Australia’s SIV Raised A$680m in FY2020, But Processing Severely Thwarted by Pandemic

In the twelve months to June 30th, 2020, Australia received 427 applications to its Significant Investor Visa (SIV) program, which mandates that applicants invest a total of A$5 million in a portfolio allocated across high-, medium-, and low-risk asset classes. Fewer than one in three applications (135), however, were granted during the period, due to COVID-related disruptions.

The 2020 fiscal year was severely impacted by the pandemic, explains Enda Stankard, Managing Director of MA Asset Management, one of Australia’s leading providers of SIV-approved fund services. “In the last four months of FY2020, only 11 SIV applications were granted,” says Stankard.

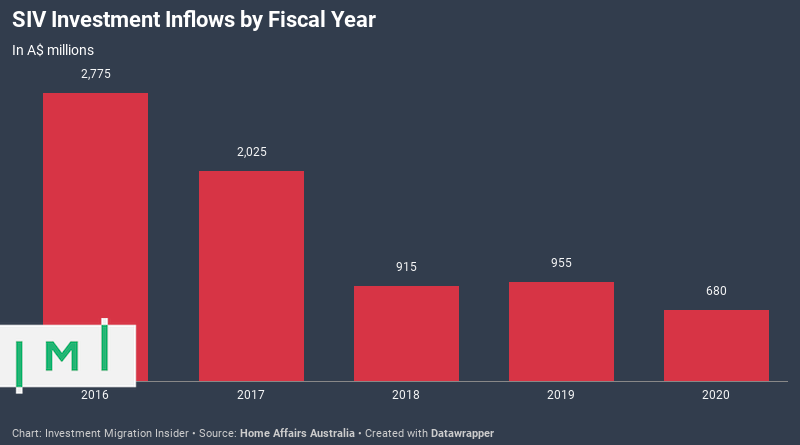

The stunted processing ability translated into a sharp drop in capital inflows in 2020 compare to the preceding year; the program brought investment worth A$680 million to Australia during the period, far below the A$955 recorded in FY2019. Though visa grants fell precipitously, application volume actually saw a slight increase (the program received four more applications in FY2020 than in FY2019), which means that much of foregone revenue is likely to be made up for in 2021 as the accumulated backlog of applications is processed.

In the 2019 fiscal year, the SIV, which is a sub-stream of the country’s broader Business Innovation and Investment Program (BIIP) saw its fortunes reverse for the first time since July 2015, when investment requirements were re-channeled toward private equity and venture capital and away from real estate, sending application volumes plummeting.

The cumulative investment raised through the program since 2012 now stands at A$11.75 billion, a figure that appears all the more substantial when considering, as Stankard points out, that SIV applicants account for only one in a thousand immigrants to Australia each year.

Chinese applicants remained the top source of SIV investment in FY2020 (85% of the total), followed by Hongkongers (5%), Vietnamese (1.3%), Malaysians (1.2%), and South Africans (1.3%).

Stankard points out that China’s share of applications has dipped steadily since its pre-2016 heyday, while those of Hong Kong, Vietnam, and South Africa have risen each year. In aggregate, however, Chinese applicants still account for some 87% of all SIV investors since 2012.

Since the program’s very beginning, the states of New South Wales and Victoria have been the most popular destinations within Australia. In FY 2020, New South Wales took a slim lead with 44% of the total over Victoria’s 41%. On a cumulative basis, however, Victoria (largely because of the popularity of Melbourne among Chinese and Vietnamese applicants) remains the clear leader with 56% of the total, compared to New South Wales’ 34%.

To delve more deeply into the Australia SIV statistics, we recommend interested parties review MA Asset Management’s detailed statistical overview, available in PDF here.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.