Applications for Greek Golden Visa Soared in Anticipation of Price Increase

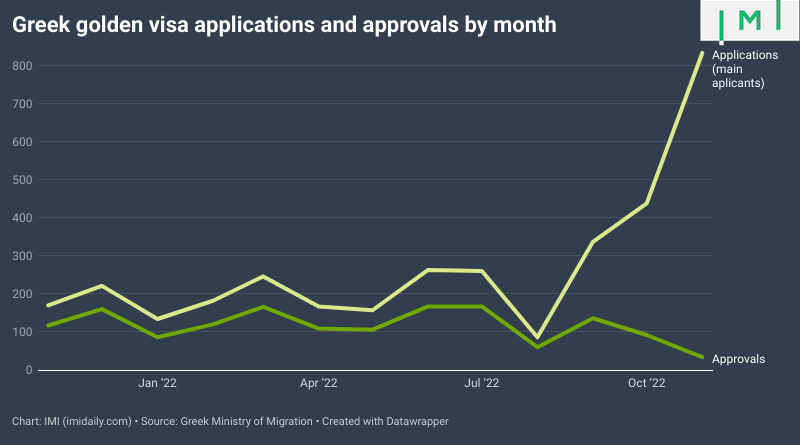

In early September, Greek Prime Minister Kyriakos Mitsotakis declared, in a surprise announcement, that the minimum investment requirement for the real estate component of his country’s golden visa program would double in 2023. While we would later learn that the price increase would only apply to a small number of municipalities, investors’ reaction to the initial announcement was massive and immediate, show statistics from the Greek Ministry of Migration:

Already in September, the same month as the initial announcement, applications for Greek golden visas nearly tripled to 337. In October, it rose again to 438. In November, the last month for which figures are available, an unprecedented 833 investors filed applications. The immigration bureaus of the decentralized authorities, however, have not been able to scale up processing to cope with the sudden rise in demand, the result of which is a backlog of pending applications that has now reached nearly 2,800.

In the first 11 months of 2022, the Greek Golden visa received 3,103 applications, already exceeding the 2021 total by more than 50%. Results from December, once available, are likely to push that figure considerably higher, as most of the pre-price-hike rush is likely to be concentrated in that month.

In the same 11-month period, the decentralized authorities approved 1,243 applications, rejected four, and saw nine investors withdraw their applications.

Due to the travel restrictions imposed during the COVID years, the ban on Russians, as well as a mix of other factors, a non-negligible number of golden visa holders did not successfully renew their visas when they reached the five-year mark this year. This drove a reduction in the total number of currently-active investor residence permits in Greece, starting in May when that figure suddenly dropped from 11,075 to 10,157. Not until November, five months later, did the total recover to its pre-May 2022 high.

Among the 11,132 visas currently active, Chinese investors hold more than half. At a distant second, Turks account for 5% of active golden visas, Russians (who, since February 2022, are no longer eligible for initial golden visas or for renewals) for 3.6%, Lebanese for 3.6%, Egyptians for 2.3% and Iranians for 2.6%.

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.