6 Global Economic Effects of The War in Ukraine And What They Mean for Investment Migration

The Russian invasion of Ukraine in February and the outbreak of a new war in a strategic part of the world have been accompanied by huge losses of human lives and the destruction of apartment buildings, hospitals, theaters, and critical infrastructure. These developments are bringing disarray to a world economy and society already shaken by the effects of Covid-19. Humanity is perplexed by the unrelenting destruction in Ukraine and a possible escalation of this conflict to nuclear, chemical, and/or bacteriological warfare. The probability of this latter scenario exists but it can be avoided if world leaders manage the current juncture with determination and sensitivity. The new conflict comes when the world, at different speeds and levels of effectiveness, started recovering from the worse effects of the pandemic of Covid-19 and addressing other critical challenges such as global warming and ecological destabilization.

In 2022, according to international organizations such as the IMF and OECD, the war and accompanying economic sanctions are bound to reduce global economic growth by 0.5-1 percentage point due to further disruptions in supply chains, increased uncertainty, trade tensions, and financial disarray. The situation is more dramatic in Ukraine, where GDP may contract 25-30% this year if the war continues.

In turn, the fallout is enormous for the Russian economy, with GDP expected to decline by 10-15% over economic sanctions, the collapse in the value of the ruble, the massive withdrawal of foreign companies serving the Russian market, and the exodus of the young professional class. In addition, global inflation is on the rise; in the US, it is anticipated to reach more than 7% in 2022, as inflationary pressures become more pronounced also in Europe and other regions of the world.

It never rains but it pours

I’ve identified the below six main economic and social effects and shocks associated with the conflict:

1 – An increase in energy prices mainly oil and coal.

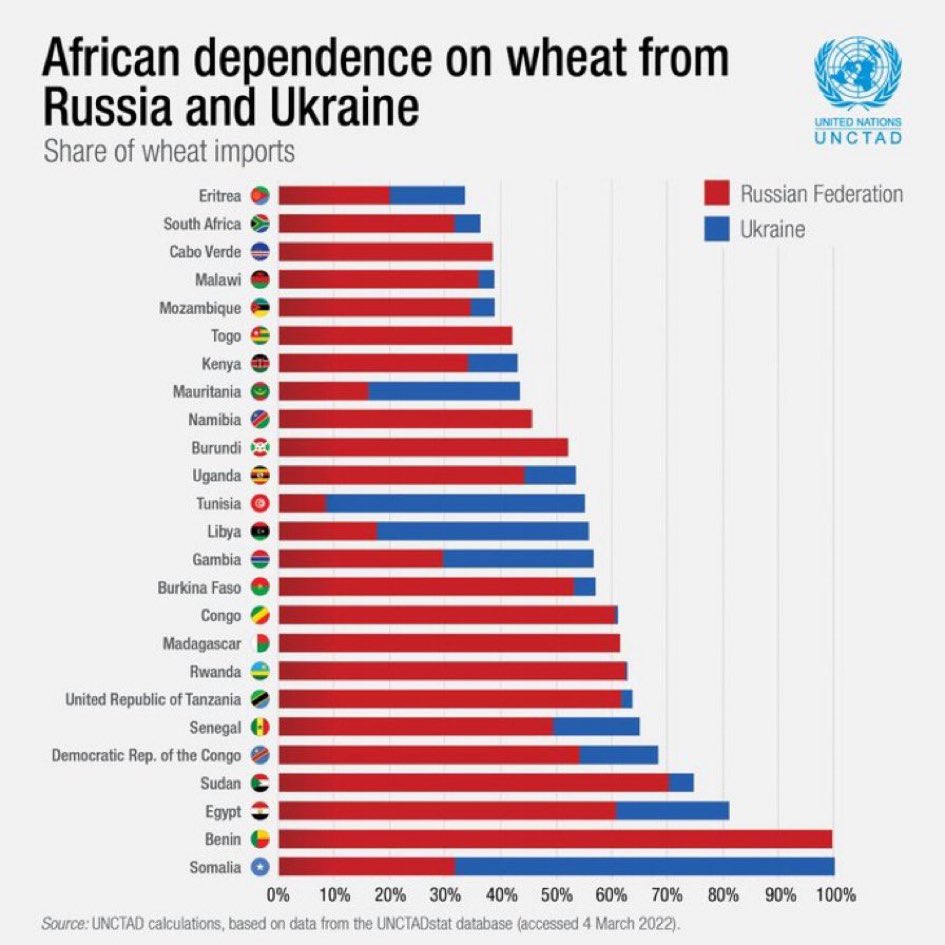

2 – Increases in food prices, particularly for foods linked to the price of wheat, corn, and fertilizers.

3 – Financial disruptions and uncertainties associated with the ban on access to SWIFT codes by Russian banks and the freezing of nearly two-thirds of international reserves of the Russian central bank held in financial centers in western countries.

4 – A rise in interest rates due to the tightening of money creation by the main central banks oriented to reduce inflation besides higher financial risk.

5 – An unprecedented refugee crisis with the massive exodus, in a few weeks, of nearly 3.5 million Ukrainian residents and citizens towards, mainly, western European countries.

6 – An increase in military spending in the West, led by Germany with an announced rise in its defense budget of EUR 100 billion, along with some additional increase in defense expenditure in the United States, as recently announced by President Biden, and moves in a similar direction by other nations.

The consequences of these shocks and policy responses can be serious and of an unexpected nature. History tells us that the two oil price shocks of the 1970s brought about the Islamic revolution in Iran and disarray in the Middle East.

In turn, the food price shocks of 2007-10 are considered a contributing factor in triggering the 2011 Arab Spring in North Africa.

A rise in interest rates triggered debt crises in highly indebted countries in Latin America, Turkey, and the Philippines in the 1980s. Now, Russia can be close to a default on its external debt. The last time this happened was in early 1918 after the Bolshevik revolution. The seizing of international reserves of central banks can give rise to portfolio realignments away from traditional currencies (the US dollar, the British Pound, the Euro, and the Japanese yen) to non-traditional currencies (Canadian dollar, Australian dollar, Swedish Krona, Norwegian Krone, and Chinese Renmimbi) a process already underway since the run of the century.

Massive flows of refugees from Ukraine will force necessary increases in public spending on housing, job provision, and education to accommodate their resettlement in Western Europe. Nonetheless, at the same time, several of these countries will have chosen to increase defense spending creating fiscal burdens that will have to be financed by a combination of higher taxes and/or additional domestic and foreign borrowing.

The consequences of an economic collapse in Russia, and possibly Belarus, along with the massive destruction of valuable infrastructure in Ukraine, will likely spur emigration from these nations for a long time. In addition, the possible onset of a mood of resentment in Russia and Ukraine due to the perceived effects of economic sanctions, isolation, and invasion should not be discarded. Remember how resentment towards war reparations sanctioned by the Treaty of Versailles in the aftermath of World War I played an important role in the rearmament of Germany in the 1930s.

Economic globalization is bound to become more fragmented, risky, and unpredictable in the years to come.

How can all these developments affect investment migration?

Three considerations can be cited for effects that are still largely uncertain:

1 – An increase in the demand for investment migration is likely to follow as geopolitical, financial, and security risks have dramatically increased with the war, economic sanctions, and strategic realignments. The premium for having the possibility to live and work in more secure and economically stable countries will increase.

2 – At the same time, the ban on Russian citizens applying for citizenship and/or residence in various countries (Caribbean islands, many EU countries) will reduce the supply of investment migration solutions, affecting citizens from countries whose demand for these programs is expected to rise the most.

3 – Official appreciation for these programs by supra-national entities, such as the European Parliament, is receding and proposals have been put forward to substantially restrict the scope of these programs albeit the granting of residence and citizenship rights remain in the national states.

The golden years for investment migration of the 2010s may be over. However, governments of receiving countries will need foreign funding, entrepreneurial capacities, and investments to accelerate their economic recoveries after two main shocks: The pandemic and, now, war.

Incidentally, in the aftermath of the global financial crisis of 2008-09, the need for economic resources was the main factor behind the setting-up of IM programs in several countries.

Summing up, we live in complex and very uncertain times, in which stabilization and resolution need statesmanship, imagination, common sense, humanism, and generosity. Investment migration, along with other policies in receiving nations sanctioned at the supra-national level, can help in this endeavor if managed properly.

A video presentation covering these topics by the author can be found in the March 30, 2022, edition of Crossing Borders of the Investment Migration Council (IMC Youtube Channel).

Andres holds a Ph.D. in Economics from the Massachusetts Institute of Technology (MIT). He is founder and Chairman of the International Center for Globalization and Development (CIGLOB), formerly Country Director at the World Bank, Executive Director at the Inter‐American Development Bank, and Director of the project on International Mobility of Talent with the United Nations University ‐ World Institute of Economic Research. Recent books include Global Capitalism at Disarray, Inequality, Debt and Austerity Oxford University Press, 2017, Economic Elites, Crises and Democracy, Oxford University Press 2014, International Migration in the Age of Crisis and Globalization (2010), Cambridge University Press. He also edited the International Mobility of Talent: Types, Causes and Development Impact (2008).