8th Annual Report on Malta CBI: Regulator Laments “Surreal” EU Criticism as Program FDI Reaches EUR 1.7bn

The Office of the Regulator of the GCES (ORgces, formerly ORiip) today released its 8th annual report on citizenship by investment in Malta, covering the calendar year of 2021.

As far as statistical releases on CBI programs go, the 60-page ORgces report contains the richest data set among all investment migration programs and represents the global benchmark for data transparency, an observation that has earned Malta the top spot in The CBI Transparency Index.

In his foreword to the report, Regulator Carmel L. De Gabriele once more drew attention to “the unfair criticism and baseless accusations” levied against the program arising from “fears of possible money laundering and other financial criminal activity or abuse, which, in true fact, have never been brought to light or proven.” Those truthfully “unfounded and surreal” criticisms, he said, had culminated in the European Commission’s infringement procedures against Malta, which he characterized as “nothing less than a blow below the belt.”

With regards to the infringement procedures, De Gabriele commented that he could not but once again express his “sheer and utter perplexity” about his observation that, despite having openly criticized the program for many years, institutions both national and international had “failed to get in touch with my Office to witness with their own eyes how my Office is meticulously scrutinizing to the minutest detail the work performed […].”

That undeserved scorn and concern, he pointed out, was all the more frustrating and implausible in light of the “far higher number of citizenships granted throughout the EU to non-nationals through non-CBI schemes without any seriously handled due diligence procedures that are anywhere near and are totally incomparable to the due diligence procedures that we profess and adopt in operating our CBI scheme[…],” not to mention the IIPs “outstanding benefits” to the country’s development.

Report chiefly covers data on IIP, rather than MEIN policy

The erstwhile Malta Individual Investor Programme formally closed to new applications on August 15th, 2020, and began accepting applications for Eligibility Assessments under the MEIN policy in March of 2021.

Because the IIP, like the MEIN policy, had a two-step process (first residency, then citizenship), a number of individuals who had applied for residency under the IIP with the aim of eventually applying for citizenship were permitted to apply for citizenship on an IIP basis also in 2021, despite that program’s formal closing to new applications on August 15th, 2020. For this reason, the Community Malta Agency (CMA) recorded 23 IIP applications in 2021, a year during which that program was not open to new applications.

The CMA began receiving applications for so-called Eligibility Assessments for exceptional citizenship under the MEIN policy in March 2021. Overall for 2021, the CMA received 75 applications for MEIN Eligibility Assessments, none of which had been concluded by the end of 2021. In a manner of speaking, therefore, Malta received a combined 98 investment-based applications for citizenship in 2021.

In the statistical tables below, we have included only data related to the IIP. Application and revenue data pertaining to the MEIN policy will be the subject of the annual report for 2022, which is already under preparation.

Application outcome data

The CMA received 23 citizenship applications (under the IIP rules) in 2021, a sharp decline from the 317 files recorded in 2020. During the same period, the CMA approved 109 applications and rejected (or recorded as withdrawn) 112. 160 main applicants reached the naturalization stage during the year, as did 365 dependents.

Overall, Malta has received 2,245 applications, of which 1,608 have been approved and 630 rejected or withdrawn. This has resulted in a grand total of 1,452 Maltese citizenships for main applicants and 3,515 citizenships for dependents. The implied rejection rate, based on the number of applications that have had an outcome so far, is 28%. The true rejection rate is likely to be slightly lower, considering some applicants withdrew their applications, though the precise rate is not available because of the commingling of rejections and withdrawals.

The report also noted that while 47 agents submitted applications on behalf of applicants during the period, only three of them submitted more than ten files. Three agents alone were responsible for 42% of applications. 22 agents submitted only a single application.

Men continue to account for the overwhelming majority of applicants, making up about 8 in 10 applicants overall.

While based on a small absolute number of 23 applicants, Europeans (including Russians) remain the largest applicant group, rising to a record 48% (11 applicants) in 2021, followed by Asians (5 applicants), North Americans (4), Africans (2), and South Americans (1). No applications from the Middle East, Oceania, or the Caribbean materialized in 2021.

As is the custom, only about one-tenth of applicants chose to buy, rather than rent, a home in Malta.

Among those who did buy a home in 2021, however, the average price paid (EUR 1.43m) was almost twice as high as in 2020, no doubt thanks to a few outliers in the year's small number of applicants. Average rental prices, meanwhile, have fallen to a record low: Applicants who rented homes in Malta did so at prices averaging EUR 90,978 for the five-year period.

Since the program opened in 2014, 73% of home purchases have been concentrated in just two localities; Sliema and St. Julian's.

Home rentals, meanwhile, though still concentrated in the Central Region, have been somewhat more evenly distributed.

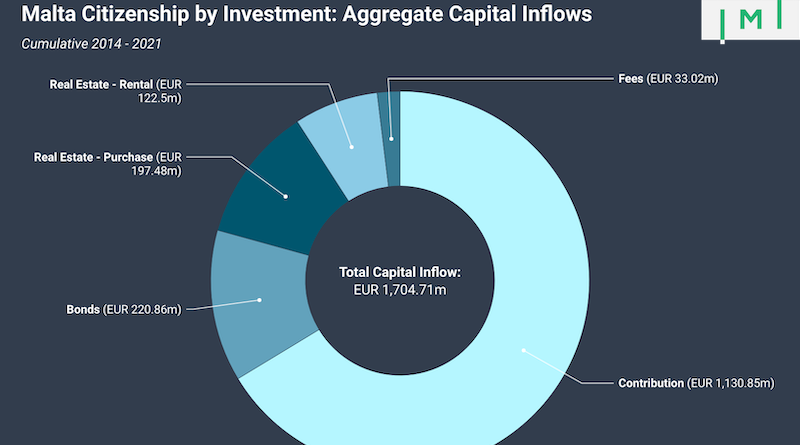

Under the IIP's aegis, Malta saw EUR 145.3 million in capital inflows in 2021, categorized as follows:

- EUR 85.4m in applicant contributions

- EUR 24.2m in bonds ("government stock")

- EUR 21.5m in real estate acquisitions

- EUR 13.2m in rental spending

- EUR 0.5m in fees

- EUR 0.6m in applicant donations to various causes

On a cumulative basis since 2014, the IIP has raised direct investments and contributions in Malta amounting to EUR 1.7 billion.

Out of the EUR 1.13 billion raised through applicant contributions, the single-largest cost item for applicants, about 55% has accrued to the National Development and Social Fund (NDSF) and a third to the government's Consolidated Fund (effectively the Treasury). The various agencies that have been responsible for managing the program throughout the years have been the recipients of some 6% of the total, while Henley & Partners, the program's original concessionaire, has earned 4.6% of the total, or about EUR 52 million.

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.