“We Simply Need to Open More Doors”: Industry Long-Timers React to The Blackest Week in Investment Migration History

Last week was arguably the most tumultuous week in investment migration’s short history.

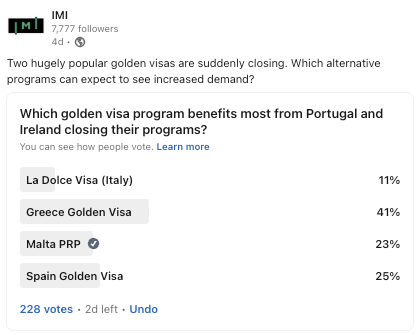

Portugal’s Prime Minister announced his intention to end his country’s golden visa program (though many questions remain as to timing and implementation). Ireland closed its Immigrant Investor program outright, and without any particular explanation except that the program last year became the subject of record levels of investment from China, an observation Justice Minister Harris somehow found troubling.

As if that weren’t enough, we also learned last week that Spanish parliamentarians have submitted a bill that seeks to end the real estate option of that country’s golden visa (without which route that program would become drastically less attractive).

To gain some perspective on last week’s events, IMI reached out to get the reactions of three seasoned investment migration veterans who have spent several decades at the commanding heights of the industry, witnessing all its ups and downs:

- Eric Major, who heads the Latitude RIF Trust Group

- Henry Fan, who heads Globevisa, the world’s largest investment migration firm by client volume, and

- Hakan Cortelek of Beyond Immigration, who – like Major – is part of the Montreal “old guard” from the period when residence by investment was almost entirely a Canadian phenomenon.

“The European Commission is getting its way”

“It’s been a tough week indeed for the investment migration industry,” says Major. “We knew Portugal was at risk, but I didn’t see Ireland coming. Just last week, we launched a EUR 10 million endowment project for Cancer Research with the Royal College of Surgeons of Ireland. We now have only three months to fill those 25 slots.”

Major appears genuinely concerned and hints that last week’s experiences were emblematic of an industry that’s fighting for its continued existence.

“The European Commission is getting its way, and it is reasonable to think this will eventually reach Spain and Greece as well.”

He indicates that companies that choose to remain pure-play investment migration firms, relying on the dozen-or-so household-name programs that seem to be continuously under threat, are placing themselves in a vulnerable position.

“As I said many times before: To survive, you must diversify! Latitude and RIF Trust are ready for the challenge,” he concludes.

“The thirst for foreign direct investment and foreign talent will continue”

Hakan Cortelek, whose friends know him as an inveterate optimist, takes a more sanguine view of things:

“Last week, last month, last year – actually, the last two decades in this investment migration business of ours has shown me one inevitable fact of life: All things are born, live, serve a purpose (some more than others ), and eventually die. Just like humankind, our industry also follows the same cycle. All programs will end one day – no exceptions. Some will end due to their popular success, like the Canadian IIP. Others will be forced shut, like Cyprus.”

While source markets and destinations will change, the one constant we can always count on, Cortelek maintains, is that global populations, wealth, and the number of investment migration programs will keep growing.

“The 2008 financial crisis gave governments a chance to protect themselves from an electoral backlash by raising funds from RCBI instead of raising taxes. They struck gold with the new golden visas. The infamous PIGS countries joined this new gold rush in the early 2010s.”

Now that the world is becoming “complicated” again – economically and geopolitically – state demand for unencumbered funds is likely to grow rather than diminish, giving investment migration more chances to shine.

“The thirst for foreign direct investment and foreign talent will continue to grow, and there will be a metamorphosis of programs. When I started this business, the country options were just two. Fast-forward 20 years, and there are more than 30 options available for us to offer.”

With a nod to the antifragile nature of investment migration, Cortelek points the industry has withstood innumerable crises in the past and that the future is unlikely to be materially different:

“At Beyond Immigration, we’ve stayed on top of the market and offered an increasingly diverse choice of programs to our clients and our business partners. My team and I have faced the tumultuous waters of investment migration, cascades of regulatory paperwork, fear-mongering bogus media blizzards, and the EU and the OECD’s hunger for finding rogue players to finally show everyone how ‘murky’ this business is. Despite all of it, this diverse growth has continued, and I don’t see this changing. Despite the apocalyptic predictions of both internal and external voices, we anticipate continuing our not-so-seamless journey to reach new, more prosperous, and more welcoming harbors for our patrons and partners. Hold tight and enjoy the ride!”

A window closes, a door opens

Globevisa’s Henry Fan explains that since his firm is the biggest, it stands to reason that it should also be the firm that’s most affected by last week’s events.

“I’ve received lots of condolences in the last few days for the obvious reason that Globevisa is supposed to be the number one most heart-broken investment migration company in the world. Our firm was even blamed for the closure of Ireland since Ireland is basically a China-dominated market, and we are dominant in China. I tried to defend my firm by pointing out that the Chinese market is not the number one contributor of applicants to Portugal’s golden visa (anymore). Maybe it’s more suitable to blame Americans this time?”

Fan also echoes many of Cortelek’s sentiments and bright outlook:

“My partners’ condolences notwithstanding, Globevisa is fine. We have already been a highly diversified firm for a long time, and we are involved in more than 150 projects. This week, two of those 150 programs closed. In the long term and in the big picture, that is nothing. Our strategy is simple: As long as the market demand is the same, i.e., if the number of people intending to migrate is the same, we are fine. Two programs were closed this week. This just means that two doors to the outside world were closed and that we simply need to open more doors – or make the small doors wider. That’s it.”

He encourages less-experienced practitioners, who may be experiencing the market’s vicissitudes for the first time, to take heart and roll with the punches:

“The industry as a whole will be fine. Consider what we went through in the past with the Quebec IIP, the Singapore Investor program, and New Zealand’s once-popular program. Everything turned out fine in the end. There’s no reason to worry about the long term. Suck up the short-term pain and move on.”

If you’d like to meet Eric Major, Henry Fan, and Hakan Cortelek in person, join us for

IMI Connect in Malta on May 18-20