Record Application Volume Sees Greek Golden Visa Authorities Struggling to Keep Up With Demand

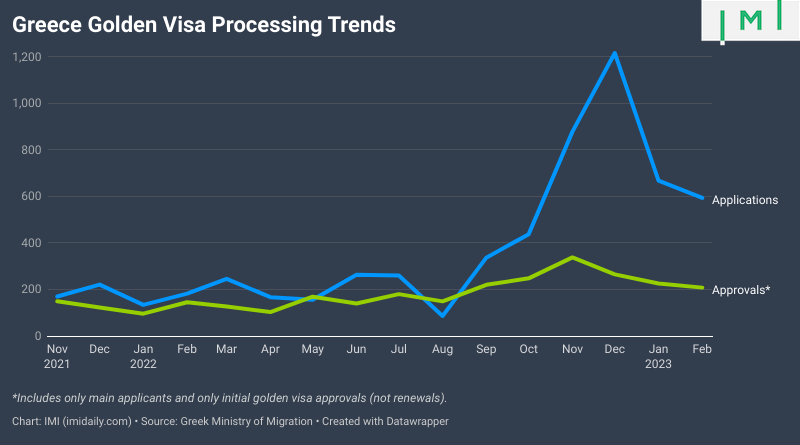

Application volume for the Greek Golden Visa program reached a new all-time in 2022, and the trend is continuing into 2023. Greece’s Decentralized Authorities, however, are struggling to bolster processing capacity to meet the sharply rising demand.

Greece received 4,365 golden visa applications in 2022, the highest such number on record and more than twice as many as it received in 2021. The positive tendency has also spilled over into 2023: By the end of February, Greece had recorded another 1,248 applications so far in the year.

The program's sharply rising popularity is buoyed by a handful of factors, chief of which is the government's September 2022 announcement that it would double the minimum investment requirement for real estate in 36 key municipalities to EUR 500,000 starting in May. The Greek Golden Visa is also benefiting from the attrition of competitors; over the last 18 months, two European golden visa programs - those of the UK and Ireland - have closed, while a third - that of Portugal - looks to be on its last legs.

While application volume has expanded at a previously unseen clip, however, program authorities appear not to have amplified its processing capacity. In the last six months, the program recorded 4,133 applications but has approved only 1,505 in that period. Overall, more than 3,700 applications remain pending.

See also: Special Tax Regimes: How to Live in Greece and Pay a Single-Digit Tax Rate

In fact, several applications filed in 2021 remain pending even now.

The statistics reveal significant regional differences in processing speed: While 594 investors who filed applications in 2021 are still awaiting an answer, 13 investors who filed their applications this year have actually received approvals already. Those investors likely filed their applications with one of the less busy decentralized authorities. Statistics from the Ministry of Migration show that most of the backlog is concentrated in Attica (Greater Athens).

Among the currently valid golden visas in circulation, Chinese investors account for 62%. While still dominant, the Chinese proportion of the program has fallen steadily since before the pandemic, when more than eight in ten applicants were Chinese nationals. In the last year-or-so, the American, Vietnamese, and UK contingents have seen the largest relative growth in applications.

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.