Thailand Elite Membership Passes 20,000 – Approvals of Chinese Nearly Tripled in 2022

Spurred by a seemingly interminable “Covid-Zero” policy, now-definitely dashed hopes of a change in top leadership, and a slew of other strong push factors, China’s investment migration market – which cooled off sharply during the first two years of the pandemic – is rapidly reviving. That trend is statistically evident from the recently published nationality figures of programs like Portugal’s Golden Visa, Ireland’s IIP, and New Zealand’s Investor Visa, as well as anecdotally from the programs that don’t.

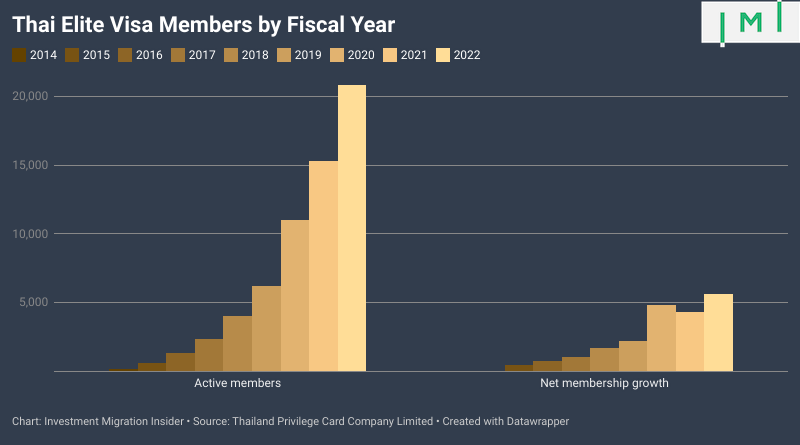

This week, we learn that one of the biggest beneficiaries of this Chinese exodus has been Thailand's Elite residence program. During the 2022 Thai fiscal year, which ended on September 30th, program authorities approved 3,131 Chinese applicants, nearly three times as many as the 1,095 it approved in the same period last year. Overall, the program now has 7,350 Chinese members, accounting for 35.2% of the total 20,884 active participants, according to statements from Yuthasak Supasorn, Board Chairman of Thailand Privilege Card Co. in Bangkok Post.

The number of active Elite Visa holders has virtually doubled since the beginning of the pandemic. In FY2022 alone, authorities approved a record 5,582 applications, exceeding its 4,407 target for the year.

While statistics for other nationalities are not available, other sizeable applicant groups are Japanese (who made up 8% two years ago), British, Americans, and French (each made up 6% of the total in September 2020).

Introduced at the beginning of 2021 as a means to inject foreign capital into pandemic-struck Thai property developers, the program's "Flex One" option, which allows applicants to qualify through the acquisition of real estate valued at THB 10 million (about US$270,000), has also seen some uptake. 22 developers now offer 77 projects that qualify under the program.

The number of General Sales and Services Agents (GSSAs), companies permitted to act as program agents, has grown considerably in the last two years, from 18 GSSAs in 2020 to 32 today. The official list of GSSAs is available here.

Overview of Long-Stay Income- or Capital-Based Visas in Southeast Asia

| Min. Bank Deposit (Cheapest Option) | Min. Fees (Cheapest Option) | Min. Annual Stay | Max. Visa Validity | Min. Annual Income | Min. Investment | Path to PR or Citizenship | Min. Age | |

|---|---|---|---|---|---|---|---|---|

| Malaysia M2H | $212,000 | $1,060 | 90 days | 5 years (renewable) | $100,000 | N/A | N/A | 35 |

| Malaysia M2H - Sarawak | $32,000 | $1,060 | 30 days | 5 years (renewable) | $18,000 | N/A | N/A | 30 |

| Malaysia PVIP | $212,000 | $42,000 | N/A | 5 years (renewable) | $100,000 | N/A | N/A | 18 |

| Cambodia M2H | N/A | N/A | N/A | 10 years (renewable) | N/A | $100,000 | Citizenship in 5 years | 18 |

| Indonesia M2H | $130,000 | $192 | N/A | 10 years | N/A | N/A | N/A | 18 |

| Thailand Elite Visa | N/A | $16,000 | N/A | 20 years | N/A | N/A | N/A | 18 |

| Thailand LTR Visa (Group 1) | N/A | $1,300 | N/A | 5 years (renewable) | $80,000 | $500,000 | N/A | 18 |

| Thailand LTR Visa (Group 2) | N/A | $1,300 | N/A | 5 years (renewable) | $80,000 | N/A | N/A | 50 |

| Thailand LTR Visa (Group 3) | N/A | $1,300 | N/A | 5 years (renewable) | $40,000 | N/A | N/A | 18 |

| Thailand LTR Visa (Group 4) | N/A | $1,300 | N/A | 5 years (renewable) | $80,000 | N/A | N/A | 18 |

| Philippines SIRV | N/A | $300 | N/A | N/A | N/A | $75,000 | Citizenship possible after 10 years | 18 |