Portugal Golden Visa Fund Investment so Far in 2022 Already Exceeds Last Year’s Total

Portugal’s golden visa program saw an influx of nearly EUR 60 million from 121 investors in April, a 22-month high that reaches altitudes not seen since the frothy days of spring 2020.

In April, 26 investors (21.5% of the total) were Americans, followed by 15 Chinese, 13 Turks, 11 Indians, and 8 Brazilians. So far this year, more than one in five approved main applicants have been Americans, making them the number one applicant nationality.

If the American lead holds through the year, 2022 will be the first year over the program's 11-year history in which Chinese investors have not been the top applicant nationality. Americans have been increasing their lead over the Chinese throughout the year so far, indicating such an outcome is likely.

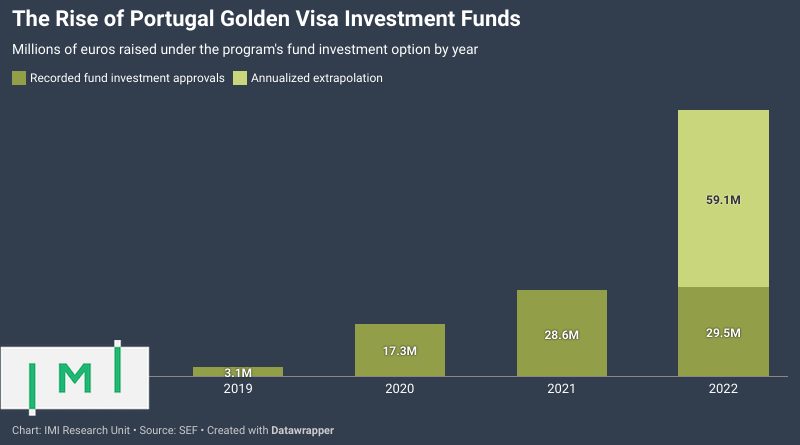

The second unmistakable trend over the last two years, and one which has been the subject of extensive commentary and coverage in IMI, is the seemingly inexorable rise in interest for the Subparagraph 7 fund investment option. In 2019, only 0.6% of investors chose this option. That proportion had risen to 4% in 2020 and 9.4% in 2021. So far this year, 22% of all golden visa applicants have qualified through the fund investment option. Anecdotes from golden visa service providers indicate that proportion likely to rise throughout the year (note that residence permits issued today are based on pre-approvals granted 12-18 months ago).

With two-thirds of the year left to spare, golden visa fund investment has already surpassed last year's total, raising EUR 29.5m from 84 investors. For comparison, Portugal raised EUR 28.6m from 81 investors in all of 2021.

The increasing preference for the investment fund and renovation property options (which until this year had minimum investment requirements of EUR 350,000 rather than the EUR 500,000 required for central real estate) have occasioned a corresponding decline in average per-applicant investment amounts from a high of EUR 661,000 in February 2020 to a low of EUR 448,000 precisely two years later. As Portugal begins to process applications filed under the higher-minimum new rules (hopefully sometime before the end of Q2 if the transfer of responsibilities from SEF to APMA can be completed), we should expect to see average per-applicant investment to rise again.

The overall approval and investment trend looks promising four months into the year. If application and investment volumes continue apace in the latter two-thirds of the year, approvals in 2022 will exceed those of 2021 by about a third.

The above selection of statistical charts on Portugal's golden visa represents but a minority of the data visualizations available for that program (and dozens of others) in the IMI Data Center.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine - online or offline - for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.