Dubai Still Top Hub for RCBI Companies; 3 Firms Present in 20+ Markets; Istanbul is Rising Star

Last year, in what would turn out to be a seminal article, we provided an overview of Where The 52 Biggest International RCBI-Specialist Firms Have Offices.

Today, we’re following up with an updated overview to reflect the tremendous changes that have taken place in the global market presence of investment migration companies over the last 18 months.

What do we mean by “international RCBI specialists”?

As before, we are defining “international RCBI specialists” as companies that meet the following four criteria:

- They have offices in more than one country;

- They have at least 10 employees (reduced from 15 last year);

- They offer services for a diverse range of IM programs (i.e., no single-program focus);

- Investment migration is the companies’ primary business.

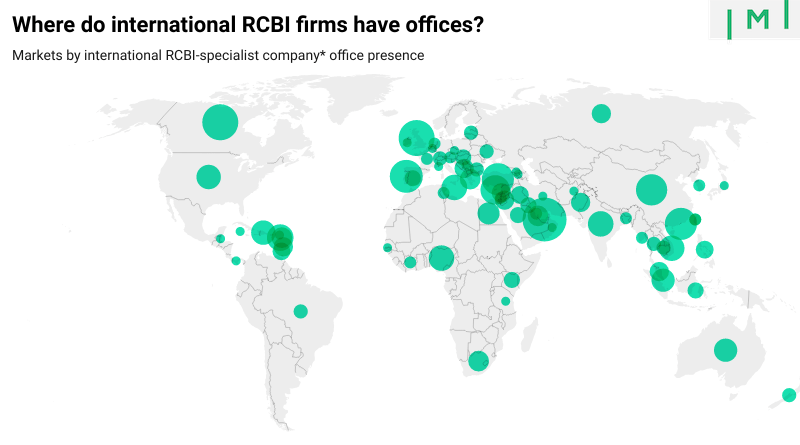

Note that, just as last year, we are measuring the market presence, rather than the absolute number of offices, of the international RCBI companies. That means that we count the number of countries in which a company has physical premises and not the total number of offices, a figure that is often the same but which differs in those cases where a company has multiple offices in the same country.

In determining global office presence, we have relied on the information published by the firms themselves, typically on their websites, social media, and other public sources.

What’s changed since last year?

Considering the relatively short amount of time that’s passed since our first report on the topic, the changes that have taken place in the global footprint of investment migration companies are remarkable.

There are more international RCBI specialists than ever before

In this year’s overview, a further ten companies fit our definition of international RCBI specialists, which means we have tracked the market presence of 62 companies.

Biggest gainers and losers

While the number of international RCBI specialists has grown in most markets, it has shrunk in some; notably in Russia (from 9 to 6), Malaysia (from 7 to 6), Egypt (from 9 to 8), and Cyprus (from 15 to 16).

Conversely, the following countries saw the greatest absolute growth in the number of international RCBI specialists physically present in their markets:

- Türkiye (100% in Istanbul) saw its IM firm roster more than double, increasing by ten companies from eight to 18.

- Portugal nearly doubled as well (9 to 19), also adding ten new companies.

- Hong Kong and the UK each grew by six firms (12 to 18 and 17 to 23, respectively).

- The UAE and Vietnam each grew by five firms (30 to 35 and 7 to 12, respectively)

- India grew by four firms (7 to 11)

- Nigeria and Malta grew by three firms (both 8 to 11).

See also: 1 in 3 Investment Migration Firms Plan to Open Offices in Africa This Year

The UAE (chiefly Dubai) remains the pre-eminent global hub for international RCBI specialist firms, 35 of which have offices in the country. At 23 firms each, Canada and the UK share a distant second, followed by Portugal (19), Turkey (18), Hong Kong (18), China (17), and Cyprus (16).

Which companies have the biggest global footprints?

Only three companies have a physical presence in more than 20 countries. Henley & Partners and Migrate World each have offices in 31 different countries. Strictly speaking, H&P's footprint is the bigger of the two as it maintains multiple offices within a handful of countries (three in South Africa, three in India, two in Switzerland, and two in Nigeria).

Harvey Law Group, which is particularly dominant in Southeast Asia, has the 3rd greatest global market presence thanks to its premises in 23 countries. The firm is closely followed by Arton Capital, which has offices in 19 countries, and Latitude/RIF Trust, which is present in 18 markets.

The only truly internationalized firm among the Chinese majors is Delsk, which sports 17 international office locations.

See also: The Three Types of Investment Migration Company and How to Measure Their Size

While most firms expanded their footprints, some consolidated theirs

In absolute terms, the companies that have entered the most new markets since last year's tally were:

- Xiphias Immigration: +9 countries

- Harvey Law Group: +6 countries

- Beyond Residence & Citizenship: +5 countries

- Migrate World: +5 countries

- Reach Immigration: +5 countries

Other companies, as is evident from the below table, have spun off some of their offices to focus on their best performers.

See also: Diseconomies of Scale in the Investment Migration Market: Why IM Remains a “Boutique” Industry

Dig deeper

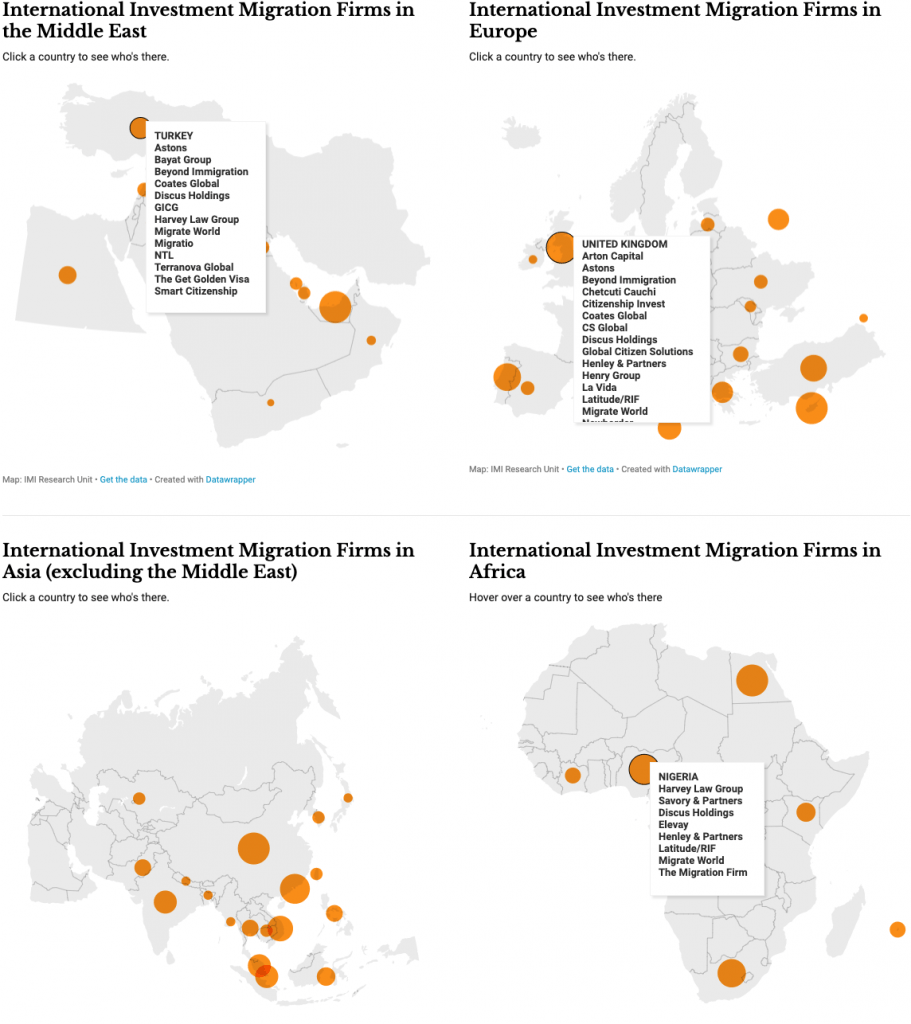

Those interested in learning further details about which companies are present in which markets are encouraged to visit the International Investment Migration Firms’ Global Office Distribution, where they can:

- See the complete, scrollable, searchable, and filtrable table of which firms are present in 80+ countries. New this year is the ability to filter and sort both by company and by country.

- Explore our interactive map of each world region to see precisely which of your competitors are already present in each particular country.