How to Live in Italy and Pay a Single-Digit Tax Rate: 3 Special Tax Regimes

The following article is an excerpt from our report:

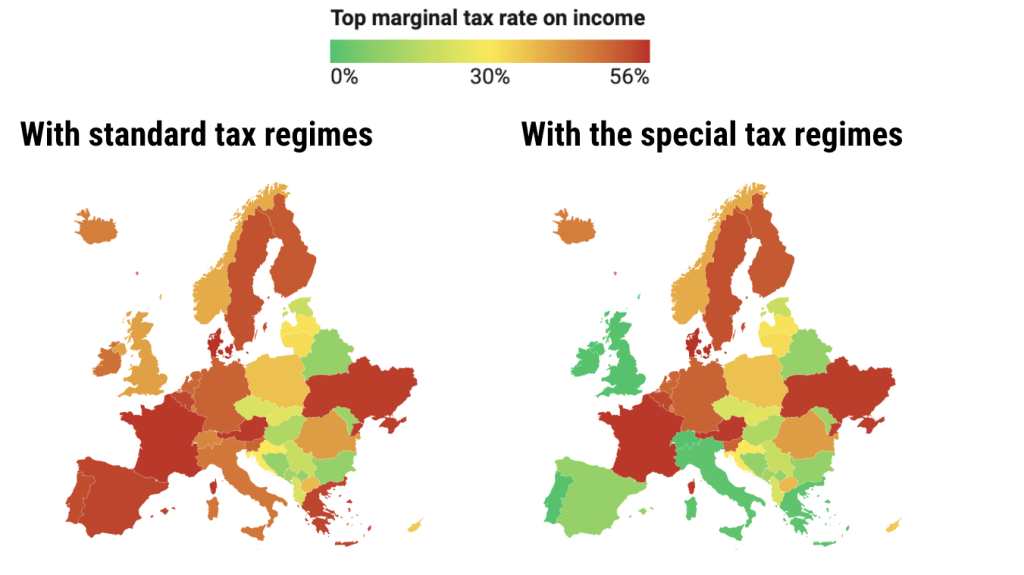

11 Special Regimes for

Low-Tax Living in High-Tax Europe

How you or your client can legally pay a single-digit tax rate and live in eight otherwise high-tax Western European countries.

The report is for those attracted to Western Europe for its lifestyle proposition but deterred from residing there full-time by high levels of taxation. The report will show how you (or your client), by participating in special tax regimes that Western European governments have expressly designed to soften the fiscal blow for foreigners, can have your cake and eat it too.

Italy offers three special tax regimes that enable effective tax rates in the single digits:

- Special Tax Regimes in Italy

- The Lump-Sum Regime

- The Lavoratori Impatriati Regime

- The Southern Italy Flat Tax Rate Scheme

1. The Lump Sum Regime

Key indicators

Maximum duration: 15 years

Years of non-tax-residence required to qualify: 9 of the last 10 years

Extendable to family members? Yes

Executive Summary

The Italian Lump-Sum Tax regime, first introduced in 2017 to attract HNWI residents otherwise deterred by Italy’s high rates of ordinary taxation, allows new residents to pay a fixed tax of €100,000 per year on all non-Italian sourced income for up to 15 years. This option is also extendable to family members, who would each pay €25,000 annually.

The lump sum payment covers practically all categories of non-Italian sourced income. Participants are also exempt from donations and inheritance taxes relating to assets and real estate owned abroad, as well as from wealth taxes on foreign real estate or financial assets.

Furthermore, no remittances tax or foreign-held asset reporting is required when opting for this regime, allowing individuals the freedom to remit funds between countries with no restrictions due to the already paid lump sum tax.

Note, however, that capital gains realized upon transfer of non-Italian ‘qualified’ shareholdings within 5 years of becoming tax residents are not covered under this scheme and must still be declared separately according to Italian laws.

What are the eligibility requirements?

The lump sum regime is open to new residents who were not residents of Italy in the past 9 out of 10 years. Individuals registered as residents of Italy in the past year can still qualify as long as the tiebreaker rules included in a Double Tax Agreement (DTA) protects them. The regime is open to any nationality, including Italians and citizens of countries with which Italy does not have any tax treaty.

What are the principal tax benefits?

Participants in the lump sum tax regime

- Need only pay a fixed €100,000 tax, regardless of how much income you have worldwide;

- Can extend the lump sum tax to cover all family members, who will be subject to a €25,000 tax on worldwide income (family members must adhere to the same non-tax-residence period as main applicants);

- Can benefit from this special tax for up to 15 years (For family members, the 15-year term counts from the year in which the main applicant transferred to the lump-sum regime;

- Are exempt from international asset reporting obligations, and, consequently;

- Are also exempt from IVAFE and IVIE, Italy’s wealth taxes on foreign real estate or financial assets;

- Are exempt from gift tax and inheritance tax on transfers of assets located outside Italy; and

- May remit unlimited funds to Italy at no additional tax burden.

Which categories of income qualify for reduced taxation?

Lump-sum taxpayers are exempt from taxes relating to any foreign income, including

- employment income;

- rental income;

- financial income;

- self-employment income; and

- dividend income.

However, note that this tax regime does not apply to Italian-sourced incomes or capital gains realized upon transferring non-Italian “qualified” shareholdings within 5 years after electing for this system. A “qualified participation” is typically a stake with more than 20% of the voting rights or ownership of more than 25% of the shares, regardless of voting rights. For publicly-traded companies, “qualified participation” denotes shares representing more than 2% of the voting rights or a stake of more than 5%, regardless of voting rights.

2. The Lavoratori Impatriati Regime

Maximum duration: 10 years

Years of non-tax-residence required to qualify: 2 years preceding application

Extendable to family members? No

Executive Summary

The Lavoratori Impatriati (also known as the Rientro dei Cervelli) special tax regime incentivizes the relocation of “human capital” – Italian or foreign workers – to Italy. This system exempts 70% of income from employment completed in Italy from income tax, leaving only the remaining 30% subject to taxation. In addition, those who take up residence in any of the Southern Italian regions of Abruzzo, Molise, Campania, Puglia, Basilicata, Calabria, Sardinia, or Sicily receive a 90% exemption from income tax.

This regime is applicable for at least 5 and, in many cases, 10 years. Social security, however, remains fully taxable per usual rules.

What are the eligibility requirements?

To qualify for the Lavoratori Impatriati scheme, applicants must

- Not have been tax resident in Italy in the preceding 2 tax years;

- Commit to reside in Italy for at least 2 years and be a tax resident for 2 tax years – or risk losing the relief and paying extra due plus penalties;

- Perform work prevalently in Italy – typically meaning more time spent working in Italy than anywhere else but, strictly speaking, at least 85% of work performed in Italy;

- Have a university degree/highly specialized qualification (not applicable to Italian citizens)

- Move to Italy in direct connection with the beginning of a new professional activity, such as a job offer, the beginning of self-employment activity, or the opening of a new company.

What are the principal tax benefits?

Those who take up residence in Northern Italy will pay personal income tax on only 30% of their gross income, while those residing in the Southern provinces pay income tax on only 10% of their income. Standard income tax rates on the reduced tax basis apply in either case. The special status is initially valid for 5 years.

An individual may extend their exemption by an additional 5 years if they have at least one dependent below 18 years old or if they (or their spouse/civil partner) purchase a residential property in Italy either after moving there or within 12 months before moving there. If the individual has at least three dependants under 18, they can claim an exemption of 90% on their taxable income.

Examples: For someone residing in Northern Italy and making a €100,000 gross income, for example, the personal income tax due would amount to €7,210, i.e., the same as someone earning a gross salary of €30,000 would pay at the normal Italian income tax rates. For someone living in Southern Italy, the income tax due on a gross income of €100,000 would amount to €2,300, i.e., the same as someone earning a gross income of €10,000 would pay under normal circumstances.

Italian authorities have confirmed that the regime does not necessitate that the work be performed for a company located in Italy.

Which categories of income qualify for reduced taxation?

Income from professional activities, such as employment, self-employment, or entrepreneurial activities, are covered under Lavoratori Impatriati.

This special regime only applies to income taxes; it does not extend to dividends, capital gains, or statutory social security contributions, which are calculated on 100% of salary. Furthermore, there is no wealth tax reduction or exemption from Italy’s foreign asset reporting requirements for those tax residents in Italy during a given year.

3. The Southern Italy Flat Tax Regime

Maximum duration: 10 years

Years of non-tax-residence required to qualify: 5 years preceding application

Extendable to family members? Yes

Executive Summary

To draw more people to rural Southern Italy, the government has introduced a 7% flat tax rate on passive income from outside Italy. Launched in 2019 by the Italian Revenue Agency (Agenzia delle Entrate), the scheme is open to both foreign nationals and Italians who have not been tax residents in Italy for the last 5 tax years. With this tax break, the government hopes to encourage the repopulation of small villages and towns in the South and to fund local services and education, so younger generations stay in these picturesque locations. The scheme is valid for a maximum of 10 consecutive tax years.

What are the eligibility requirements?

Retirees (or others living off a passive income), both Italian and non-Italian, can apply for a tax cut to their foreign earnings as long as they meet the criteria set out by Italy's Revenue Agency. The applicant

- Must not have been an Italian tax resident for any of the past five tax years;

- Must receive passive income (typically a pension, regular dividends, annuities, and so on) from abroad;

- Must be currently resident in a country that has a Dual Tax Agreement with Italy (see a list of countries that have a DTA with Italy here);

- Must submit the application within a year of becoming an Italian tax resident.

- Must move to (and remain in, for the duration of the tax break) an Italian village included in one of the categories designated for this specific incentive, i.e., municipalities with a population of under 20,000 in the regions of Abruzzo, Basilicata, Calabria, Campania, Molise, Puglia, Sicily, Sardinia, as well as certain parts of Lazio, Umbria, and Marche.

Even if the population of your town increases beyond the specified limits after you register as a resident, you will still be able to take advantage of the 7% tax program until it expires.

Which categories of income qualify for reduced taxation?

If you meet the necessary criteria, you can benefit from a 7% flat rate personal income tax on all your foreign earnings. "Personal income" includes incomes derived from private or public pensions but also rental income and dividends from overseas.

With this rate, neither Regional nor Municipal taxes apply. Moreover, foreign asset monitoring is not required; IVIE and IVAFE - the Italian wealth taxes applied to foreign-held assets - do not apply to residents under this regime.

The 7% rate is valid for 10 years in total.

Special thanks to Marco Bersani of Bersani Law for quality-controlling the above content.

To learn more about how you or your client can live a low-tax life in high-tax European countries, see our report.