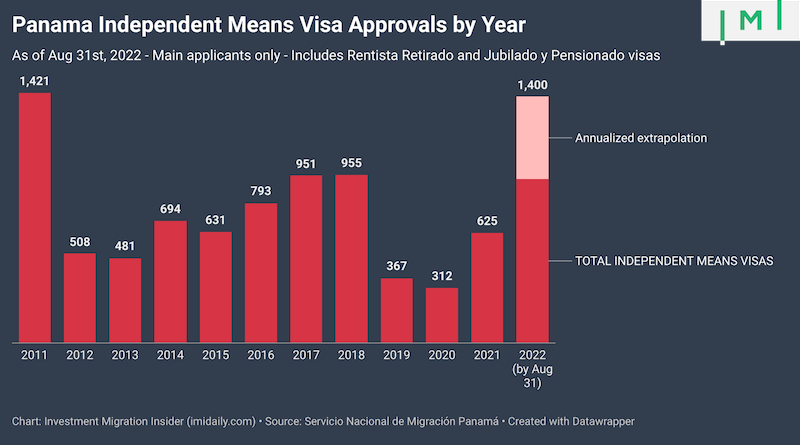

Panama Independent Means Visa Approvals on Track for 11-Year High in 2022

Already by the end of August, Panama had approved 933 Jubilado o Pensionado visas (a form of independent means visa – IMV) since the beginning of the year, figures released last week by Panama’s Ministry of Migration show.

That is already 50% more than it approved during all of last year and, should the trend hold throughout the year, Panama will approve some 1,400 independent means visas in 2022, more than it did in the last three years combined. Not since 2011 has annual IMV approvals reached four figures.

IMV programs - which typically grant residence permits to those willing to physically relocate and who can demonstrate a certain level of income or assets, rather than in exchange for investments as is the case with golden visa - have been the subject of fast-growing interest since the onset of the pandemic.

This is particularly true for Portugal’s D7 visa, the Greek Financially Independent Persons visa, Spain’s Non-Lucrative visa, and Italy’s Elective Residence visa, where these categories have increasingly been eating into the market share of golden visas.

Economically dynamic Panama also maintains a range of investment-based visas; more than a dozen of them have been in effect concurrently over the last decade, more than any other country in the world.

In 2022, however, applications have been concentrated in four categories, by far the largest of which is the Friendly Nations Visa (90% of all investment-based visas in 2022), followed by the Solvencia Propia Real Estate Investor, Solvencia Propia Fixed Deposit, and Call Center Investor categories.

Investor visa applications had been on a downward trend this year because of the introduction of a US$200,000 minimum investment requirement for the Friendly Nations Visa (previously, this category had required only a minor bank deposit). This trend may now be turning, at least if August figures are any indication; 395 FNV applicants received approvals in August, bringing the year-to-date total to 1,929, which indicates more FNV issuances are set to surpass both 2019 and 2020 volumes.

It is unlikely however, to reach the highs seen in record-year 2021, which saw the approval of 4,318 applicants, many of whom had rushed to file before the increase in minimum investment requirements that took effect late that year.

Investors in the other three large-ish investment-based categories - Solvencia Propia Real Estate Investor, Solvencia Propia Fixed Deposit, and Call Center Investor - have so far this garnered a combined 167 investors, indicating performance in these categories will be largely on par with that of last year.