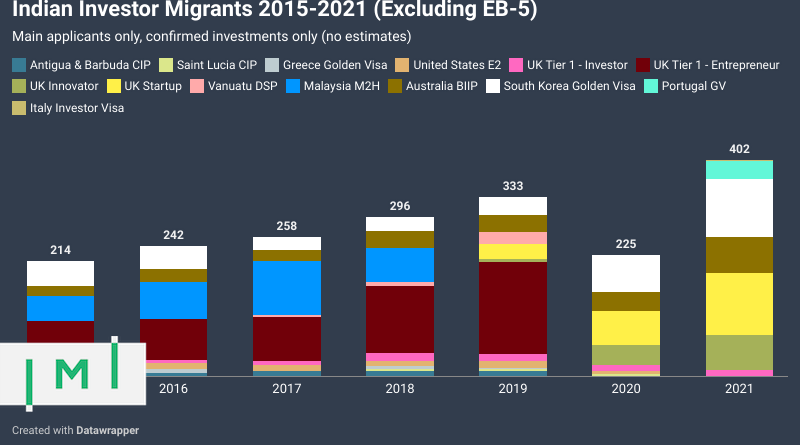

Indian Investor Migrant Data 2015-2021: UK and South Korea Programs Stand Out in 2021

A review of the most recent data on investor migrant from India shows the continued concentration of interest in Anglosphere countries and, surprisingly, South Korea.

We now have full-year 2021 nationality data for eight different investment migration programs, allowing us some measure of year-to-year comparison on the investment migration preferences of Indian applicants. All told, IMI has been able to confirm 472 approved Indian main applicants globally, up from 429 last year but considerably below the 586 recorded in 2019.

That should not be taken to imply that Indian participation in investment migration is declining, for the following reasons:

- We are still awaiting the most recent nationality data for many programs with sizeable Indian applicant contingents, including Malaysia's M2H, Antigua & Barbuda's CIP, Saint Lucia's CIP, the Greek Golden Visa,and Vanuatu's DSP.

- Most of the decline is explained by the outsized impact of global (not related to India in particular) of a single program; the US EB-5.

- Many programs in which Indian applicants feature prominently do not provide nationality data at all, including three Caribbean CIPs, the Turkey CIP (which alone would account for hundreds of Indian applicants), and Canada's Startup Visa.

We must emphasize that the data obtained is partial and incomplete and should, as a consequence, be considered merely indicative rather than absolute.

Among the programs for which data are available, the UK Startup visa recorded the highest number of approved Indian main applicants in 2021 (115), closely followed by the South Korean golden visa (108). Prior to its closure in 2019, Indians dominated the UK's Entrepreneur visa category. Much of this demand appears to be shifting toward the Startup and Innovator programs that replaced it.

Indian participation in Australia's BIIP nearly doubled in 2021, although this has less to do with an Indian change in demand for the program than with the program's near-doubling of its annual quota in 2021.

The impact of the EB-5 program's turbulent 2020 and 2021 - a period that saw the minimum investment amounts change a number of times as well as a year-long lapse of the regional center program - becomes more readily apparent when this particular program is stripped away from the comparison:

Excluding the EB-5 program, the number of confirmed Indian investor migrants nearly doubled between 2020 and 2021. And that is before full-year 2021 figures have even been published for half the programs in this comparison.

If you like data-driven articles like this one, you'll love the IMI Data Center, the world's largest collection of investment migration statistics, with more than 350 graphs and charts on dozens of IM programs and markets.

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine - online or offline - for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.