The Problem Isn’t That the Rich Can Buy Citizenships But That Everyone Else Can’t

[Opinion of the editor]

Detractors of citizenship by investment (CBI) balk at the notion that people with $100,000 or more at their disposal can buy citizenship.

That “European values are not for sale” has become the predictable refrain of European commissioners commenting on the topic.

Journalists pontificate on the CBI market with thinly veiled disdain for the practice, which they invariably describe using adjectives that give the reader not-so-subtle guidance as to how they should feel about “the murky passports-for-cash market,” where “the elites skip to the front of the line for EU citizenships.”

The common thread that runs through this morality-based criticism of CBI is the unspoken, implicit assumption that wealth should not buy privileges. People with money should not get any special treatment or advantages. To this category of critic, inequality of any kind is anathema.

By that logic, of course, the rich should also not be permitted to fly business class or sleep in nicer hotel rooms (with better-looking spouses) than the rest of us.

But, unless those who vilify CBI are also prepared to advocate for outright communism, they should make their peace with one of the oldest truths of human civilization:

The rich get nicer things.

Or, more accurately, the rich get the nice things first.

Mobile phones, refrigerators, and intercontinental travel. The rich got these things before everyone else. And that makes perfect sense. The rich get the nice things first because they are willing to pay more. Their willingness to pay “stupid” money for new gadgets or experiences is what provides the high margins, seed funding, retained earnings, and R&D budgets that – later – enable the production of those nice things at scale.

In the 1980s, only Gordon Gekko types could justify the outrageous expense of a mobile phone. Early mobile phone manufacturers applied huge margins to their products. If they hadn’t, they would not have been able to make the investments in productivity that would later bring down the cost for the end user to the point where, today, teenagers in Ethiopia can afford smartphones.

In this respect, citizenship sales are not materially different from mobile phone sales. If we allow a free market in citizenship to flourish, one day, Ethiopian teenagers will be able to afford citizenship too.

The problem isn’t that the rich can buy citizenship; the problem is that the rest of us can’t – at least not yet

Before we had citizenship by investment programs, we had citizenship by investment at a discretionary level (citizenship by decree/exception/merit). It was expensive, and you didn’t even necessarily know up front precisely how much you needed to invest. Being non-standardized and ad-hoc, the product of citizenship before the advent of formulaic programs was time-consuming and expensive because there were no economies of scale. Each application, being non-uniform, required case-by-case consideration, and the outcome depended on the judgment of individual government officials.

In the mid-2000s, however, private-sector CBI pioneers working with Caribbean governments devised streamlined ways of “mass-producing” citizenship by investment solutions in a manner that brought down the marginal cost of granting additional citizenships.

This process engineering, to use a manufacturing term, also gave buyers of the product (citizenship) greater predictability regarding the cost and timeline, which drastically bolstered demand. In turn, the now-established demand for citizenships in the Caribbean soon attracted new market entrants; a dozen more countries opened CIPs in the decade that followed.

Suddenly, there was competition for CBI investors, which meant we now had a market for citizenships.

In 2017, following a string of catastrophic hurricanes, this competition came to a head with the 2017 Caribbean “CBI Price Wars”. Justified by the need to raise emergency funds to recover from natural disaster, one of the five countries halved its asking price for citizenship.

This effectively forced the other four regional competitors to cut prices too. Many industry stakeholders, particularly those native to the countries in question, lamented this “race to the bottom” on the grounds that it unnecessarily reduced the financial benefit to the local economies. The downward price spiral was only stalled by the formation of an informal Caribbean CBI cartel, which – to this day – maintains an unofficial price floor of US$100,000 for citizenship by investment in the region.

But price cartels are fragile artifices: A single instance of nonconformity can suffice to break them up. And someday, in the not-too-distant future, a CBI country (perhaps in the Caribbean, perhaps elsewhere) will decide to go beneath $100,000. It is in the nature of a market that – in the absence of coordinated efforts to forestall competition, such as through a cartel or state intervention – prices will fall until margins are minimal.

And what does it really cost for a Caribbean country to supply citizenships? It’s difficult to measure but, in any case, the amount is considerably lower than $100,000, which means prices have further to fall.

That may not be good news for governments in the five Caribbean CBI economies, but it’s great news for the democratization of CBI. It’s great news for the billions of people in the middle class who can’t currently afford citizenship by investment but who might if the price were sharply reduced.

I think this development is inevitable and unstoppable. Neither the European Commission nor the OECD (and much less Sophie in ´t Veld) will be able to dictate terms to all countries at all times, particularly in a period when the international order is fragmenting and countries become increasingly unaligned. Enterprising governments in small countries will open new CIPs, and who’s going to stop them from going under $100,000?

How mass-market, affordable citizenship by investment would bring about a fairer, freer world

While most critics of citizenship by investment argue that it’s unfair that people who produced and saved up the requisite capital can purchase citizenship, they somehow don’t consider it unfair that individuals, through no credit or fault of their own, are born into a high-value or low-value citizenship entirely by chance. What they overlook is that it is the very concept of citizenship that is unfair, never mind the particular manner in which it is obtained by this or that person.

Is it fair that someone born to Norwegian parents draws tremendous benefits – financial and social – from a citizenship acquired by accident of birth, while someone born into Afghan nationality is met with closed doors and a lack of opportunity at every turn? Is it fair that some are born beautiful and intelligent while others are slow-witted and grotesque? Of course, it is not fair. Life has never been fair.

But we can make life fairer by making citizenship meritocratic, rather than hereditary, as is the case today.

Making citizenship meritocratic means making it available to anyone – regardless of color, creed, or class – as long as they fulfill the required conditions of the country offering that citizenship.

Citizenship as club membership

Imagine a world in which every country sold citizenship. What might it look like?

For starters, there would be citizenships in different price ranges, the price of any particular citizenship determined by the demand for it. Countries with high standards of living, safety, economic opportunity, and so on would command a premium, while the citizenships of less attractive countries would be cheap. Perhaps unappealing countries would even pay you to become a citizen, if they considered you someone who would contribute to the improvement of the country or elevate its brand, just like Nike pays Lebron James to wear their shoes while the rest of us must buy them.

Some countries might offer citizenship for free to those who fit the profile of what they’re looking for, while charging those who don’t. For example, the country might grant immediate citizenship at no charge to people who are under 30 and married, with a degree in STEM fields and, at the same time, ask that individuals nearing retirement (at the tail-end of their productive years) pay an annual citizenship fee. Other countries might offer a free trial period, like Netflix.

In any case, there would be citizenships at all kinds of price points, at all quality levels. Some countries might offer citizenship in the form of payment plans or membership dues. As Christian Kälin once pointed out, citizenship is not dissimilar to club memberships; people make a cost-benefit analysis when they consider joining: “What do I get, and what do I pay?”

Hundreds of millions of people would, no doubt, choose to become members of multiple clubs.

Can you imagine how well governments would behave if most people had multiple citizenships? If we all had geographically diversified settlement rights, portfolio allocations, and personal networks, and we all had location-independent incomes?

A high degree of mobility – for your assets, income, and physical person – represents tremendous leverage against the state. In a world where most people were global citizens, states’ poor treatment of their citizens would be a thing of the past. If most people could go somewhere else at the drop of a hat, do you really think we’d have things like social credit scores, army conscription, or inheritance tax?

Certainly not! States would have to treat their citizens the way businesses treat their customers. They would have to offer high-quality services at a reasonable price or lose their citizens to countries that do. And that is the real reason many governments oppose CBI; it has nothing to do with “security concerns” and a great deal to do with fear of having to compete.

But is it realistic to expect most people to buy multiple citizenships?

No, not today. Apart from the current high cost of CBI, people still have an ethereal, symbolic, even romantic notion of citizenship. People have a sentimental bond with their citizenship of origin, fomented by national spirit-building exercises like cheering for the national team, attending public schools, and watching the same national news at 6 PM.

But the younger generations travel more than their parents, are used to working remotely, and certainly don’t watch the six-o-clock news.

In any case, we don’t actually need most people to become global citizens to encourage states to treat their citizens better; it is enough if the top 1% of income-earners – who, in many developed countries, account for nearly half of tax revenue – become physically and financially mobile. The effect of the 1% withdrawing their capital from a particular jurisdiction would be as great as if the bottom 90% had done the same; the country has to improve to retain or re-attract the rich, which in practice means improving conditions for everyone.

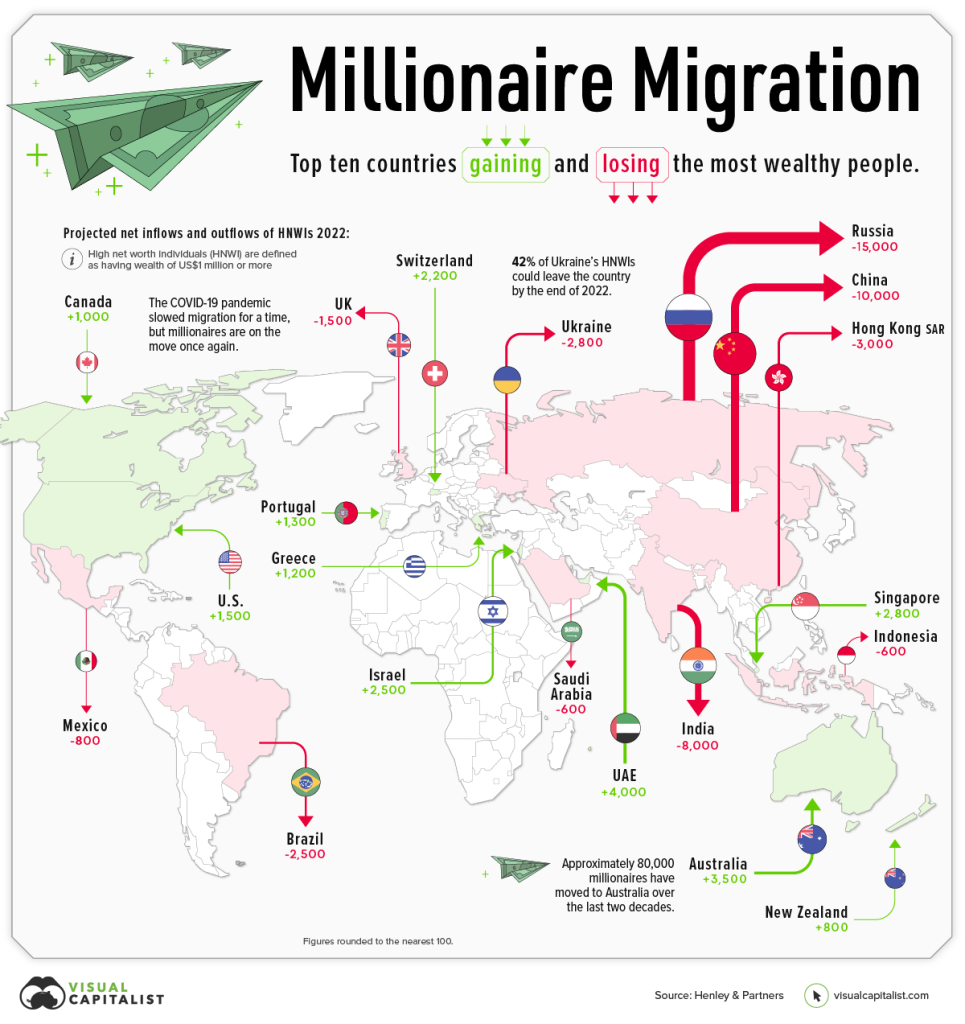

And the 1% are already on the move – big time:

This is nothing short of a revolution, and it has already started. In 2023, practically everyone who is a high-earner can now work from anywhere. Individuals with skills and/or capital are now up for grabs. Interstate competition to attract them is heating up.

One obvious manifestation of this trend is the barrage of digital nomad visas launched since the pandemic. But that’s just the beginning. It’s only a matter of time before tax rates, for example, begin falling across the world, as welcoming jurisdictions lower theirs to draw in globally mobile knowledge workers and put pressure on other countries to do the same. The OECD’s much-dreaded “harmful” tax competition is about to accelerate.

The investment migration industry works to expand the supply of and demand for citizenship by investment programs. Over time, this intensifies the competition for citizens among countries and, thereby, lowers the cost and improves the quality of citizenship for everyone. Investment migration, fundamentally, rewards good states and penalizes bad ones by facilitating the shifting of people and their capital from the latter to the former.

At its core, investment migration makes the following proposition: You don’t have to be a member of just the one club you happened to be born into. If you work hard and apply yourself, you can be a member of your dream club – or many clubs.

Letting the coincidence of birth determine someone’s opportunities in life is plainly unjust. We need to lower the cost and reduce the friction of investment migration so that everyone has the chance to improve their lot in life.

And that is an idea that ostensibly egalitarian-minded journalists and MEPs should be able to get behind.