6 moronic objections to investment migration (and how CBI/RBI is improving the lives of millions)

Opinion of the editor:

Dear investment migration professional,

Much of the mainstream media and a slew of social commentators would have you believe investment migration is a nefarious business, even to the extent that it makes some of you keep a low profile about what you do for a living. By way of vague hints, unsubstantiated claims, and leading the witness using loaded phrases (I’m looking at you, Steve Kroft!), they attempt to tarnish the image of an industry that is not only legitimate but also inherently moral, not to mention instrumental in championing human liberty and well-being. For shame!

Let me make something absolutely clear right away:

As an investment migration professional, you have nothing to hide and nothing to defend. In fact, you have good reason to take pride in what you do for a living. The work you do keeps repressive governments in check, improves the lives of millions, and is quite literally changing the course of history.

Why that is the case will become clear as you read my responses to the following common objections to CBI.

Moronic objection #1: CBI/RBI only benefits the rich.

On occasion, I fantasize that someone of a cerebral bent will raise an original argument against CBI. This, alas, is not one of them, but rather just another platitude uttered ad nauseam by every half-wit CBI-critic from Valletta to Basseterre, leaving my fantasies wistfully unfulfilled.

Although you don’t need to be very rich, it is true that you’ll need at least US$100,000 at your disposal to participate in a citizenship-by-investment program, and only those who commit this amount can benefit directly.

But only the willfully uninformed could fail to see the millions of people who benefit indirectly. By providing wealthy individuals from countries that aren’t very free with the opportunity to take their know-how, talent and capital abroad, you put pressure on that country’s government to improve domestic conditions and treat their citizens better so as to encourage them to stay.

All governments (save for that of Kim Jong-Un, perhaps) want rich people to live, invest, spend and pay taxes in their countries. Entrepreneurs and investors are the backbone of any economy. They create the vast majority of jobs and pay the lion’s share of taxes. In the US, for example, the infamous one percenters pay nearly half the total federal income taxes.

What would happen if this one percent of Americans decided to leave, or even threatened to do so? When you can cut the government’s tax receipts in half from one day to the next by going “John Galt”, you have leverage. Investment migration provides that leverage.

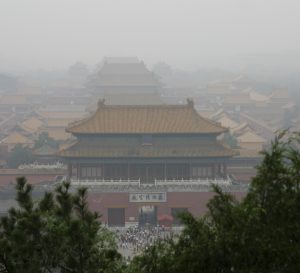

Or, take China: Only yesterday, Hurun Research reported that half of Chinese HNWI want to emigrate. 64% of them cited concerns about the environment as an important motivator. China is hemorrhaging capital and productive people. They leave in droves because their assets are not safe from confiscation by venal officials, because the air they breathe is murderous, and because their children are receiving a propagandizing and antiquated form of education.

And the Chinese government is starting to listen: They’re becoming a world-leader in green energy and imposing tough restrictions and penalties on polluters. They’ve embarked on comprehensive economic liberalization reforms. They’re engaged in the most comprehensive (some would say overzealous) anti-corruption drive in history.

If half of the most productive individuals of a country decide to withdraw their skills, their know-how and not least their capital from a repressive, polluted, or otherwise inhospitable country, then, in order to re-attract them (or at least stem the exodus), their governments will have to change and become more like the countries to which their rich are escaping.

This means those countries’ governments will be forced to move towards, or at least not further away from, respect for the freedom of individuals and their property rights, an impartial judiciary, tackling corruption, and reducing pollution. Such pressure to liberalize and not slide into totalitarianism benefits not only the affluent but the population of such countries as a whole. The wealthy are the ones who pay for it and benefit directly, but everyone reaps the indirect benefits over time.

Poor people can be bullied and pushed around; their protestations ignored; their dissatisfaction with the state disregarded. After all, what are they going to do? Where are they going to go? Rich people, on the other hand, have options. Thanks to our industry, there’s no shortage of pleasant countries willing to take them in. They can go, as Nomad Capitalist Andrew Henderson would advocate, where they are treated best.

The investment migration industry, then, is a bulwark, not only against political repression and the predatory taxation of avaricious governments, but also against environmental degradation. And that benefits not merely the rich, but also your average Zhou.

Moronic objection #2: You’re just selling passports

Passports are the physical manifestation of what we provide, but what we really offer is freedom. Freedom to travel, freedom from undue persecution, freedom from war and conflict, freedom of expression, freedom of education, freedom of religion, freedom of information, freedom from dictatorial rule, the freedom to have as many children as you’d like, the freedom to not fear for your life because of your sexual orientation, the freedom to not be arbitrarily deprived of your property and the freedom to criticize governments without being sent to a “re-education” center.

So, are we selling passports? Sure, that’s part of it. What’s wrong with that? Does someone who happens to be born within lines on a map drawn up by the warlords of yesteryear somehow deserve those freedoms more than someone who wasn’t? This question is even more pertinent when considering that the persons participating in these programs contribute millions to the economy and are verifiably upstanding individuals. Marrying into a citizenship is not generally seen as contentious, so why should investing in one be? Which brings more benefit to the local economy?

Moronic objection #3: Commoditizing citizenship diminishes a country’s value

I would argue the opposite. These programs increase the value of the receiving state by bringing in capital to both the public and private sector. To the public sector, this may come in the form of donations to the government, tax payments or treasury bond investments. In Antigua & Barbuda, citizenship by investment accounts for a quarter of government revenue. CIP-funds are re-housing hundreds of locals who lost their homes to Tropical Storm Erika in Dominica. Telling Saint Kitts & Nevis they can’t have a CIP is tantamount to condemning its population to poverty.

To the private sector, increased value may come in the form of investments in real estate, businesses, and startups. In addition, wealthy individuals generally have a high level of consumption on, for instance, restaurants, schools and private staff. All of this creates employment and brings in capital. Apart from the strictly economic benefits, successful applicants also bring their skills and global network.

As for the countries that the rich are leaving, their value is indeed diminished, and that’s a good thing. People of means emigrate from countries like China, Russia and Saudi Arabia for a variety of reasons: Lack of respect for property rights, unreliable judicial systems, draconian laws and environmental degradation. They immigrate to countries like the UK, Malta, Cyprus, and Grenada because these countries have rule of law, freedom of speech, and predictable respect for property rights. The proliferation of economic citizenship programs rewards states that treat their citizens well, and punishes the ones that don’t. Comme il faut!

But wealthy people are not only escaping totalitarian regimes. Whereas historically many Russians, Chinese, and Arabs have looked to investment migration programs for deliverance from entitled and capricious governments, recently there has been a marked increase in applications from Americans, particularly after the introduction of the Foreign Account Tax Compliance Act (FATCA) in 2010, which compels foreign banks to report extensively on the holdings of Americans. Many foreign banks now simply refuse to deal with Americans due to the prohibitively high cost of FATCA compliance.

Americans are also forced to pay taxes to the IRS on their worldwide income, even if they don’t live or make any money in the US. The US is one of only two countries in the world that has this policy. The other is the military dictatorship of Eritrea.

American public debt now stands at nearly $20 trillion, or about $62,000 per citizen. If we count unfunded future liabilities, that figure is $630,000. Where will this money come from? Many Americans with saved up capital are seeing the writing on the wall: who will it come from, if not them? A burgeoning trend for several years already, the IRS and the federal government’s tendency to confiscate assets and freeze accounts, on the thinnest of pretexts, looks set to continue. As a growing number of Americans feel their cash-strapped state tighten the noose around their wallets, I anticipate the number of applications from that part of the world to increase dramatically in the years to come.

Moronic objection #4: Rich foreign immigrants only serve to drive up the price of housing

Ah, this old chestnut. It pops up every so often in places like Melbourne, Vancouver, London, and Seattle. So predictable. Isn’t it funny how people complain so vociferously both when housing prices go down and up? I bet they would complain if home prices remained static too.

I guess people are just naturally predisposed to only consider one side of the equation, forgetting that every transaction has a buyer and a seller. For every young Vancouverite who can’t find affordable property in the neighborhood in which he grew up, there’s another middle class family that just sold their home for 20 times what they paid for it when they were just starting out. Who are you to tell them they can’t sell it to whomever they please?

Yes, when rich people move to your town, they drive up house prices. They also increase demand for carpenters, interior designers, restaurants, medical facilities, car dealerships, english tutors, clothing stores, grocery stores, kindergartens, plumbers, electricians, sailing schools, tennis instructors, art galleries, elevator repairmen and an innumerable assortment of other products and services, all of which create new employment and business opportunities for the local population.

It always strikes that we only ever hear from the disgruntled few, never from the contented many. The people who think rent is “too damn high” take to the streets; the guy who just opened a karaoke bar is too busy making money.

Briefly put, it’s true that rich immigrants pay stupid money for two-bedroom homes in neighborhoods with good schools. But, if you prevented them from doing so, they wouldn’t come at all, and the local economy would suffer for it. Besides, both parties to the transaction have entered into it voluntarily. What kind of person would want to intrude on a voluntary transaction between two adults? Stalin, that’s who.

Moronic objection #5: Giving citizenships only to rich people when there’s a refugee crisis is unjustifiable

Who says we’re trying to justify it, idiot? It isn’t just. But why ask us to justify it? We would rather everyone had the chance to live in freedom, peace and prosperity. That not everyone has this opportunity is a great tragedy. But the investment migration industry is not to blame for this injustice. Nor are the Europeans who vote in favor of enforcing their borders, for that matter.

Sovereign countries are free to grant citizenships to as many or as few individuals as they see fit. Agents in the Citizenship-by-Investment industry don’t decide that; the countries themselves do. And the fact is that most Europeans don’t welcome large waves of immigration, in large part because they have welfare systems that would crumble under the weight of millions of migrants unable to support themselves. We could have a borderless world, but then we could not have the type of welfare state we have today. You have to choose one or the other.

And, lest we forget, there are some crucial differences between many of the millions of Middle Eastern and African migrants currently entering Europe and CBI applicants, chief of which is that the latter pay their own way and aren’t a burden on taxpayers. They’re also migrating through legal channels. Oh, and they’ve been vetted. Thoroughly. How much due diligence do you think takes place in the middle of the night on some beach on Lampedusa?

To suggest that, if the poor cannot avail themselves of an opportunity, then nobody should be able to, is not only asinine, it’s petty. If we blocked off this avenue to those who can afford it, that would do nothing to help those who can’t. If anything, the added revenue from these programs renders governments more able to help refugees. Without for-profit enterprise to provide the means there can be no humanitarian efforts either.

Moronic objection #6: You’re just in it for the money

Yes, of course, we are in it for the money. Like everybody else in this world, we want to make a living. And the only reason we can make a living out of this is that we provide a service of real value. Most positive change around the world happens because those who bring about that change are in it for the money. Alexander Graham Bell and Thomas Alva Edison were in it for the money. Bill Gates and Steve Jobs were in it for the money. Henry Ford was in it for the money. Indeed, most of the products and services we rely upon daily exist because someone had a financial incentive. You think 60 Minutes isn’t in it for the money?

So, yes, we are in it for the money, but the effect is that governments the world over cannot harass their populations without fear of the consequences.

Investment migration is a moral pursuit

Again, dear investment migration professional: These next few lines may sound overly prosaic, but I think it’s important for you to consider that your work in this industry is not only a job but also something that serves a greater, nobler purpose, which is easy to lose track of as you’re filling out application forms, requesting affidavits and compiling apostilles.

The next time you have the displeasure of encountering some pious ignoramus at the pub, or some smug reporter pandering to the prejudices of the mob, or any other category of cowardly cretin who, never having himself stood up for anything in his life, nonetheless has the gall to suggest you should have moral qualms or misgivings about your work, you tell him, with moral rectitude in your voice:

I have not one shred of doubt about the importance and virtue of what I do. Were it not for the investment migration industry, autocrats the world over could subjugate their populations with impunity.

We won’t be stifled by demagogues and populists who try to trip us up at every turn, who twist our words and obfuscate the truth in order to discredit our work before the uninformed.

We won’t kowtow to sophistry, nor cater to the lowest common denominator by appeasing irrational detractors, but rather be vocal in our advocacy of investment migration as a means to stem the tide of totalitarianism and despotism.

We are on the right side of history. If we must take some low blows from petty politicians and weather media storms in the present, then so be it! It is a small price to pay for the enduring gratitude of posterity.

As an investment immigration professional, you are on the side of the good. Because of the work you do, tyrants may not do as they please. Perhaps you never saw it this way, but whether you want to be or not, you are a professional freedom fighter.

And don’t you forget it.

Christian Henrik Nesheim

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.