Dominica CIP Tightens Due Diligence, Bars Some Nationals From Applying

Dominica has had a reputation for being the most open and simple program among its peers, and previous visa rejections from countries with which visa-waiver agreements do not preclude participation in the Dominica CIP (unlike among other Caribbean CIPs). The program has not, moreover, had an extensive list of ineligible nationalities. This is now changing.

In a bold and savvy move, the Dominica Citizenship by Investment Unit has set out stricter requirements for their Authorized Agents, which took effect last month. These requirements will no doubt tighten the radius of available clients.

The main requirements set forth by the CIU in February 2020 were:

- All Agents must submit – with both the electronic and hard copy application – a WorldCheck/pre-screen due diligence of their applicant(s) from a reputable due diligence company.

- Applicants who have been denied a visa from jurisdictions with which the Commonwealth of Dominica has a visa waiver agreement (such as the Schengen region and the United Kingdom) should refrain from applying to the program.

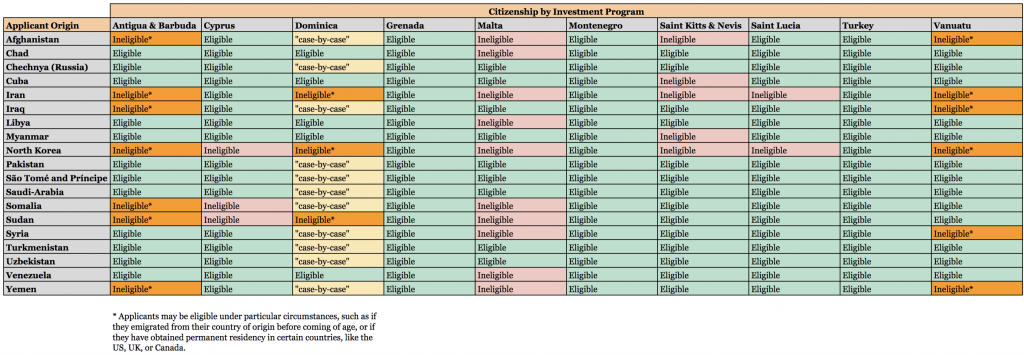

- The Citizenship by Investment Unit will only accept clients of Iranian, Sudanese, or North Korean nationality if they have met the following conditions:

- They have resided outside that jurisdiction for a period of 10 years or more.

- They have no substantial assets in that jurisdiction.

- They have not performed any business or similar activity in the stated jurisdictions.

- Authorized Agents are required to provide the proof of receipt of funds of the full investment and remitter details to match the applicant. In the event of a third-party remitting for the applicant, an explanation must be provided and the KYC procedures must be performed.

Breaking it down, we can take a look at how these will affect industry professionals worldwide.

The first point is but a measure for enhanced due diligence, a point everyone can agree on because it improves the integrity of the program, which is good for the submitting firm, Dominica as a country, and for the safeguarding of the program itself.

The downside however, is that smaller RCBI firms that do not have the financial capacity to match those on top of the pyramid must now factor in the cost of creating a due diligence report into their fees. For those firms that depend on lower cost as a competitive edge, they now have to restructure their fees or reduce their margins.

The second point is a shrewd, and arguably overdue, move; maintaining visa-free waivers with desirable destinations such as the UK and the Schengen zone are a top priority for the survival of any CIP (except, apparently, for Turkey). Although Many RCBI firms will be scrambling to get a tourist visa to Italy or the UK in order to restore the eligibility status of their client, that is but a small hurdle, surmountable to all but a few incompetent service providers.

As for the third point, RCBI firms targeting difficult markets such as Iran, North Korea, and Sudan will undoubtedly take a hit. These firms, however, tend to work on a remote basis and will have other markets to lean on.

The fourth point, although not directly affecting all RCBI firms, will take a toll on those relying on larger firms to process their files. The main idea is to keep the processing of the program within the scope of authorized agents, a sound strategy on the part of Dominica. However, many small firms are not registered and tend to work on lead generation for larger ones (or work through them). This restrictive measure is set to maintain a certain standard for consulting investors on the program, and while lead generation may now be a bit more tricky, it is a wonderful opportunity for online platforms such as CiviQuo to enter the fray.

Overall the new regulations are a step in the right direction, tightening the reigns a bit, yet ensuring a sustainable process for the future with minimal gaps.

Want to know more about the Dominica Citizenship by Investment Program? To see recent articles, statistics, official links, and more, please visit its Program Page. To see which firms can assist with applications to the program, visit the Residence & Citizenship by Investment Company Directory.

Properties that can qualify the buyer for citizenship in Dominica:

See more properties that come with residence/citizenship opportunities in IMI Real Estate.

Ahmad Abbas is Director of Content Services at Investment Migration Insider and an 8-year veteran of the investment migration industry.