Stephen D. Barnes

Hong Kong

The Times They Are a-Changin …

The Citizenship by Investment (CBI) industry, once celebrated as a pathway to global mobility and economic growth, now faces mounting challenges due to scandals, legal disputes, and increasing regulatory scrutiny.

Initially praised for its mutually beneficial arrangement—where high-net-worth individuals could acquire citizenship in exchange for substantial investments in a host country—the CBI industry is now under intense scrutiny.

A wave of scandals, accusations of corruption, misuse of funds, and legal challenges have severely undermined the industry’s reputation, raising questions about its long-term sustainability.

This article examines numerous instances of CBI programs undergoing criticism, explores the legal and regulatory challenges they face, and discusses the potential decline in their attractiveness.

It also argues that Residency by Investment (RBI) programs may emerge as a more credible and sustainable alternative for investors and professional resellers, particularly as the convenience of a second passport for ease of travel faces growing opposition.

The Rise and Fall of CBI Programs

CBI programs began as a novel concept in the late 20th century, offering individuals the chance to acquire a second citizenship in exchange for substantial investment in a host country. These programs promised various benefits, including visa-free travel, favorable tax regimes, and enhanced global mobility.

However, as the industry expanded, so did the opportunities for abuse, leading to a series of scandals that have significantly damaged its credibility.

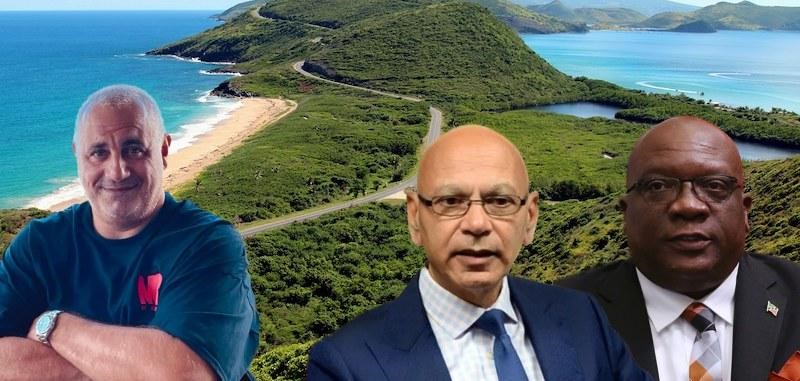

St. Kitts & Nevis: The RICO litigation and its implications

One of the most significant blows to the CBI industry came with the Racketeer Influenced and Corrupt Organizations Act (RICO) litigation in the United States involving St. Kitts & Nevis.

The lawsuit alleged that nefarious actors exploited the CBI program for money laundering, tax evasion, and other illicit activities. This case underscores the vulnerabilities within the CBI framework, particularly concerning due diligence and applicant screening.

In response to the challenges brought to light by the RICO litigation, St. Kitts & Nevis has undertaken significant reforms to restore the credibility of its CBI program. The St. Kitts & Nevis Citizenship by Investment Unit (CIU) has been restructured as a statutory corporation to enhance transparency, accountability, and efficiency.

These reforms are part of a broader effort to align the program with international best practices and address the concerns raised by international stakeholders.

Moreover, in a bid to safeguard the integrity of the CBI industry, the Caribbean Five—a group comprising the five Caribbean nations most prominent in the CBI market—have reached an agreement with the United States on six key principles.

These principles focus on improving due diligence processes, enhancing transparency, and ensuring that “bad actors” cannot illicitly exploit the CBI programs. This agreement represents a significant step toward restoring confidence in Caribbean CBI programs, but challenges remain.

The Cyprus scandal: A cautionary tale

Once considered a prestigious offering, the Cyprus CBI program became synonymous with the risks inherent in these schemes. In 2020, an undercover investigation by Al Jazeera exposed how the program was being misused by criminals and politically exposed persons (PEPs) to acquire EU citizenship.

The investigation revealed that intermediaries and government officials were willing to bend or break the rules to facilitate the sale of citizenships to individuals with dubious backgrounds.

The scandal led to severe repercussions, including the government revoking several citizenships and suspending Cyprus’s CBI program. The EU responded by increasing its scrutiny of CBI programs across member states, calling for stricter oversight and regulation.

The Cyprus scandal serves as a cautionary tale, illustrating how CBI programs can be exploited and the risks they pose to the integrity of the EU and other international bodies.

Learning from Cyprus’ mistakes

The Organization of Eastern Caribbean States (OECS) has been actively working to standardize and improve the Citizenship by Investment CBI programs across its member states. This effort is part of a broader initiative to enhance transparency, due diligence, and the overall integrity of these programs.

In March 2024, OECS member states, including Antigua and Barbuda, Dominica, Grenada, St. Kitts and Nevis, and later St. Lucia, signed a Memorandum of Agreement (MoA) to establish common standards for their CBI programs.

This MoA sets forth several key measures, such as setting a minimum investment threshold, prohibiting discounting of CBI options, and establishing a regional regulatory body to oversee compliance with international standards.

The aim is to ensure that governments manage these programs responsibly and that they contribute positively to the socio-economic development of the participating countries.

These efforts are part of a broader strategy to protect the region’s CBI programs from the kind of scandals that have plagued Cyprus.

Vanuatu and the loss of EU Schengen visa privileges

The European Union’s suspension of visa-free travel for Vanuatu passport holders in 2022 has been a significant blow to the country’s Citizenship by Investment program.

This suspension was primarily due to concerns over Vanuatu’s lax due diligence processes and the issuance of passports to individuals with questionable backgrounds.

The EU highlighted the potential security risks these issues posed to its member states, leading to a temporary suspension in May 2022. The EU has proposed making it permanent in 2024 after Vanuatu failed to implement sufficient reforms.

This situation underscores the heightened scrutiny that CBI programs face globally, particularly from the EU, which is concerned about the integrity of its visa-free travel regimes.

The loss of Schengen visa privileges for Vanuatu passport holders serves as a cautionary tale for other nations offering similar programs, demonstrating that failure to adhere to strict due diligence standards can have severe consequences.

The Saint Lucia RICO scandal: Further erosion of trust

Adding to the challenges facing the CBI industry is the ongoing alleged scandal in Saint Lucia.

The lawsuit, which accuses Saint Lucia’s CBI program of being involved in corruption and other illegal activities, has further eroded trust in the CBI market. St Lucia has categorically denied these claims.

The tumult in Saint Lucia has raised serious concerns about the governance and transparency of CBI programs in the Caribbean.

Reports suggest efforts were made to cover up the scandal, including pressuring victims to retract their statements. These reports, however, have not been verified.

This alleged misconduct has sparked outrage among citizens and international observers alike, leading to calls for greater oversight and accountability in CBI programs.

The implications of the Saint Lucia alleged scandal extend beyond the Caribbean. It has intensified fears of “de-risking,” a process where financial institutions withdraw services from jurisdictions perceived as high-risk due to concerns about money laundering and other financial crimes.

If de-risking accelerates as a result of the Saint Lucia scandal, it could have devastating consequences for the CBI industry, particularly in small island nations that rely heavily on these programs for economic stability.

The Malta-EU legal dispute: A battle over sovereignty

Another significant legal battle affecting the CBI industry is the ongoing dispute between the European Commission and Malta over the latter’s CBI program.

The European Commission has taken Malta to the European Court of Justice (ECJ), arguing that the program undermines the principles of EU citizenship and poses risks to the EU’s internal security and integrity.

Malta, however, has defended its CBI program as a matter of national sovereignty, arguing that the right to grant citizenship is a state prerogative.

The legal dispute has sparked a broader debate about the balance between national sovereignty and EU oversight. Critics argue that the European Commission’s actions represent an overreach and could set a dangerous precedent for other member states with similar programs.

The outcome of this legal dispute could have far-reaching implications for the CBI industry across Europe. If the ECJ rules in favor of the European Commission, it could lead to stricter regulations or even the effective prohibition of CBI programs in EU member states (Malta had already intimated theirs will end irrespective of the ECJ ruling back in 2022). On the other hand, some countries have taken a different stance. Albania announced its intention to establish a CBI program if Malta wins the case.

This case may significantly impact the attractiveness of these programs and could prompt a shift towards alternative forms of investment migration, such as RBI programs.

The breach of Chinese nationality law: A serious concern

Another significant issue facing the CBI market is the sale of passports to Chinese citizens in violation of Chinese nationality law. Chinese law explicitly prohibits dual nationality, requiring individuals who acquire foreign citizenship to renounce their Chinese nationality.

International sales agencies, however, have aggressively marketed CBI programs to Chinese nationals, encouraging them to acquire second passports while concealing this from Chinese authorities.

This practice not only violates Chinese law but also raises grave ethical concerns. The role of intermediaries and agents in facilitating the unlawful acquisition of citizenship highlights the darker side of the CBI industry.

As Chinese authorities become increasingly aware of these practices, there is a growing risk that Chinese nationals who have acquired foreign citizenship through CBI programs could face legal repercussions.

This, in turn, could further damage the reputation of the CBI industry and lead to increased scrutiny from other countries concerned about the integrity of their nationality laws.

Whilst the breach of China’s nationality law regarding dual nationality is not typically treated as a criminal offense but rather as a civil matter, the primary consequence for a Chinese citizen who obtains a foreign nationality is the automatic loss of Chinese citizenship.

There are no specific criminal penalties outlined for simply holding dual nationality.

Depending on the circumstances, however, Chinese law could impose administrative or other legal penalties on agents or entities aiding in the acquisition of dual nationality.

The legal consequences would generally be based on the nature of their actions and any related offenses, such as falsifying documents or engaging in fraudulent activities.

If Chinese authorities crack down on individuals holding dual nationality, leading to the confiscation or escheatment (bona vacantia) of assets acquired under a second nationality, affected clients could potentially pursue civil action against agents who facilitated the acquisition of the second nationality.

The basis for such action could include claims of negligence, misrepresentation, or breach of fiduciary duty, particularly if the agents fail to adequately inform their clients of the risks involved.

The success of such claims would depend on the specific legal context and the terms of any agreements between the client and the agent.

Agents might also face liability if it is proven that they actively misled clients about the legal consequences of obtaining a second nationality, including the risk of losing Chinese citizenship and the associated assets.

Either way, the risk of litigation is there. Are agents ready for this?

The impact of regulatory clampdowns and international scrutiny

The numerous scandals surrounding CBI programs have prompted a wave of regulatory clampdowns and increased scrutiny from international bodies.

The European Union, in particular, has been vocal in its criticism of CBI programs, warning of the potential for abuse and the risks they pose to the integrity of the EU’s visa-free travel regime.

The 2023 Investment Migration Executive Survey revealed that a significant proportion of industry professionals are concerned about the future of CBI programs in light of these regulatory challenges.

According to the survey, 63% of respondents expressed worry that the EU might revoke Schengen visa privileges for CBI countries. This move could have devastating effects on the attractiveness of these programs.

In response to these concerns, Caribbean countries have strengthened their CBI programs. The Caribbean Five's agreement with the United States on six principles and the OECS's Memorandum of Agreement are part of a broader effort to restore confidence in these programs by enhancing due diligence, increasing transparency, and ensuring compliance with international standards.

The shift toward Residency by Investment (RBI) programs

As CBI programs' challenges continue to grow, Residency by Investment (RBI) programs are gaining traction as a more credible and sustainable alternative.

Unlike CBI programs, which offer immediate citizenship in exchange for investment, RBI programs provide investors with the opportunity to obtain permanent residency and possibly acquire citizenship after fulfilling certain requirements over time.

Governments generally perceive RBI programs as less risky and more transparent than CBI programs. They often require a longer-term commitment from investors, such as maintaining a residence in the host country and contributing to its economy over an extended period.

This reduces the likelihood of abuse and ensures investors genuinely contribute to the host country's development.

Moreover, RBI programs do not carry the same reputational risks as CBI programs. Since they do not offer immediate citizenship, they are less likely to attract individuals seeking to evade legal scrutiny or engage in illicit activities.

As a result, international bodies view RBI programs more favorably as these programs are less likely to face the same level of regulatory scrutiny.

For professional resellers and investors, RBI programs offer a safer and more sustainable path to global mobility and investment opportunities. As the convenience of a second passport for ease of travel comes under increasing fire, RBI programs are likely to emerge as the preferred option for those seeking to establish a bona fide foothold in a foreign country without the risks associated with CBI programs.

Upskilling the CBI profession

The role of skilled practitioners in the field of national immigration law is increasingly critical as the complexity and diversity of global immigration policies continue to expand.

These professionals, especially those engaged in Residency by Investment programs, must possess a deep understanding of the legal, economic, and cultural nuances of various jurisdictions.

Unlike the more standardized "off-the-shelf" Citizenship by Investment products, RBI professionals navigate a maze of intricate regulations, ensuring that clients meet the eligibility criteria and comply with long-term residency requirements, tax obligations, and other legal stipulations.

The expertise required in RBI includes knowledge of property laws, tax regimes, and the socio-economic impacts of migration policies, which vary significantly from country to country. This contrasts sharply with CBI programs, which often focus on a quicker, transactional process of acquiring citizenship through investment.

While CBI products may appear more straightforward, they lack the personalized, in-depth legal guidance necessary for sustainable immigration outcomes that RBI professionals provide.

Final thoughts

The Citizenship by Investment industry is at a critical crossroads. Once a pathway to global mobility and economic opportunity, the industry now faces scandals, legal disputes, regulatory challenges, and increasing scrutiny.

High-profile cases in St. Kitts & Nevis, Cyprus, Vanuatu, and Saint Lucia, as well as the ongoing legal dispute between Malta and the European Commission, have tarnished the predictability and reputation of CBI programs.

As these risks mount, Residency by Investment programs are emerging as a more credible and sustainable alternative.

Unlike the "off-the-shelf" nature of CBI, RBI programs require skilled practitioners with a deep understanding of complex immigration laws. These professionals offer a tailored approach, ensuring compliance with long-term residency requirements, tax obligations, and legal stipulations, thus avoiding the immediate risks and reputational damage associated with CBI programs.

For professional resellers and investors, the future lies in embracing RBI programs' transparency and long-term commitment.

As the CBI market faces increasing challenges, the focus should now shift towards promoting residency and investment opportunities that align with the interests of both investors and host countries.