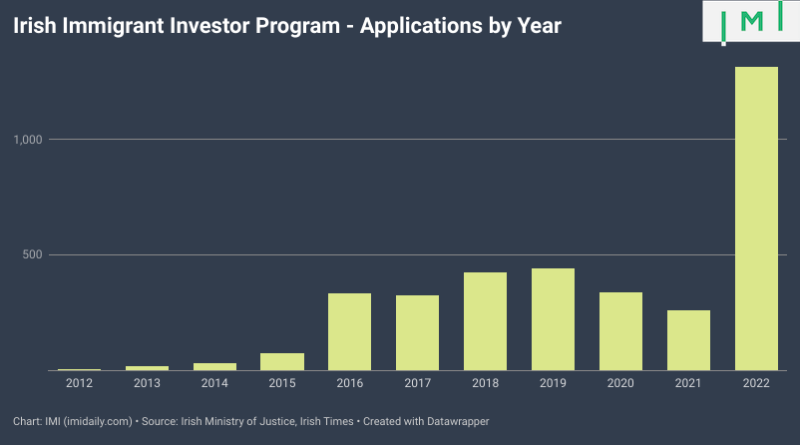

Irish Immigrant Investor Application Volume Swelled by 410% in 2022 as Officials Called for Program Suspension

Throughout much of last year, particularly in the aftermath of the UK’s closing of its Investor Visa route, rumors indicating the Irish Ministry of Justice was harboring misgivings about Ireland’s Immigrant Investor Program had been circulating. As is often the case whenever an investment migration program “might soon close”, scores of prospective applicants began a rush to file their applications.

The rumors, while no doubt enthusiastically fanned by Chinese investment migration agents, were not unfounded. In a series of articles this week, the Irish Times claims to have established definitively that (unnamed) senior members of Ireland’s Ministry of Justice have been urging Justice Minister Helen McEntee to freeze the acceptance of new applications to the program. Such proposals were reportedly discussed in government circles, but the administration determined that, due to the program’s significant contributions to the country’s universities, charities, and social housing – contributions that have amounted to well north of a billion euros – such proposals warranted further consideration.

When, in September, Minister McEntee was informed that, already in the first nine months of the year, the program had received what was already then a record 812 applications and that more than 90% were from Chinese nationals, certain quarters within the Ministry received the news with growing unease.

In the last three months of the year, however, the program received a further 504 applications, bringing the annual total to 1,316. That is more than five times as many as in 2021 and three times as many as in 2019, the previous record year. Of the 1,316 applications filed in 2022, all but 41 came from Chinese investors. While the Ministry received a record number of applications, it only approved 306 last year. 282 of these pertained to Chinese nationals and 10 to Americans, while the remaining 14 approvals accrued to investors of various other nationalities.

According to the Irish Times, the Chinese domination of the program has caused consternation among officials, who worry that Brussels - which opposes golden visas generally and which maintains increasingly less cordial relations with Beijing - will not look kindly on the program's continued existence.

In parallel, the program has been subject to a formal review since 2019. In November 2020, Minister McEntee received a 33-page report detailing the results of the review. That report remains unpublished.

One senior coalition figure told the Irish Times that the Ministry of Justice was "reviewing the review" and also highlighted that Brussels had expressed reservations about such programs.

Responding to questions from the Irish Times about the program's future and when the review report might be published, Ministry officials said only that the review report "remains under consideration within the department in conjunction with wider developments in relation to residency by investment programs internationally and particularly at the EU level."

Though the review remains under consideration, senior government sources have informed the Times that discussions regarding the report - and the program more broadly - "are said to be advanced with a view to reaching a conclusion soon."

Ireland is among the eight Western-European jurisdictions covered in our new report:

11 Special Regimes for

Low-Tax Living in High-Tax Europe

How you or your client can legally pay a single-digit tax rate and live in eight otherwise high-tax Western European countries.

The report is for those attracted to Western Europe for its lifestyle proposition but deterred from residing there full-time by high levels of taxation. The report will show how you (or your client), by participating in special tax regimes that Western European governments have expressly designed to soften the fiscal blow for foreigners, can have your cake and eat it too.

Our guide covers 11 preferential tax regimes in Western Europe:

– Greece

– Ireland

– Italy

– Malta

– Portugal

– Switzerland

– United Kingdom

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.