EB-5 Special: How The 2022 Program Changes Impacted Application Volume, Processing, and Stakeholders

This 2022 Annual Review aims to provide an overview of the key legislative developments affecting the EB-5 visa program and to highlight the main trends and statistics relating to the volume of applications submitted and the number of approvals granted by the US Visa Office during this period.

In this article:

- Effects of the Reform and Integrity Act (RIA)

- EB-5 program’s FY2022 in numbers

- Summary and conclusions

The data reported below relates to the fiscal year (FY) 2022 that ended on September 30th, 2022.

Which notable developments impacted the EB-5 visa application process in 2022, and what do they mean? Let’s start with an overview of the most important legislative changes that took effect with the passing of the Reform and Integrity Act (RIA) in May 2022.

Effects of the Reform and Integrity Act (RIA)

RIA changes impacting EB-5 investors

- 5-year reauthorization period

Crucially, the new legislation provides for a five-year extension to the Regional Center Program (RC) along with other substantial changes affecting existing and future EB-5 investors, the Regional Centers, developers, and promoters. The new regulations require that immigration agencies continue to adjudicate petitions and allocate visas to RC investors who file I-526 petitions up to September 30, 2026.

- Eligibility of I-526 and I-829 applications before the enactment

On another positive note, the immediate repeal of the prior Regional Center law does not prevent adjudication and visa allocation for pre-investment RC investors.

- Investment Amounts

For all new applications, the minimum investment is US$800,000 in a Targeted Employment Area (TEA), meaning either a rural or high unemployment area. For all other investments outside a TEA, the minimum is US$1,050,000. These minimums will be adjusted for inflation every five years.

- Reserved Visas

Visas will now be “reserved” each fiscal year: 20% for rural projects, 10% for high unemployment areas, and 2% for infrastructure projects. Any unused reserve visas can be carried over to the following year but – if unused by the third year – go without reservations. This 20% quota for rural visas might matter, but the other reserves will probably not.

- Adjustment of Status

In another positive piece of news, investors and their family members already legally in the US and eligible for a visa number may file an application for adjustment of status (AOS), thus avoiding the need for consular visa processing while awaiting their I-526 petition to be adjudicated.

- Innocent Investor Protection

The legislation adds some protection for so-called “innocent investors” who suffer the termination or debarment of their Regional Center, New Commercial Enterprise, or Job Creating Entity. In the case that their investment arrangements are in good order, they will now be able to associate with a replacement entity, and, if they so desire, make an additional investment.

RIA changes impacting Regional Centers

- Regional Center Responsibilities

According to the new law, running a regional center will now be far more burdensome and demanding. RCs are expected to keep records, face USCIS audits every five years, and provide annual reports, including certifications of securities and other compliance conditions. RCs will also face tough sanctions for misstatements or noncompliance, including suspension, fines of up to 10% of the capital raised, debarment of individuals, or termination. RCs are also required to share pertinent information from annual statements with their investors.

- Indirect Job Limits

The law states that indirect jobs created through a Regional Center investment can count for no more than 90% of the total jobs, and only 75% of these new jobs can come from construction projects lasting fewer than two years (and those count only to the extent of the fraction of a two-year period).

- Redeployment

Another modification relates to the redeployment of capital paid back to the “new commercial enterprise” (NCE) before the investor’s conditional residence permit ends. This is now recognized. All the required jobs must have been created, and the regulation relaxes one requirement to permit redeployment throughout the US, rather than in an approved RC area.

- Administration of funds

Where audited financial statements shared with investors are not available, NCEs must maintain EB-5 capital in “insured” separate accounts and hire a third-party fund administrator to ensure that the capital correctly flows to the job-creating activity.

RIA changes impacting promoters

Another obligation is that promoters, including migration agents based abroad, must first register with USCIS, and follow all regulatory guidelines for immigration and securities compliance. They must have a written agreement with issuers and disclose fully all fees received in the respective investor petitions.

EB-5 FY 2022 in Numbers

I-526 processing data

By the end of FY2022, a total of 13,062 I-526 petitions were pending in the USCIS system, a number not very dissimilar to previous years and one that demonstrates little real progress has been made. For example, in 2022, as shown in the table below, 829 new petitions were submitted, 590 petitions were approved, and 825 were denied.

The very low number of petitions submitted in 2022 is attributable to the Regional Center pilot program’s not functioning properly. Following the enactment of the RIA in May 2022, the USCIS mandated that all Regional Centers go through a procedure of re-registration. However, a court order at the end of August 2022 canceled this requirement, which effectively meant that the Regional Center program was functioning normally for little more than one month during that fiscal year.

A matter of concern in 2022 is the relatively high denial rate; the USCIS denied a higher number of petitions than they ended up approving. This is remarkable since the EB-5 program generally has had one of the highest approval rates. One possible explanation for this is that when the RC program was not functioning normally, the agency was focusing on direct business projects, which are typically harder to justify, and this may have contributed to the higher denial rate.

Another reason for the high denials of 2022 is that, in the period 2016-2018, there were a lot of new players in the Regional Centers industry who were not so familiar with the EB-5 program’s requirements and were possibly unable to respond to all USCIS compliance requirements.

It is important to mention that USCIS does not normally publish details that break down the pending I-526 petitions by nationality. Understanding the breakdown of I-526 petitions by country can help us to better understand possible waiting times for EB-5 visa approval.

However, in March 2023 following a Freedom of Information Act (FOIA) request by the American Immigrant Investors Alliance (AIIA), the USCIS released the following breakdown:

These statistics provide a clear picture of how large the I-526 petition backlog has become, especially among countries such as China, India, Vietnam, and South Korea, which represent a large volume of applications. Since the law changed in March 2022, EB-5 investors with priority dates up to March 2022 are now waiting in a queue for “unreserved” visas (68% of the EB-5 total), while investors applying after March 2022 will likely join new queues for “reserved” visas (the remaining 32% of EB-5 visas).

The main factor contributing to the backlog is the apparent underfunding of USCIS as well as the pandemic-related difficulties in the US and abroad. These issues have been impacting staffing levels and the ability of USCIS to sustain operations.

EB-5 visas and Adjustments of Status

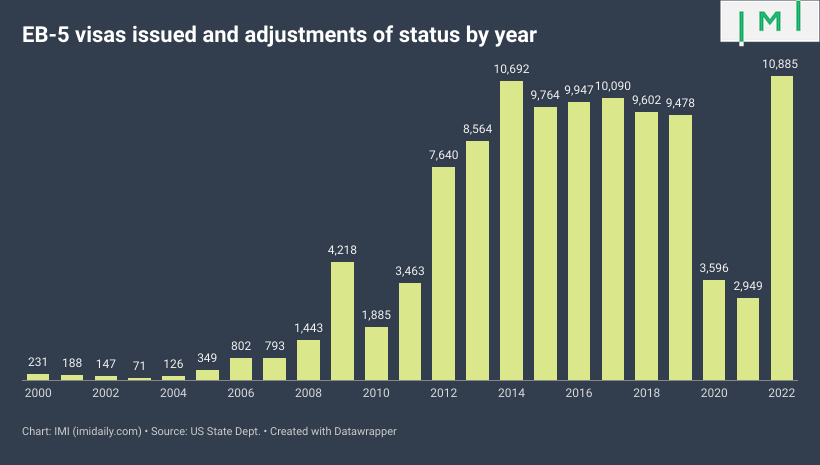

As is apparent from the chart below, the total number of EB-5 visas and Adjustments of Status issued per year was significantly impacted in 2020/21 due to the COVID-19 pandemic. For example, in 2021, only 2,949 visas were issued compared with the 9,478 issued in 2019. In 2022, however, the numbers bounced back to a total of 10,885 visas and AOS issued, which is the highest recorded annual figure since the program began.

The following table shows how the total number of visas issued per year is split between direct EB-5 visa applications and adjustment of status applications. It is noteworthy that since the COVID-19 pandemic, despite the absolute numbers falling in 2020/21, the proportion of AOS visas issued has grown significantly, and in 2022 reached a high of 4,003, representing 37% of the total.

With respect to the countries with the highest number of visas issued, the following data clearly shows the main players, including China (6,125), India (1,351), Vietnam (815), South Korea (396), and Brazil (336).

Although a total of 10,885 visas were issued in 2022, which is a considerable number, there remains a high volume of applicants who have had their I-526 petition approved but are awaiting their EB-5 interviews in US Consulates worldwide.

Below, we see the total number of EB-5 (Fifth Preference) visas pending in November 2022 by country.

In most cases, these pending visa interviews are due to pandemic-related delays, but for countries such as China and India, they are the result of numerical visa limits and country quota caps. Only 7% of the total visa numbers available are allocated on a per-country basis, and only in the case that these numbers are left unused can they be reallocated for use by other countries where country limits have been exceeded. For this reason, China was allocated around 80% of the total visas in 2014-2017.

Key data on pending I-829 petitions

For similar reasons to I-526, and as explained above, the I-829 petitions backlog for Permanent Green Card status has been increasing year by year. The table below clearly shows the number of pending applications increasing from 1,345 in 2013 to 11,150 in 2022. At the same time, 2022 was a relatively poor year for visa approvals at only 1,453 compared with recent years.

The data below for Feb-Mar 2022 show the I-829 pending visas breakdown by country of origin and form of investment; Regional Center or stand-alone.

Summary and Conclusions

Looking back on 2022 with a particular focus on the EB-5 visa program, there are positive reasons to be hopeful. The US Congress, through the Reform and Integrity Act, has given the path to a Green Card through job-creating investment an extended lease on life. That means a five-year regulatory extension that is good news, not only for new immigrant investors but also for those waiting in the visa queue whose legal rights have now been recognized.

The RIA has also brought in other positive measures to improve and strengthen the EB-5 framework, not least for those investors who can now apply for I-526 visas on an adjustment of status basis and avoid unnecessary delays in consular processing. Additionally, the new compliance and financial obligations on Regional Centers, although creating more burdens on their operation, will likely translate into a more robust and transparent RC industry which will benefit investors greatly too.

On a less optimistic note, the effects of the COVID-19 pandemic, combined with USCIS funding and staffing constraints, have resulted in unacceptably low levels of visa approval, meaning high levels of visa wastage with annual visa quotas going unused. In the context of the increasing backlog of I-526 and I-829 petitions this problem needs to be addressed by USCIS and the U.S. Government. This makes economic sense as more EB-5 investors will create more jobs and help to build more US infrastructure.

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.

Co-founder and Managing Director of Second Wind EB-5, a company specializing in investment immigration opportunities in the USA.

My goal is helping and advising private individuals and their families with the process of relocating to the USA through the EB5 investment visa program, making their path easier, less risky, and more predictable.

I have been actively involved in the field of immigration for more than 14 years, coordinating immigration processes and managing our relocation agency teams.

Since 2017, my key focus has been on the EB-5 program, and the main area of my expertise. My professional background combines knowledge of Immigration, Finance, Planning, Marketing and working alongside some amazing people, both on the client and partner side.

At Second Wind, I working with our EB-5 clients, develop our network of partners in the US, and oversee marketing and management of the non-immigrant visa team.