interim, united we stand, divided we fall. This has been proven many times before and it will be true again unless we heed the lessons of the past.

Written by Kenny Green, Managing Director of Apex Capital in Dominica, and was originally delivered in speech-form at the 2018 Caribbean Investment Summit.

Kenneth Green is an investment migration specialist and a Managing Partner at Advance Global Partners